Credit constraints prevent farmers from arbitraging seasonal price fluctuations; integrated financial solutions can enable grain storage, channel returns into forward-looking investments, and smooth seasonal prices, yielding benefits for the broader community.

Editor’s note: For a broader synthesis of themes covered in this article, check out Issue 2 of our VoxDevLit on Agricultural Technology in Africa.

Seasonal price fluctuations present arbitrage opportunities for farmers

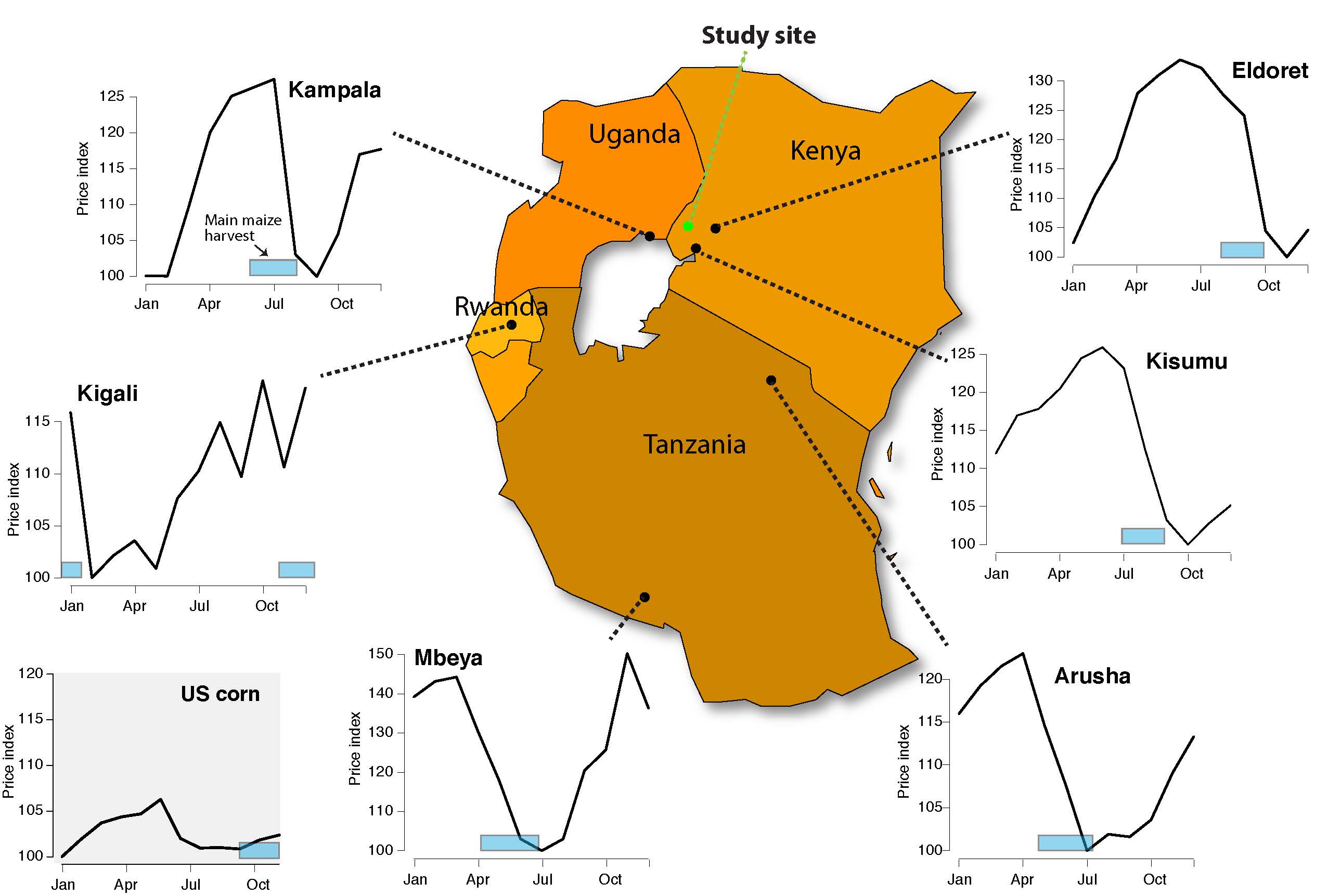

Large seasonal price fluctuations in African grain markets often imply low price for the majority of farmers who sell immediately after harvest and high prices for consumers buying in the “lean season” (Fafchamps 1992, Barrett and Dorosh 1996). Although there is variability across years (Cardell and Michelson 2022), prices on average rise by 25–40% between the harvest and lean seasons in major markets, and by even more in remote areas. In comparison, US grain markets see only a 5% fluctuation (see Figure 1). This should present an arbitrage opportunity for farmers, who could store their grain at harvest and sell (or avoid buying for consumption) at a higher price in the lean season. However, most smallholder farmers do the exact opposite, selling grain at low prices at harvest and buying it back at high prices in the lean season. Credit constraints may explain these challenges: rather than waiting for prices to rise, farmers often sell quickly during harvest to cover immediate expenses like school fees (Stephens and Barrett 2011).

Figure 1: Monthly average maize prices

Notes: Monthly average maize prices in major East African markets from 1994–2011. Data are from the Regional Agricultural Trade Intelligence Network (RATIN) and prices are normalized such that the minimum monthly price = 100. Our study site in western Kenya is indicated. The grey squares represent an independent estimate of the given location’s main harvest season. Price fluctuations for maize (corn) in the United States are shown in the lower left for comparison.

Credit constraints prevent smallholder farmers from selling high

In partnership with the One Acre Fund (OAF), we conducted a two-year study in Western Kenya testing whether providing small cash loans at harvest time could enable farmers store their grain and sell it later at

higher prices (Burke et al. 2019). We randomise the loan offer across OAF farmer groups and then conduct high-frequency follow-up surveys three times throughout the year.

