The effect of MNEs on CO2 emissions

This section examines empirical evidence on the influence of MNEs on emissions in developing countries and the policy implications that arise from these findings. MNEs can influence emissions through various channels as their operations span multiple countries.

First, these firms may find it easier to evade national stringent environmental regulations by shifting emission-intensive production to regions with less stringent environmental standards. This is known in the literature as the pollution haven hypothesis. This practice can not only undermine local environmental policies addressing global pollutants like CO2, but can also pose challenges for developing nations that may become recipients of environmentally harmful production facilities.

Second, policies directed to MNEs offer a potential avenue for developing countries to enhance their access to cleaner technologies that may not be readily available domestically. This phenomenon is commonly referred to as the pollution halo hypothesis. There are large disparities in the access to environmental technologies across countries. In this context, if MNEs have access to cleaner technologies at their headquarters, they could play a pivotal role in facilitating the transfer of more advanced and efficient technologies to their operations in developing countries.

Lastly, the impact of MNEs can affect the emissions of domestic firms within host countries. Local firms might be able to acquire knowledge about cleaner technologies by copying practices employed by foreign-owned firms. Furthermore, in recent years MNEs started responsible sourcing policies, which often require environmental standards for local suppliers along the MNE supply chains. These policies can affect the emission rates of domestic suppliers connected to the MNE.

Are MNEs cleaner than domestic firms?

Numerous studies investigate whether facilities operated by MNEs exhibit lower emissions per unit of output, for both local and global pollutants, than those owned by domestic firms. While the ideal metric for this calculation would involve direct measurements of plant-level emissions per quantity produced, such data is often unavailable, especially in developing countries. Consequently, researchers often resort to alternative indicators, such as the ratio of energy consumption to a measure of total output (i.e. energy intensity), as proxies for environmental efficiency. The prevailing consensus in the existing literature suggests that plants under foreign ownership generally exhibit superior environmental performance compared to their domestically-owned counterparts.

Eskeland and Harrison (2003) analyse plant-level data from Cote d’Ivoire, Morocco, Mexico and Venezuela. They show that in each of those countries, plants owned by MNEs have lower energy intensity than plants owned by domestic firms. Albornoz et al. (2009) employ a cross-section of 1,200 firms located in Argentina and find a positive correlation between foreign ownership and the implementation of environmental management systems. Dardati and Saygili (2012) analyse plant-level data in Chile and find that foreign plants have lower emission rates than domestic plants, even after controlling for productivity and other firm-level characteristics.

Building on this body of work, Brucal et al. (2019) take a step forward to identify the causal effect of foreign ownership on plant emission rates. They use rich plant-level data from Indonesia, over the period 1983-2008. The novel aspect of their research lies in the analytical technique: they have an event-study design that uses the timing of foreign acquisitions of domestic plants to isolate the causal effect of foreign ownership on emission rates in the years following the acquisition. They find that following a foreign acquisition, plants initially increase total energy use and carbon emissions due to an expansion in the scale of production. However, there is a significant decrease in energy and emission intensity per unit of output. The drop in energy use relative to output ranges from 26% in the year of acquisition to 30% two years later, indicating that foreign ownership tends to result in more energy-efficient and environmentally cleaner plants.

The studies discussed above consistently show that foreign-owned plants exhibit lower emission rates compared to their domestically-owned counterparts. Does this result depend on the cleanliness of the home country of the MNE? Are foreign-owned plants of firms headquartered in France cleaner than foreign-owned plants of firms headquartered in India? Garcia-Lembergman et al. (2023) investigate this question by combining two datasets. The first dataset records firm-level emissions from the Carbon Disclosure Project (CDP), a proprietary database where firms report their CO2 emissions separately for each host country where they operate. Firms in the CDP cover over 10% of global CO2 emissions. The second dataset records firm-level revenues for each host country where the firm operates and information on the global ultimate owner of the firm, from Orbis Global Database by Bureau Van Dijk.

