Mobile connectivity improves access to land, enabling individuals to use land titles as collateral for bank credit and invest in construction.

Authors’ note: The views expressed are solely those of the authors and should not be interpreted as reflecting the views of the Bank of Italy, the Foreign, Commonwealth and Development Office, the FERDI, the International Monetary Fund, their Executive Boards, or their management.

The internet has profoundly transformed contemporary societies, influencing political engagement (Manacorda and Tesei 2020, Guriev et al. 2021), expanding employment opportunities (Bahia et al. 2023) and helping to lift people out of poverty. At the same time, digitalisation holds the potential to reshape financial markets and institutions by lowering the costs associated with securing and verifying property rights. This enables individuals to use their assets as collateral to access bank credit. Such transformations are particularly impactful in low- and middle-income countries characterised by weak institutional frameworks and severe financial frictions.

In recent research (D’Andrea et al. 2024), we examine the conditions under which the combination of technology and property rights broadens the range of financial products available to individuals, thereby enhancing access to credit and fostering investment. We first analyse how the introduction of mobile internet influences borrowers' choice between microfinance institutions (MFIs) and commercial banks. We then explore the role of collateral in driving this reallocation and its subsequent effect on construction investment.

The expansion of 3G mobile coverage in Rwanda

Our study focuses on Rwanda during the period 2008–2015, leveraging extensive administrative data on financial decisions alongside detailed information on 3G coverage, which was the primary source of internet connectivity during the analysis period. Notably, 3G mobile internet was introduced in Rwanda in 2011, providing a key source of time-series variation in internet connectivity. For identification, we also exploit the variation in the rate of 3G adoption across municipalities, related to: (i) the frequency of lightning strikes and (ii) the municipality's proximity to the existing electric grid and its position on different sides of a hill's slopes.

We examine the impact of mobile internet on access to credit using loan-level data from Rwanda's credit registry, which covers all regulated credit institutions in the country. Specifically, the registry provides detailed information on loans issued by commercial banks and MFIs, including data on loan amounts, interest rates, collateral status, and defaults.

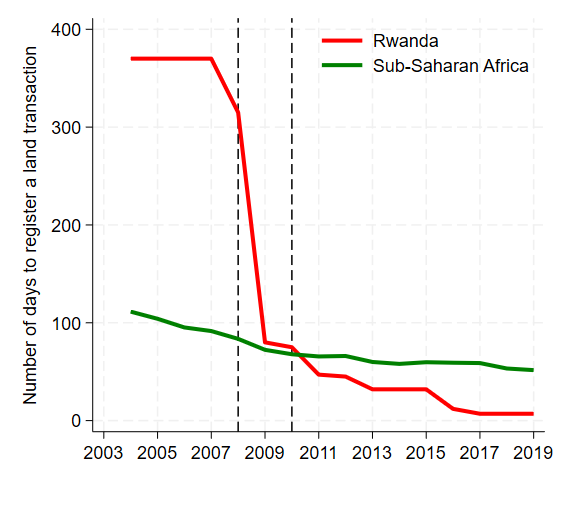

To study the role of collateral, we focus on the Land Tenure Regularization (LTR) programme, which established Rwanda’s land tenure system and, by 2012, created digital records for over 10 million land parcels linked to banks through the mortgage registry (World Bank 2020). Following the land reform, the time required to register a land transaction dropped dramatically—from over 300 days to less than 40 days within five years (Figure 1). The concurrent rollout of mobile internet played a crucial role in disseminating information about the reform, thereby facilitating its implementation. By 2013, all financial institutions in Rwanda were connected to the digital registry, which streamlined the tracking and verification of land ownership. To assess the impact of the LTR programme, we use data on land certificates, transactions, and mortgaged land, along with satellite data on building volumes.

Figure 1: Registration time for land titles

Notes: This figure plots the average number of days to register a land transaction between 2004 and 2019. The red solid line represents Rwanda, while the green solid line shows the average across Sub-Saharan Africa countries. The vertical lines sign the years of the land title reform. Source: World Bank Doing Business.

How does mobile internet influence how individuals borrow?

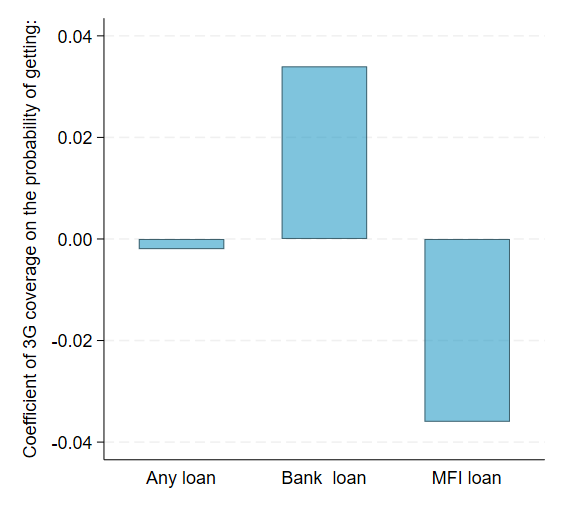

We begin by showing that the arrival of mobile internet in Rwanda influenced individuals' financial decision-making and induced a reallocation away from microfinance institutions towards banking, without overall effects on inclusion. We find that a one standard deviation increase in 3G coverage makes individuals 3.4 percentage points more likely to have a loan from a commercial bank and 3.6 percentage points less likely to borrow from MFIs, while the net effect is close to zero and not statistically significant (Figure 2). Notably, these effects are consistent across individual characteristics such as gender, marital status, and age, highlighting the inclusive nature of internet technologies in this context.