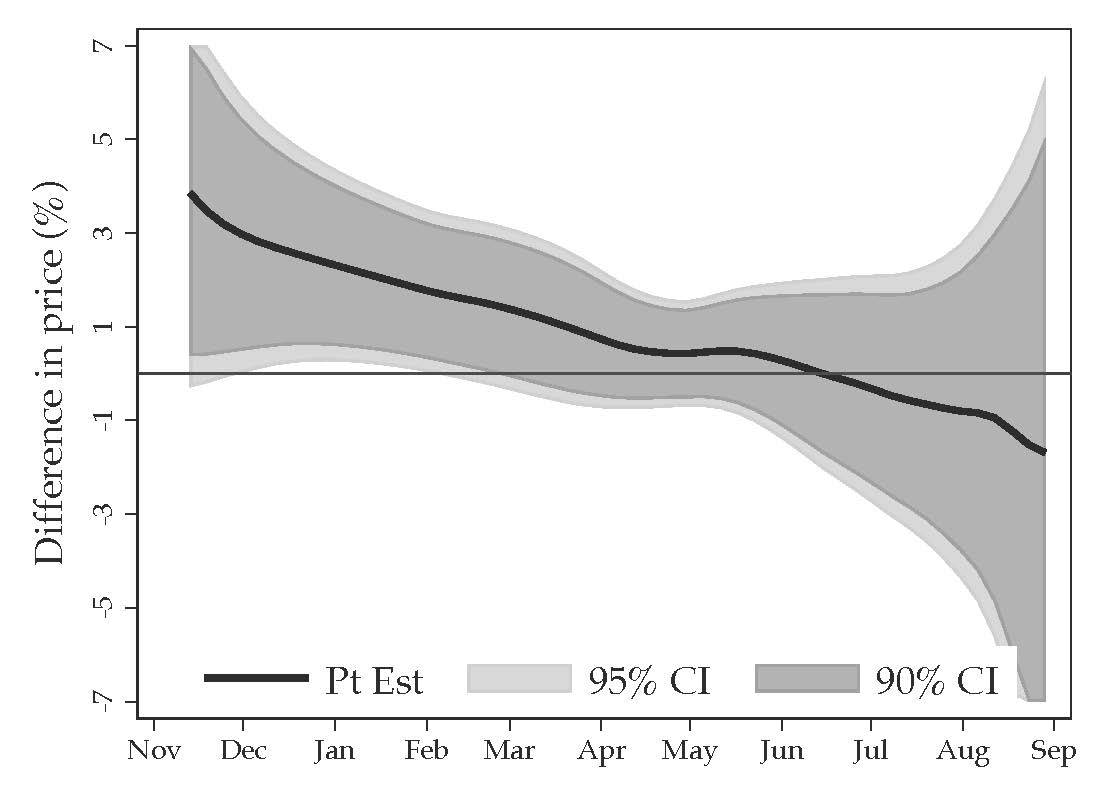

Figure 2 presents the findings, showing results over time from the post-harvest period in November through the end of the lean season in August. We find that farmers who are offered the loans store about 25% more grain, with inventories jumping in the post-harvest period and gradually getting released in the lean season. This results an initial dip in net maize revenues in the post-harvest period, as treated farmers hold off selling their crops (and, for a minority, even buying to take advantage of low prices); however, net revenues are significantly higher in the lean season, as that stored maize is released to the market and sold at higher prices. In total, this results in a positive effect on net revenues, which are KES1,573 (US$18) higher, yielding a 29% return on the loan. Though consumption follows a similar pattern, dipping in the post-harvest period and rising in the lean season, results are not significant, a point to which we return below.

Figure 2: Pooled treatment effects

Notes: The figure shows the difference between the treatment and control, with the bootstrapped 95% confidence interval shown in grey (100 replications drawing groups with replacement). Inventories are measured by the number of 90-kg bags of maize held by the household. Net revenues are the value (in KES) of maize sales minus the value of maize purchases. HH consumption (measured in log KES) is aggregated from a detailed 30-day recall consumption module.

We also find that the timing of the loan is crucial. In the first year of the experiment, we randomly varied the exact timing of the loan: for some, the loan was disbursed immediately after harvest in October, while for others it was disbursed right before school fees were due in January. We find impacts are concentrated among the October harvest-time loan, highlighting the importance of loans arriving at the same time that harvest sales would otherwise occur.

At a market level, loans dampen seasonal price fluctuations, which reduces the direct gains to borrowers (arbitrageurs) but yields even larger gains for the broader community