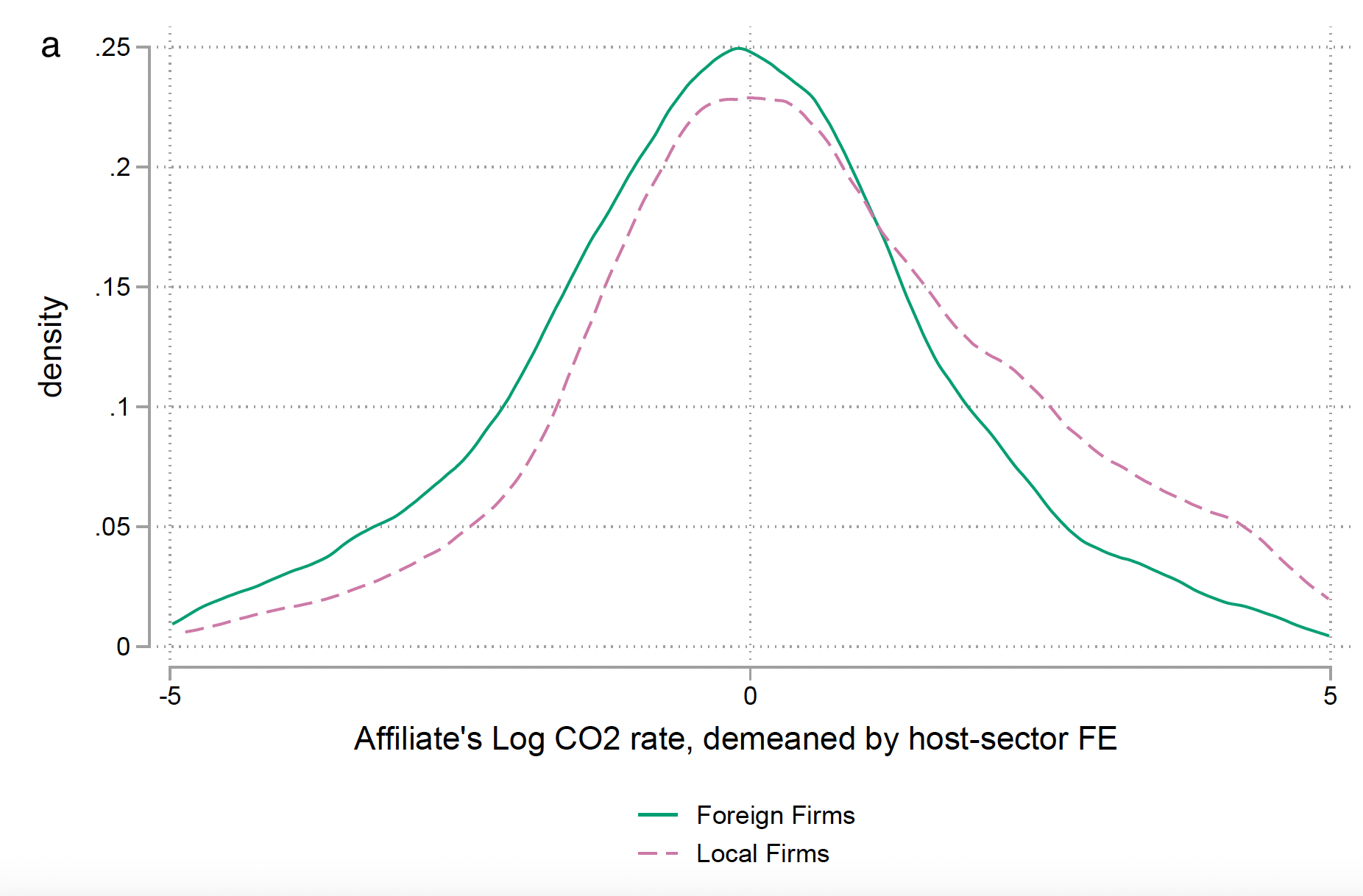

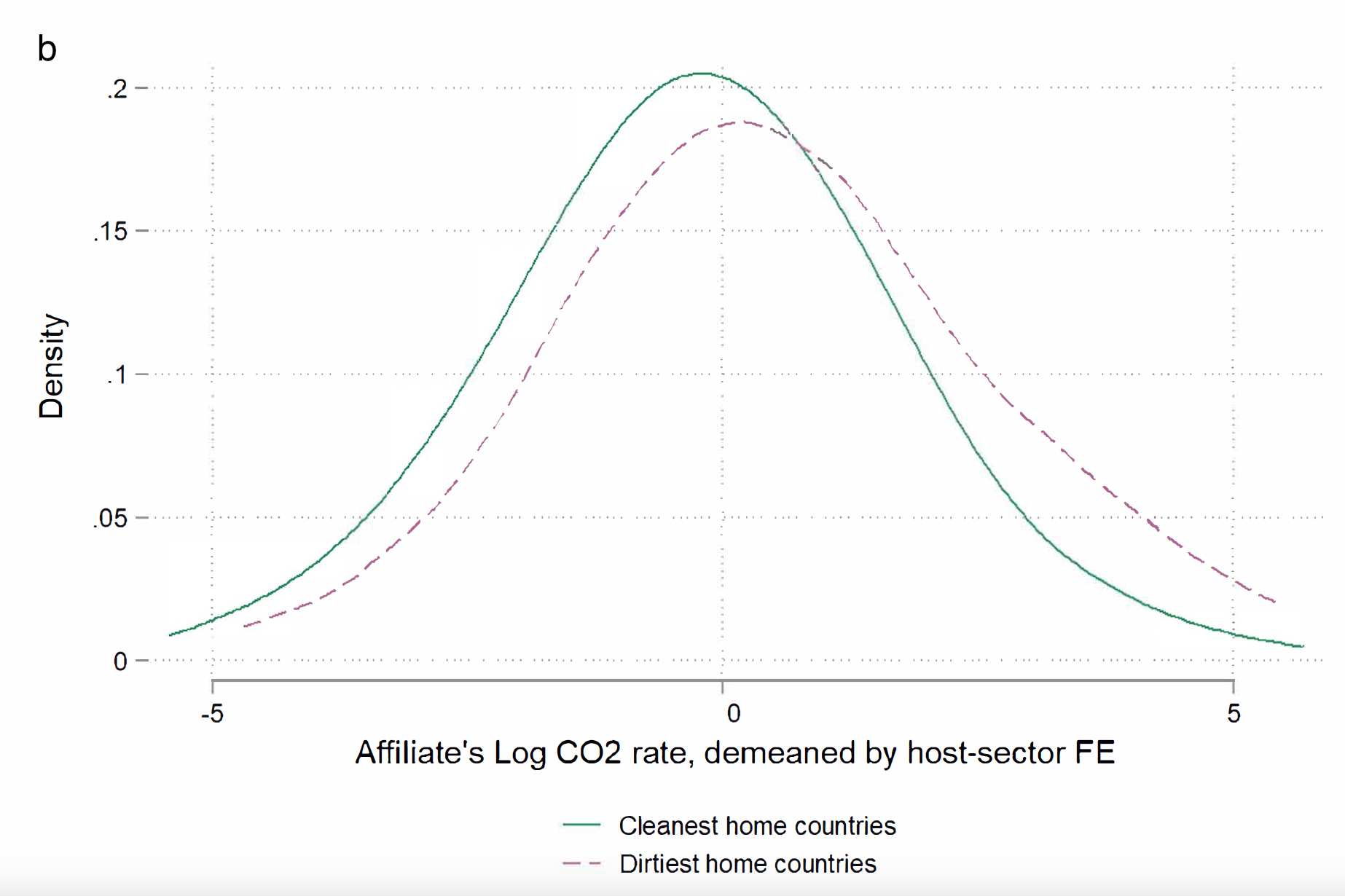

Garcia-Lembergman et al. (2023) find that plants belonging to firms from cleaner home countries indeed exhibit lower emission rates than plants belonging to local firms or firms from dirtier home countries. Figure 2 panels (a) and (b) illustrate this finding by displaying the kernel density of log CO2 emissions per dollar of revenue, separately for plants from different home countries. In both panels, the CO2 rate is residualised by host country-industry fixed effects in order to compare plants that operate within the same host country and industry, but differ based on their home country. Similar to other papers in this review, Panel (a) indicates that foreign firms exhibit lower emission rates than local firms. Panel (b) plots the kernel density of CO2 rates separately for plants belonging to firms from the top 25% cleanest versus the top 25% dirtiest home countries. Comparing plants within the same industry and host country, it is clear that plants owned by firms from cleaner home countries tend to emit less than plants owned by firms from dirtier home countries.

This pattern suggests that MNEs might transfer the advanced environmental technologies and practices available in their home country to their foreign subsidiaries. Consequently, policies directing incentives towards attracting MNEs headquartered in environmentally cleaner countries can be an effective approach to reducing a country’s average CO2 emissions rate.

