Women in Mexico who switched to digital cash transfers face higher costs and time accessing payments but gain bargaining power. Improving ATM access, reducing fees, providing timely information on the date of transfers and boosting financial literacy could mitigate these challenges.

Over the past two decades, conditional cash transfer (CCT) programmes have become among the most widely used poverty alleviation programmes in the world and have been evaluated in various countries and contexts (Fiszbein et al. 2009). The Mexican Progresa Oportunidades/Prospera programme (hereafter Prospera) pioneered both the implementation and evaluation of these types of programmes, which seek to improve the current well-being of the poor and reduce future poverty by promoting human capital investments (Parker and Todd 2017). While there is ample evidence suggesting that CCT programmes improve education, health, and household economic outcomes (Parker and Vogl 2023), there is little evidence on whether the method of delivering benefits affects programme outcomes. Particularly given the majority of beneficiaries of CCT programmes are often located in isolated and/or rural areas, is it better to deliver transfers in cash directly to beneficiaries, or can transitioning to a deposit-based delivery system improve programme effects? Our recent research (Marquez-Padilla and Parker 2024a and 2024b) analyses the effects of delivering CCTs via direct deposits for Prospera beneficiaries. We find that beneficiaries incur higher costs (both in time and money) when collecting transfers and report greater difficulties in doing so.

Changing the way beneficiaries of Prospera receive their cash transfer

To improve the way Prospera’s most isolated beneficiaries receive, access, and use their CCT payments, Mexico’s federal government implemented the Prospera Digital pilot in 2018 to test the provision of benefits via direct deposits instead of cash for women still on a cash-based system. The vast majority of Prospera beneficiaries live in rural communities (with populations of fewer than 2,500 individuals) and had, until then, received their bimonthly benefits through temporary payment modules set up every two months in a nearby town. Although transitioning the programme’s operation to a deposit-based system is likely to reduce the costs of delivering benefits for the government, it is less clear how it might impact beneficiaries, as there is little evidence on how transitioning to a deposit-based delivery system could affect programme beneficiaries, particularly those in isolated regions with few linkages to financial institutions.

Direct deposits could reduce transaction costs of receiving programme benefits for beneficiaries. They could also affect women’s behaviour through other mechanisms, such as by modifying the default mode of the payments (i.e. into a savings account versus on-hand). When money is received in an account, it is saved by default and is only accessible once withdrawn—especially in a context where most transactions are cash-based. However, direct deposits could also be more costly and harder to access, particularly in areas where financial institutions and ATMs are far from beneficiaries’ homes or where bank commissions are high.

We hypothesise that the transition costs from receiving benefits in cash to receiving them via deposits may be substantial, particularly in poor rural contexts where beneficiaries have little experience with financial instruments and institutions, and where they have been receiving cash transfers for years. The mainly rural areas where Prospera has operated have historically been characterised by low labour market participation among women and low women’s status, including low levels of education. In our study’s sample, only about one-quarter of women report working outside the home, and a similar fraction report needing their husband’s permission to leave the house. Only 10% report having used an ATM prior to our experiment, and only 4% report knowledge of interest rates. Additionally, only about 10% of beneficiaries report knowing the level of bank commissions for ATMs.

Differences in outcomes from deposit versus cash delivered transfers in Mexico

In order to assess deposit- versus cash-delivered benefits, we use a unique randomised control trial in the Mexican state of Hidalgo. 150 localities—the smallest administrative divisions in Mexico—were randomly assigned into three groups: a control group that would continue to receive benefits in cash, and two treatment groups—one that would start to receive benefits via direct deposit, and one that would receive direct deposits and additionally receive SMS messages to support the transition to using financial services. As beneficiaries are randomly assigned cash versus deposit groups, we can interpret any differences in outcomes as the causal effect of transitioning to deposits (since, on average, the characteristics of treated and control individuals should be equal).