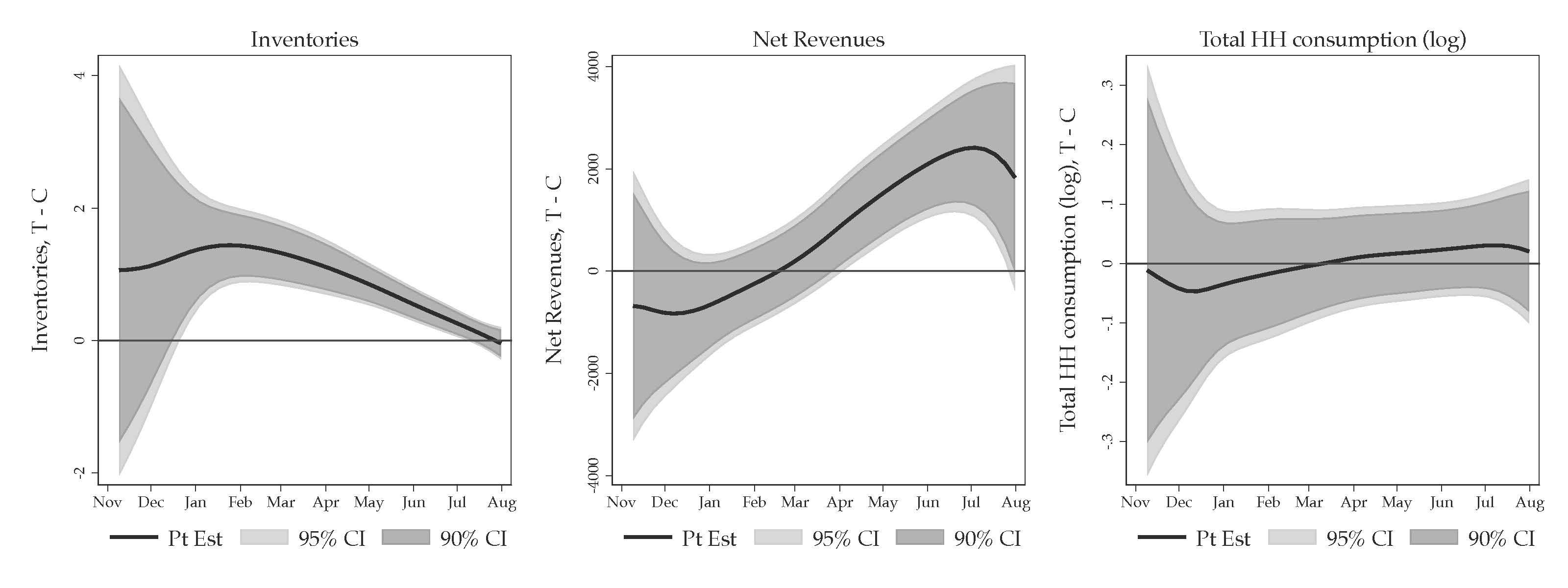

To test whether this shift in sales behaviour by individual farmers has an effect on market-level prices, we experimentally varied the density of treated farmers across locations and tracked prices at over 50 local markets. In locations where more farmers received the loan and therefore more grain was stored, we find significantly higher prices at harvest – as maize is kept in stores, lowering supply – and lower prices (albeit not quite significant) in the lean season – as the stored maize is released (see Figure 3).

Figure 3: Pooled market prices for maize as a function of local treatment intensity

Notes: Average difference in prices between high- and low intensity areas over time, with the bootstrapped 95% confidence interval shown in light grey and the 90% confidence interval shown in dark grey (prices are normalized to 100 in November in low-intensity sublocations; bootstrap conducted with 1,000 replications drawing groups with replacement).

This shapes the returns to the loan: revenue impacts are largest for borrowers in low-density areas, where large arbitrage opportunities remain; in high-density areas, storage by others dampens the seasonal price fluctuations that borrowers are exploiting. Put another way: arbitrage is most profitable when you are the only one doing it.

Conversely, for farmers who do receive the loan, these price effects may be helpful, as they imply a higher price at harvest time – when most rural households sell – and a lower price in the lean season – when most rural households are net buyers. We find suggestive evidence of these positive spillovers among our control group. On net, these positive spillovers to the broader community are substantial, accounting for 81% of the overall gains in high density treatment areas, which ultimately see larger total benefits than low intensity areas.

Integrated financial products, including simple savings technologies, can unlock farmers’ ability to channel returns into forward-looking investments

One limitation of the harvest-time loans is that they only offered short-term gains: while they helped farmers time their sales more effectively and earn higher revenues, we did not observe any significant effects on household consumption or productive investments. This led us to question whether savings tools, when coupled with loans, could help farmers achieve longer-term growth in spending and investment.