Despite substantial evidence showing that foreign-owned plants emit less, we know little about the mechanisms behind this result. There are several reasons why foreign-owned plants might use cleaner technologies. First, it is well-established that, on average, MNEs tend to be larger and more productive than domestic firms. As a result, investments in improving energy efficiency are more valuable for MNEs as they can more easily cover the significant fixed costs of these investments. Second, firms headquartered in countries with strict environmental regulations are more likely to invest in, and develop energy-efficient and cleaner technologies. Once established, transfer of these cleaner technologies to foreign affiliates may be possible at relatively lower costs. This technology transfer mechanism could be a significant factor in the reduced emissions observed in foreign-owned plants.

Figure 2: MNE affiliates and CO2 emissions

Do MNEs shift polluting activities to their foreign plants?

Given that MNEs operate on a global scale, they can avoid local environmental regulations by transferring polluting activities abroad. This behaviour is referred to in the literature as the pollution haven hypothesis (PHH). This hypothesis was initially proposed by Copeland and Taylor (1994) within the framework of North-South trade relations under NAFTA. The empirical evidence regarding the PHH remains mixed (see Cole et al. 2017, for a review).

More recently, research has explored a particular aspect of the PHH: carbon leakage. Carbon leakage occurs when an MNE responds to more stringent local climate policies by shifting CO2 emissions to foreign countries. Unlike the PHH literature, which primarily focuses on the environmental impact in the host country, the literature on carbon leakage considers the global economy. As CO2 is a global pollutant, the location of its release is irrelevant. Therefore, local policies aimed at reducing CO2 become less effective when emissions are merely shifted from one country to another.