Figure 2: Mobile internet and access to credit

Notes: This figure plots the 2SLS estimated coefficient of the standardized measure of 3G mobile coverage in municipality m at time t on the probability that borrower i in the same municipality has an outstanding loan in year t from: i) any institution; ii) a bank; and iii) a MFI. Each regression includes borrower and year fixed effects. See D’Andrea et al. (2024, Table 3) for details.

Furthermore, borrowers with access to mobile internet tend to have larger outstanding loan amounts, with no adverse effects on interest rates or default rates. For individuals who switch from MFIs to commercial banks—particularly those in the upper tail of the interest rate distribution—we observe a significant reduction in lending rates, without any increase in default likelihood. These findings underscore the role of mobile internet in improving loan conditions for switchers.

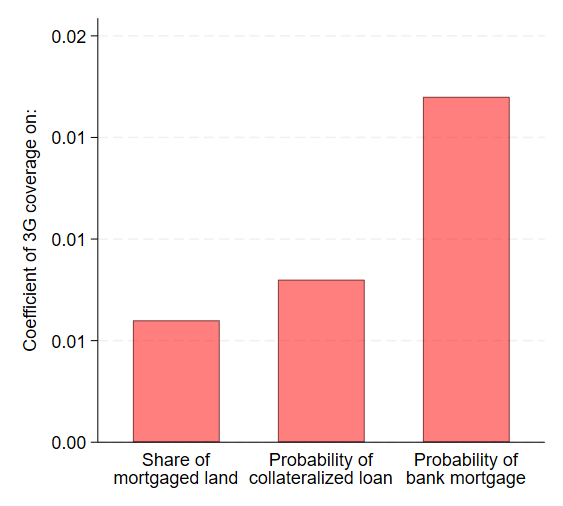

Internet technology helps individuals use land as a collateral for loans

A potential mechanism driving our results is the impact of internet technology in reducing the costs of accessing and utilising property rights, enabling individuals to obtain land titles and use them as collateral for loans. To investigate this, we conduct a series of tests to determine whether mobile internet facilitates the acquisition of land titles, thereby enhancing access to collateral, bank loans, and construction investment. Our first finding shows that land reform is implemented more swiftly and effectively in municipalities with greater mobile internet coverage, which experience a boost in the total number of land transactions. Additionally, land is used more frequently to access the financial system: both the share of mortgaged land parcels at the municipality level and the likelihood that a bank loan is collateralised increase with 3G coverage (Figure 3). Finally, collateralised lending has real effects: a one standard deviation increase in 3G coverage results in an 8.3 percentage point rise in local building growth at the municipality level.

Figure 3: Mobile internet and the collateral channel

Notes: This figure plots the 2SLS estimated coefficient of the standardized measure of 3G mobile coverage in municipality m at time t on: i) the share of land mortgaged in the same municipality; ii) the probability that borrower i in the same municipality has an outstanding loan in year t backed by collateral; and iii) the probability that borrower i in the same municipality has a mortgage with a bank in year t. See D’Andrea et al. (2024, Table 8) for details.

Mobile connectivity can help promote inclusive economic growth

Our analysis shows that increased mobile connectivity enhances access to land, which in turn enables individuals to secure bank credit by using land titles as collateral. This facilitates investment in construction, potentially stimulating local real estate markets.

Before the LTR programme and the rollout of 3G internet, borrowers who may have been creditworthy due to their land ownership and corresponding cash flows lacked formal proof of ownership for banks and were thus forced to borrow from MFIs. This typically resulted in higher costs, smaller loan amounts and shorter maturities (Agarwal et al. 2023). Following the arrival of mobile internet, we observe a transition from microfinance institutions to commercial banks among borrowers, driven by the transformative role of mobile internet in supporting land reform and making it easier to use land as collateral.

These findings strongly suggest that, prior to the reform, credit allocation was inefficient, as borrowers with land ownership but no formal title were excluded from accessing bank loans. In this regard, our analysis offers valuable insights for policymakers aiming to leverage digital tools to promote inclusive economic growth.

References

Agarwal S, T Kigabo, C Minoiu, A Presbitero, and AF Silva (2023), "Serving the underserved: Microcredit as a pathway to commercial banks," Review of Economics and Statistics 105: 780–797.

Bahia K, P Castells, G Cruz, T Masaki, C Rodriguez-Castelan, and V Sanfelice (2023), "Mobile broadband, poverty, and labor outcomes in Tanzania," The World Bank Economic Review 37: 235–256.

D’Andrea A, P Hitayezu, K Kpodar, N Limodio, and A Presbitero (2024), "Mobile internet, collateral and banking," STEG Working Paper No. 100.

Guriev S, N Melnikov, and E Zhuravskaya (2021), "3G internet and confidence in government," The Quarterly Journal of Economics 136: 2533–2613.

Manacorda M, and A Tesei (2020), "Liberation technology: Mobile phones and political mobilization in Africa," Econometrica 88: 533–567.

World Bank (2020), Enhancing Government Effectiveness and Transparency: The Fight Against Corruption, The World Bank.