Building on this, a second study (Mukherjee et al. 2024) explores the impacts of a cross-randomised savings intervention. Following the promising results from Dupas and Robinson (2013), we offered to randomly selected farmers in our sample a simple savings tool: a metal lockbox stored in their home. Outside our intervention, two-thirds of respondents’ report having no formal savings accounts. Our goal was to understand how credit and savings can complement each other to increase consumption and investment. We find that although the lockbox did not alter the returns to the loan (it had no effect on maize revenues), it did affect how farmers channelled loan returns. Farmers who receive both the loan and the lockbox invest 11% more in farm inputs and enjoy 7% higher consumption. The latter is especially pronounced during the lean season. We find no effect of the lockbox on its own. While we cannot confirm mechanisms, evidence suggests that a variety of channels previously identified in the literature may be at play in our context: having a safe place to move money across time, being able to protect loan returns from the “kin tax” of family demands (Jakiela and Ozier 2016, Squires 2016), and improving mental accounting (Thaler 1999; Dupas and Robinson 2013).

Policy implications for helping farmers in Africa

For policymakers, the findings from our research highlight the critical need for a more nuanced and integrated approach when designing financial products for rural communities in low and middle-income countries. To deliver successful outcomes, the timing, packaging, and scale of financial services must be carefully considered.

- Timing matters: Rural economies are shaped by harvest-driven seasonal fluctuations, which result in large price and consumption swings. In this context, the appropriate timing of financial products is key. Financial products should be tailored to align with the specific timing of farmers’ income and expenses.

- Integrated financial approaches can be complementary: Poor households often lack access to both the credit products needed to exploit economic opportunities and the savings vehicles needed to channel resulting profits into forward-looking investments. These results suggest that providing households with complementary credit and savings products could be particularly effective.

- General equilibrium effects can shape size and distribution of returns to financial access: In isolated and rural markets, prices can respond to changes in local supply and demand. These price responses can shape the returns to financial access. In our context, they result in damped seasonal price fluctuations, which shift the benefits of credit from direct recipients to the broader community.

We gratefully thank Devina Aggarwal and the team at the Yale Economic Growth Center for their assistance on this VoxDev article.

Editor’s note: “The views expressed herein are those of the author and should not be attributed to the IMF, its Executive Board, or its management.”

References

Barrett, C, and P Dorosh (1996), “Farmers’ welfare and changing food prices: Nonparametric evidence from rice in Madagascar,” American Journal of Agricultural Economics, 78: 656–669.

Basu, K, and M Wong (2015), “Evaluating seasonal food storage and credit programs in East Indonesia,” Journal of Development Economics, 115: 200–216.

Burke, M, L F Bergquist, and E Miguel (2019), “Sell low and buy high: Arbitrage and local price effects in Kenyan markets,” Quarterly Journal of Economics, 134(2): 785–842.

Dupas, P, and J Robinson (2013), “Why don't the poor save more? Evidence from health savings experiments,” American Economic Review, 103(4): 1138–1171.

Fafchamps, M (1992), “Cash crop production, food price volatility, and rural market integration in the Third World,” American Journal of Agricultural Economics, 74: 90–99.

Jakiela, P, and O Ozier (2016), “Does Africa need a rotten kin theorem? Experimental evidence from village economies,” The Review of Economic Studies, 83(1): 231–268.

Kaminski, J, L Christiaensen, and C L Gilbert (2014), “The end of seasonality? New insights from Sub-Saharan Africa,” World Bank Policy Research Working Paper.

Minten, B, and S Kyle (1999), “The effect of distance and road quality on food collection, marketing margins, and traders’ wages: Evidence from the former Zaire,” Journal of Development Economics, 60: 467–495.

Mukherjee, S W, L F Bergquist, M Burke, and E Miguel (2024), “Unlocking the benefit of credit through savings,” Journal of Development Economics, 171.

Stephens, E C, and C B Barrett (2011), “Incomplete credit markets and commodity marketing behaviour,” Journal of Agricultural Economics, 62: 1–24.

Squires, M (2016), “Kinship taxation as a constraint to microenterprise growth: Experimental evidence from Kenya,” Unpublished manuscript.

Thaler, R H (1999), “Mental accounting matters,” Journal of Behavioral Decision Making, 12(3): 183–206.