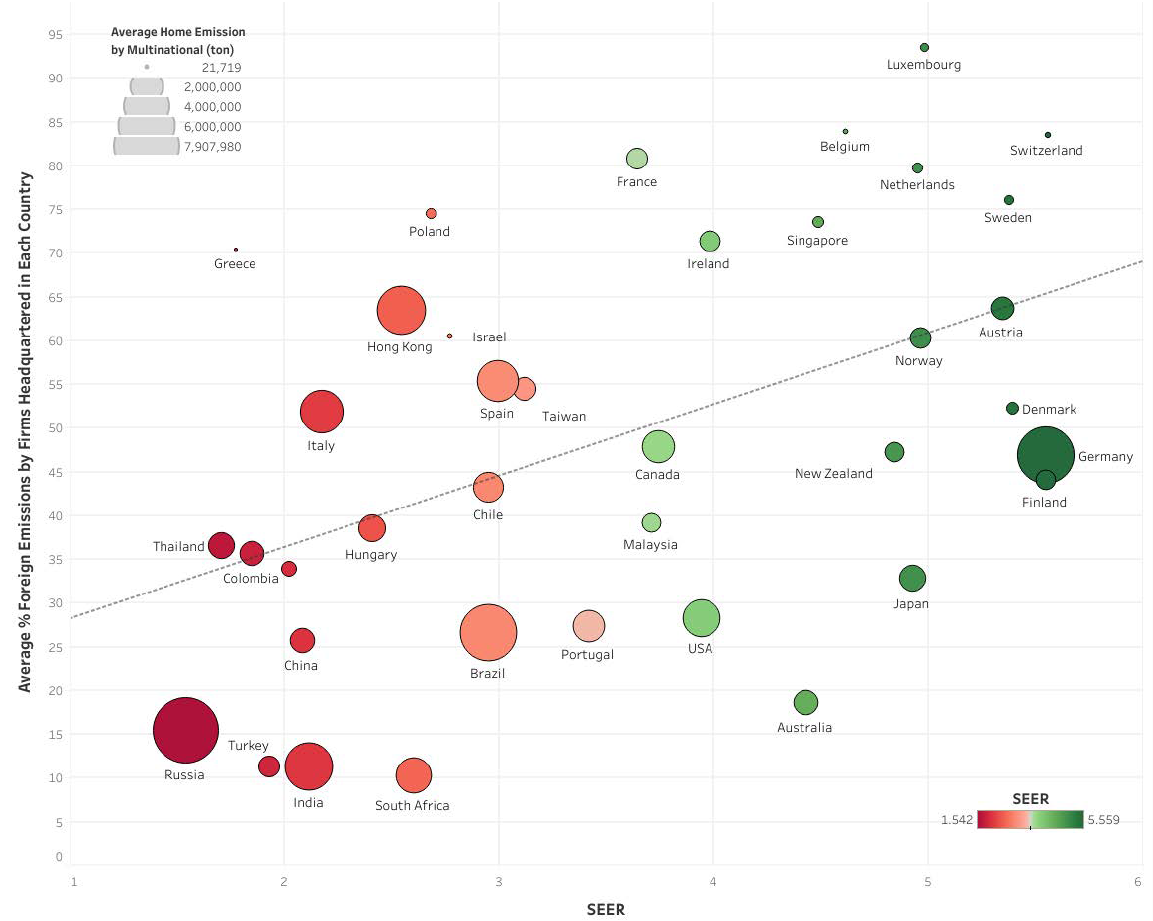

The evidence supporting the carbon-leakage hypothesis is also mixed. Table 1 presents a summary of the findings from research that has examined the carbon leakage hypothesis. Some studies document the existence of carbon leakages. Hanna (2010) tests whether the Clean Air Act Amendments (CAAA) resulted in increased foreign direct investment (FDI) by US based MNEs. The paper exploits the variation in the degree of regulation faced by firms as a result of the CAAA, controlling for firm-specific characteristics and industrial trends. This research finds that CAAA regulation caused MNEs to increase their foreign assets and output in polluting industries. However, heavily regulated firms did not disproportionately increase production in developing nations relative to other countries. In the same vein, Bartram et al. (2022) find that firms shift production from California - a state with stricter climate mitigation requirements - to other states along the intensive margin, but the effect is limited to financially constrained firms. Ben-David et al. (2021) study this question using firm-level data from the Carbon Disclosure Project. The authors document that firms headquartered in countries with strict environmental policies have higher CO2 emissions abroad. They argue that the effects are largely driven by tightened environmental policies in home countries, which incentivise firms to pollute abroad, rather than lenient policies in host countries. Figure 3 illustrates these findings. It shows that firms from countries with stricter environmental regulation produce a higher percentage of their emissions in foreign countries. Chung (2014) studies the pattern of South Korean FDI over the period 2000–2007, during which time Korean firms still relied on old production technologies despite facing rapidly strengthened environmental standards. They find strong evidence that firms in dirtier industries tend to invest more–both at the intensive and extensive margins—in countries with laxer environmental regulations.

While studies of cross-border movement of production facilities in response to climate or environmental regulation in emerging economies are quite scarce, some insights can be gained by examining within-country firm movements for large countries. Di (2007), Lin and Sun (2016), Cai et al. (2016) and Ni et al. (2022) find that, within China, foreign firms are less likely to locate in provinces with more stringent environmental regulations. Although this research does not specifically investigate whether a firm selects its plant location based on the strictness of environmental regulation, the observed preference of FDI in areas with more lenient regulation is suggestive evidence that this could indeed be the case.[1]

In contrast, other papers reveal minimal or no evidence of carbon leakage. Notably, two papers specifically investigate carbon leakages by MNEs after the implementation of the European Union Emissions Trading System (EU-ETS), one of the EU’s most stringent policies and its central strategy for addressing climate change. Dechezleprêtre et al. (2022) utilise firm-level data from the Carbon Disclosure Project to analyse the impact of the EU-ETS on MNE plant emissions outside the EU.

Figure 3: Carbon Leakage

Their analysis encompasses 1,122 MNEs, including 261 headquartered in nations regulated by the EU-ETS. Utilising a difference-in-difference methodology, they compare companies based in EU-ETS-regulated industries and countries with those in non-regulated countries. They find no significant evidence of carbon displacement from EU countries to MNE plants abroad. These results hold true even for sectors classified as ‘at risk of carbon-leakage’ by the European Commission. Colmer et al. (2023) also investigate the effect of EU-ETS on emissions in unregulated markets. They show that the EU-ETS system led to a decrease in overall emissions at the firm level, including emissions at home and abroad. Given that overall emissions declined this is indicative that there was no substantial outsourcing of emissions to unregulated markets after the implementation of the EU-ETS system. This result indicates that European MNEs did not shift their carbon emissions to regions with more lenient environmental policies after the implementation of the EU-ETS.[2]

A potential explanation for the mixed evidence is that leakage out of smaller countries might be larger than leakage out of large economic blocs such as the EU (Caron 2022). An additional factor contributing to this phenomenon could be the free allocation policy within the EU-ETS, designed with the explicit aim of mitigating leakage (Grubb et al. 2022, Naegele and Zaklan 2019). Finally, the proportion of energy costs within the overall total cost structure is comparatively modest in most of the industries. As a result, other factors, notably labour costs, may exert a more significant influence on the decisions of MNEs about where to locate their production. Aligned with this observation, some of the studies reviewed here demonstrate that carbon leakage among MNEs occurs more frequently in pollution-intensive industries.