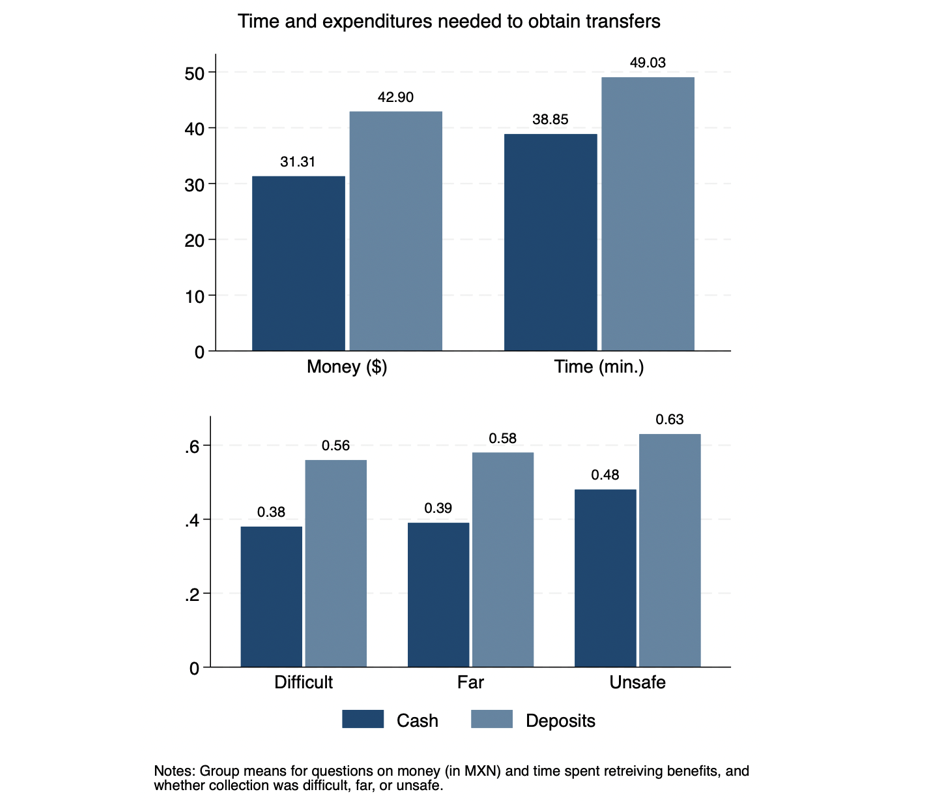

We compare the outcomes of the cash and deposit groups in terms of the time and expenditures necessary to obtain benefits, how difficult, far, and unsafe collection was, and whether beneficiaries were asked to participate in political events, community work, or provide contributions. We also analyse whether the transition affected the probability of receiving the full amount of the CCT and explore some potential mechanisms. Finally, in a complementary study (Marquez-Padilla and Parker 2024b), we analyse whether the transition to deposits affected women’s intra-household bargaining power, as benefits received via deposits may be more easily concealed than publicly delivered cash benefits (as in Aker et al. 2016). The measurement of outcomes took place about six months after the transition to deposits began.

We find that the transition to CCT benefits being delivered via bank deposits had relevant impacts for beneficiaries, at least in the short term:

- Women who transitioned to the deposit-based system report spending more money and time to obtain their payments when they must withdraw it from an ATM, as opposed to receiving it at one of the payments points organised by Prospera.

- Women who transitioned to the deposit-based system are significantly less likely (by more than 10 percentage points) to report receiving the full benefits.

- We find significant positive effects on women’s bargaining power, as (female) beneficiaries’ decision-making with respect to when to leave the house, buy things, and grant child permissions increased.

- We did not find that receiving SMS text messages with advice on how to use and administer their Prospera benefits led to differential effects.

How to support beneficiaries transition to receiving cash transfers digitally

Our findings highlight understudied costs of retrieving deposits for the beneficiary population of cash transfer programmes. These costs may include high commissions on accessing funds, transportation difficulties in isolated areas, and the need to return multiple times to the ATM to retrieve benefits due to a lack of cash in the ATM machine or delays in the benefits being deposited. Our results thus complement a small but growing literature highlighting unexpected costs and delays arising from the modernisation of payment mechanisms for cash transfer recipients (Banerjee et al. 2022).

Our results have important policy implications for the design of transfer mechanisms in cash transfer programmes. While the use of electronic deposits to provide benefits is likely to continue to increase, our evidence suggests that complementary policies to avoid significant transition costs for beneficiary populations may be necessary. Governments might want to negotiate with financial institutions to lower or waive commissions on withdrawals for CCT beneficiaries to avoid beneficiaries paying an important fraction of their benefits as commissions. Making sure that beneficiaries are provided with accurate and timely information on the dates of transfers to avoid repeated trips to the ATM would also be valuable. Policies that improve financial literacy among beneficiaries are likely to not only reduce the costs associated with transitioning to a deposit-based system but may have positive spillovers by further increasing financial inclusion. Finally, implementing mobile money solutions or partnerships with local businesses could also reduce the reliance of beneficiaries on withdrawing from distant ATMs, especially in rural areas.

Editors' note: This column is published in collaboration with the International Economic Associations’ Women in Leadership in Economics initiative, which aims to enhance the role of women in economics through research, building partnerships, and amplifying voices. The authors thank Navika Mehta for useful comments.

References

Aker J C, R Boumnijel, A McClelland, and N Tierney (2016), "Payment mechanisms and antipoverty programs: Evidence from a mobile money cash transfer experiment in Niger," Economic Development and Cultural Change 65(1): 1–37.

Banerjee A, R Hanna, B A Olken, and D Sverdlin Lisker (2024), "Social protection in the developing world," Journal of Economic Literature 62(4): 1349–1421.

Fiszbein A, N Schady, F H G Ferreira, M Grosh, N Keleher, P Olinto, and E Skoufias (2009), Conditional cash transfers: Reducing present and future poverty, Technical Report.

Marquez-Padilla F, and S W Parker (2024a), "The leaky bucket: Transition costs from cash to deposits in a Mexican transfer program," Economic Development and Cultural Change 73(1): 37–59.

Marquez-Padilla F, S Parker, and T Vogl (2024), "Rolling back Progresa: How the sudden ending of a landmark anti-poverty program affected school and labor," https://doi.org/10.31235/osf.io/h9qmc.

Parker S W, and F Marquez-Padilla (2024b), "From cash to deposits: Effects on women’s status and well-being," Economia 47(93): 1–17.

Parker S W, and P E Todd (2017), "Conditional cash transfers: The case of Progresa/Oportunidades," Journal of Economic Literature 55(3): 866–915.

Parker S W, and T Vogl (2023), "Do conditional cash transfers improve economic outcomes in the next generation? Evidence from Mexico," The Economic Journal 133(655): 2775–2806.