In summary, carbon leakage might be important in some contexts or sectors, but the literature has not reached a consensus about the magnitude or relevance of the effects and, in particular, whether MNEs play a significant role in it. At the same time, MNEs are shown to utilise cleaner technologies, not only at home but also everywhere they go. It is still an open question as to which of these effects dominates. Put simply, research should explore the question: Is a world with MNEs cleaner or dirtier than a world without them?

Table 1: A selection of studies examining carbon leakage

| Paper | Countries | Years | Leakage |

| Outcome: FDI | |||

| Ben-David et al. (2021) | World | 2008-2015 | Yes |

| Cai et al. (2016) | Within China | 1991-2001 | Yes |

| Chung (2014) | South Korea - World | 2000-2007 | Yes |

| Di (2007) | Within China | 1992-1995 | Yes |

| Hanna (2010) | Within US | 1966-1999 | Yes |

| Kathuria (2018) | Within India | 2002-2010 | No |

| Koch and Basse Mama (2019) | German- non EU-ETS | 1993-2013 | Yes, but limited |

| Lin and Sun (2016) | Within China | 2000-2010 | Yes, for polluting industries |

| Ni et al. (2022) | Within China | 2006-2019 | Yes |

| Outcome: CO2 | |||

| Bartram et al. (2022) | Within US | 2010-2015 | Yes |

| Colmer et al. (2023) | EU-ETS non EU-ETS | 1996-2012 | No |

| Dechezleprêtre et al. (2022) | EU - World | 2007-2014 | No |

Do MNEs transfer cleaner technologies or practices to domestic firms?

MNEs can create opportunities for local firms to acquire knowledge about cleaner technologies used in their operations. Furthermore, the implementation of responsible sourcing policies by MNEs, which mandate that suppliers meet specific environmental standards, might also have an impact on their domestic suppliers. These spillovers to domestic firms in the host country might be key in influencing total CO2 emissions, especially given that emissions from the supply chains of MNEs contribute substantially to their total emissions. For instance, Steenbergen and Saurav (2023) show, using survey data from the Carbon Disclosure Project, that while emissions from the direct activities of 157 major MNEs and their network of affiliates worldwide account for 10% of total direct industrial emissions; indirect emissions from their supply chains represent an additional 50%.

However, the empirical evidence analysing whether MNEs affect the emission rates of their domestic suppliers is limited due to data constraints. Gathering comprehensive data on emissions, energy intensity or other indicators of environmental efficiency for MNEs and their suppliers poses significant challenges. For instance, manufacturing census databases do not typically indicate whether a firm is a supplier to an MNE. Firm-to-firm databases from VAT records, which could reveal such firm-to-firm links, often lack information on emissions or ownership details. In one of the few studies in this area, Albornoz et al. (2009) utilised data from Argentinean manufacturing firms to investigate indirectly these environmental spillovers. Their findings suggest that foreign-owned firms are more inclined to implement environmental management systems (EMS) compared to domestic firms. Importantly, there is a tendency for firms supplying sectors with substantial foreign presence also to adopt EMS.

These insights underscore the need to build datasets that enable researchers to investigate how MNEs can impact global CO2 emissions.

Policy implications and next steps

In summary, strong evidence shows that MNEs are more energy efficient than their domestic counterparts. Evidence is mixed about whether MNEs from countries with stricter environmental regulations reallocate their dirtier production to countries with laxer policies. Finally, more research is needed about the environmental spillover of MNEs to domestic firms.

Although evidence is mixed, carbon leakage is still an important concern, particularly in industries that are both trade-intensive and energy-intensive. Unilateral policies aimed at reducing CO2 are less effective if emissions merely reallocate from one country to another. This underscores the importance of several critical research areas:

- Correctly measuring leakage and identifying the sectors at greater risk of carbon leakage, particularly those with higher emission intensity and trade exposure (Fowlie and Reguant 2018).

- Designing policy to prevent carbon leakage.

Some examples of these policies are carbon border adjustment taxes (CBAT) and Climate Clubs, as proposed by Nordhaus (2015). CBATs introduce a new component to existing tariff lines based on taxing the carbon content of imported products. Different from CBATs, Climate Clubs leverage on trade taxes as contingent penalties: countries that adopt a sufficiently high local carbon price avoid trade penalties, while non-cooperative countries face trade penalties. These policies are often discussed within the context of trade but are also powerful tools to alter the incentives of MNEs to engage in carbon-leakage behaviour.

On this ground, Farrokhi and Lashkaripour (2025) present the first comprehensive general equilibrium analysis assessing the effectiveness of these types of policies. Their analysis incorporates global carbon supply chains and climate externalities in a multi-country, multi-industry quantitative trade model. Using optimal trade and carbon taxes, their analysis uncovers the maximum potential impact of CBATs and Climate Clubs. They find that CBATs are not particularly effective as they achieve only 3.4% of the emissions reduction attainable under globally optimal carbon pricing. In contrast, the Climate Club framework can deliver 33–68% of the globally optimal carbon reduction, depending on whether the initial coalition includes the EU, the EU and the US, or the EU, the US, and China. However, none of these policies are cost-free. Specifically, CBAT and Climate Clubs face important practical challenges and might negatively affect developing countries (Grubb et al. 2022, Clausing and Wolfram 2023).

The research examined in this section of the review provides support for the pollution halo hypothesis. This hypothesis posits that MNEs, particularly those from environmentally conscious home countries, can bring cleaner technologies and practices to developing nations. Consequently, policies designed to attract these MNEs could be an effective incentive mechanism to reduce emissions in the host country.

Finally, another set of important policies are those focused on multinational supply chains. With regards to these policies, there are two important considerations. First, we need to create more comprehensive datasets that allow researchers to quantify the effects that MNEs can have on emissions through their impact on suppliers. Second, governments can provide incentives for MNEs to engage in responsible sourcing policies that encourage their suppliers to adopt high environmental standards.

Innovation on green technologies

There is widespread consensus that one of the key reasons for the large differences in economic productivity between developed and developing countries is a technology gap. Despite high hopes, these gaps prove persistent and may only be a symptom, not the root cause, of more fundamental challenges, such as poor institutions. Irrespective, there is also widespread consensus (as discussed in earlier sections of this review) that MNEs could overcome some of these gaps and be agents of investment and support the transfer of technology. It is therefore critical to understand the role of these firms in driving innovation in clean technologies and in contributing to broader efforts to clean up the global economy.

Carbon halo, carbon superstars, and innovation

Ever since developed countries started to implement climate policies, much of the policy debate and some of the academic literature revolved around the potential for carbon leakage.[3] MNEs in particular, having already incurred the cost of establishing operations in multiple countries, might facilitate carbon leakage. However, as discussed in the previous section, empirical evidence on carbon leakage is mixed. It is increasingly clear that MNEs can play a different, more positive role in efforts to reach Net Zero. There are at least two other potential mechanisms at play:

- The carbon halo effect: firms evade strict regulation by moving polluting production abroad. However, they also transfer more efficient technology so that on net, emissions reduce globally (an effect that already has been discussed in the previous section).

- The carbon superstar effect: firms in Emerging and Developing Economies (EMDE) become innovation leaders rather than adopters of technology developed elsewhere. Similarly, many EMDE countries have rich endowments of renewable energy resources or minerals crucial for battery production.[4] Hence, far from being pollution havens, these economies might become the first-best location for energy-intensive economic activities or become part of the battery production supply chain.

Both effects are closely linked to various forms of innovation. The carbon halo effect requires some form of process innovation, where firms introduce technologies and processes that are at least new to the adopting firm. The carbon star effect is inherently linked to product and business model innovation as well entrepreneurship. What is the emerging evidence on the role of MNEs in these phenomena?

The most notable example of the carbon superstar phenomenon is the emergence of China as a world leading producer and exporter of solar panels and EVs.[5] The emergence of firms like RIMAC in Croatia is another example.[6]

Investments by MNEs headquartered in developed economies may have spurred the development of green technologies in host countries, such as China, and thereby contributed to their emergence as carbon superstars. This phenomenon is a stronger version of the pollution halo effect where FDI not only leads to the adoption of, but also spurs innovation in, green technologies.

From a theoretical standpoint, the link between FDI and innovation is ambiguous. On the one hand, investments by foreign MNEs can increase the innovative capacities of local firms. This increase may happen directly as MNEs finance local innovations, or as subsidiaries quickly catch up to the frontier, enabling them to undertake their own innovations. Alternatively, it can occur indirectly in other firms through knowledge spillovers or through input-output linkages. However, investments by foreign MNEs may reduce local innovation through a competition effect, or could increase dirty innovation at the expense of green innovation, if, for instance, MNEs relocate their more polluting activities.[7] Therefore, the effect of FDI on green innovation is ultimately an empirical question.

Inward FDI and green innovation

A first area of research, focusing on China, correlates FDI and measures of green innovation at the province or city level. Despite focusing on correlations, they suggest a positive link between FDI and green innovation. For example, Dong et al. (2019) measure the bias of technical change using a panel of Chinese provinces and find that FDI is correlated with energy-saving technical change. Other papers use patent data: Shao et al. (2023) find a U-shaped relationship between FDI and green innovation in a panel of Chinese prefectures - FDI is negatively correlated with green innovation at low levels, but positively correlated at high levels. Similarly, Chen et al. (2023) and Cao and Zhang (2023) find a positive effect of FDI on green innovation in a panel of Chinese provinces and prefectures, respectively. This effect is stronger when local environmental regulations are stronger.[8]

A second area of research focuses on firm-level outcomes. In a cross-section of Spanish firms, Balaguer et al. (2023) document that firms with foreign participation spend and invest more in environmental protection. Going one step further, Amendolagine et al. (2023) use Orbis and the patent database PATSTAT to identify firms that are the recipients of green FDI — i.e. foreign subsidiaries of parent firms that have innovated in renewable technologies. They compare the innovation performance of these foreign subsidiaries with the performance of purely domestic firms that have also undertaken green innovation. They find that the gap between foreign subsidiaries and domestic firms in terms of innovativeness increases over time — a gap which is particularly large for firms in China and India.[9] More indirectly, Wu et al. (2023) measure foreign participation at the industry level in China as the share of output produced by foreign subsidiaries - defined as ‘multinational production’. They instrument multinational production using exchange rate fluctuations and find that firms in sectors with more multinational production tend to undertake more green innovations. This is also true for firms upstream and downstream of sectors with a high level of multinational production. Zheng (2023) provides perhaps more credible evidence on the effect of FDI on green innovation by exploiting regulatory changes for foreign firms across China. The Chinese government maintains a varying list of products for which the presence of foreign firms is either encouraged, tolerated or discouraged. He uses this data at the industry level to build an instrument and measures the knowledge stocks of foreign green subsidiaries using patent data. He finds that a 1% increase in the knowledge stocks of foreign green subsidiaries is associated with an increase of 0.73% of green innovation in upstream sectors, with no effect on the same sectors and a positive but less precise effect on downstream sectors. These results are consistent with the idea that FDI affects the innovativeness of the subsidiaries’ suppliers, which must provide more advanced products for their foreign customers.

Bai et al. (2023) conduct a detailed study of the “Quid pro quo” that China imposed on Western car companies ever since it started opening to FDI in 1978. Foreign companies were incentivised with high import tariffs to set up production facilities in China. However, when doing so they were required to enter joint ventures with domestic firms. By 2014, many of those domestic firms had launched their own vehicle brands and models for both domestic and export markets. Bai et al. (2023) examine detailed data on vehicle performance (including failure rates) of vehicles produced by Chinese companies. They identify FDI effects by exploring heterogeneity in the performance of foreign firms; i.e. do models from domestic firms excel in the same categories as the models from their foreign venture partner? The authors find this to be the case and interpret it as evidence of knowledge spillovers from foreign to domestic firms: a joint venture improves a car quality score by 8.7% on average. While not specifically focusing on clean cars, this research exploits the richness of the available data and allows the authors to delve into some of the underlying mechanisms driving spillovers. Among other results, they establish that quality improvements are driven both by worker flows between joint venture establishments and domestic joint venture partner establishments and by shared supplier linkages.

Outward FDI and green innovation

Inward FDI, imports, and licensing were key to the initial development of clean technologies in China and other emerging markets.[10] Yet, as these countries have become closer to the technological frontier, “unconventional” forms of technological transfers, such as outward FDI or R&D collaborations, have gained more importance over time — i.e. domestic firms in EMDE countries undertake FDI to actively source knowledge rather than being more passive recipients of spillovers. Fu and Zhang (2011) and Lema and Lema (2012) detail this phenomenon through numerous examples, for the solar industry in China and for the wind, solar, and electric vehicles industries in China and India, respectively. For instance, SAIC, one of the largest Chinese car manufacturers and a world leader in electric vehicles, initially developed joint ventures with a US lithium-ion battery manufacturer, Volkswagen, and General Motors; but later, it invested abroad, including eventually acquiring Rover. In a World Bank report, Steenbergen and Saurav (2023) also argue that “emerging economies are increasingly becoming a source of technology transfers,” referring especially to China.

The economic literature on the role of unconventional technological transfers in the rise of the emerging markets carbon superstars remains limited, particularly when it comes to well-identified studies. A few papers have looked at the effects of outward FDI using Chinese panel data at the province level. Luo et al. (2021), Dai et al. (2021), and Liu et al. (2021) all find positive effects of outward FDI on green innovation (though only if local environmental regulation is sufficiently strong in Dai et al. 2021) and substantial heterogeneity. At the firm-level, Bai et al. (2020) and Shi et al. (2023) document a positive relationship between outward FDI and green innovation of Chinese firms, particularly when the host countries are more developed or have more stringent environmental regulations.

Policy implications and next steps

The transition to a clean(er) global economic system is associated with a Schumpeterian wave of technological creative destruction. Existing accumulated knowledge in fossil-fuel technologies becomes irrelevant and the sources of comparative advantages change - e.g. knowledge in batteries and access to rare-Earth minerals become key assets. Newcomers are also unimpaired by fossil fuel incumbents. This provides opportunities for transformational growth and thus the emergence of carbon superstars. How likely is it that such carbon superstars emerge from EMDE countries? The leadership of Chinese firms in both Electric Vehicles (EVs) and solar energy should make us hopeful that relatively poor countries can leapfrog developed economies and quickly become leaders (Altenburg et al. 2022, Lema et al. 2020). Moreover, the Chinese examples show that FDI into emerging economies, as well as FDI from those economies, are central factors on the road to carbon superstardom.

However, China is a special case in many respects; the question arises to what extent the Chinese example is replicable elsewhere. This is particularly true for the involvement of MNEs. Western MNEs might be less inclined to accept strict joint venture rules in economies with small domestic markets.[11] Moreover, the Chinese government deployed a wide range of industrial policy instruments, which many other countries might find hard to match. Indeed, the degree of subsidies that China was willing to expend also raises questions as to the overall efficiency of such policies. Hence, two important areas for further research include consideration of the feasibility and efficiency of carbon superstars in a broader range of countries and an evaluation of the most appropriate policy instruments to achieve this goal. Potential policies may include joint venture requirements, explicit and implicit subsidies, or perhaps investment into the human capital of the local labour force, the creation of an entrepreneurial culture, the provision of venture capital, and other forms of finance.

Adaptation to climate risk

This section summarises the economic research on MNEs’ adaptation to the new and complex risks posed by climate change. These risks can take not only the form of ‘physical risks’, i.e. physical manifestations of climate change such as natural disasters, but also ‘transition risks’ as climate policies are implemented, consumer demand changes and green technologies are introduced.

We first review the impact of these two types of climate risks on FDI flows by summarising relevant theoretical predictions and the empirical evidence on their short- and long-run impacts. For each risk type, it is also useful to separate the effects on FDI flows to and from advanced and emerging/developing economies.[12] In the last part of this section, we provide some policy implications.

Physical risks

When a natural disaster hits a production site, or surrounding area, of a company, it will necessarily disrupt its operations, at least for a period of time, due to direct damage, inability to source domestic inputs (Kato and Okubo 2022) or damage to infrastructure and transportation (Linnenluecke et al. 2011). A number of papers document an immediate decline in manufacturing FDI inflows following climate-related disasters (Doytch 2020, Escaleras and Register 2011). At the firm level, Castro-Vincenzi (2023) shows that car manufacturers have to relocate production to different locations following flood damages. Generally, some production relocation may occur within countries from more to less affected regions (Friedt and Toner-Rodgers 2022), while some of it can occur across borders (Pankratz and Schiller 2021).

The long-run impacts of the increasing frequency of climate-related disasters are less clear. An MNE may invest into reconstruction from damages (Wang et al. 2021) and physical protection against future disasters, thus increasing FDI in the long run, as documented by Doytch (2020) and Neise et al. (2022). Or, it may choose to relocate production facilities to less affected areas, as predicted by the model in Castro-Vincenzi (2023). For the service sector, the driving force of FDI is local demand, and Doytch (2020) finds that some disasters have long-lasting negative effects on service sector FDI.

In terms of magnitudes, the effects tend to be small (Escaleras and Register 2011, Gu and Hale 2023), heterogeneous across industries (Kanagaretnam et al. 2022), and only last for a year or two (Chen and Fang 2024).

Advanced economies are less affected by physical climate risks because of their geographical location and greater resource availability to manage and adapt to risk. Thus, it is not surprising that evidence on such effects for advanced economies is limited. In terms of cross-border FDI, Gu and Hale (2023) find very little effect for advanced economies. Focusing on Europe, where there is more attention to climate change risks, Hoon Oh and Oetzel (2010) did not find a response to climate-related shocks for MNEs. At the firm level, Jia et al. (2022) find that floods reduce firm entry into affected US regions, but do not have an international dimension.

A few studies focus specifically on emerging and developing economies. They generally find that FDI inflows to these countries respond negatively to climate-related disasters, or other measures of physical risk (Sasidaran Gopalan and Rajan 2023). Although the effects are potentially larger than for advanced economies (Ait Soussane et al. 2023), the results are usually found to be small and not statistically significant (Yang 2008), and heterogeneous across countries. One possible explanation is that rather than leaving the affected country altogether, firms relocate to safer regions within target countries (Friedt and Toner-Rodgers 2022). It is also possible that foreign firms are able to place their production facilities in the safer areas of the countries when they first enter them (Li and Gallagher 2022).

Transition risks

Transition risks may come from policy changes, changes in consumer or investor preferences, or new technologies. Climate policies may impose costs or restrictions that may increase production costs, while changes in preferences and technologies may lead to rapid depreciation and loss of value of factors of production that are associated with greenhouse gas emissions. However, the theoretical predictions of the effects of transition risks on FDI are not clearcut (Dijkstra et al. 2011, Sanna-Randaccio et al. 2017, Gu and Hale 2023).

Differences in climate policies between source and target countries may itself be a barrier to FDI as firms may need to adapt their technologies to such differences (Ni et al. 2022, Sasidaran Gopalan and Rajan 2023). These effects, however, are not robust to aggregation, model specification, and different definitions of climate risk (Gu and Hale 2023). In addition, differences between country sizes may also be a barrier to firms’ response to climate policies (Sanna-Randaccio and Sestini 2012).

The empirical analysis of the response of FDI to such transition risks is also not straightforward. As reviewed in previous sections, testing the carbon leakage (López Santiago et al. 2019, Jorgenson et al. 2022, Koch and Basse Mama 2019) is complicated by endogeneity concerns (Cole et al. 2006). The survey in Cole et al. (2017) demonstrates a feedback loop between FDI and environmental policies. Not only can FDI impact environmental policies, but controlling for this endogeneity can impact the findings on how these policies affect FDI.

Policy implications and next steps

Climate risks, both physical risks and transition risks, will only become more severe over time. Yet, there is still a substantial knowledge gap in terms of how MNEs are exposed to these risks and no consensus as to how they have reacted so far and might react in the future. This is partly due the complexity of the issue, partly due to the lack of disclosure of climate risks (Kouloukoui et al. 2018), and partly due to the heterogeneity of the empirical results, which depend on the aggregation level, sample, and specification (Barua et al. 2020, Gu and Hale 2023). In addition, there is evidence of substantial heterogeneity in firms’ attention to climate risks (Sautner et al. 2023). The number of firms becoming attentive to climate risks has grown substantially over recent years, especially after the UN Climate Change Conference (COP21) in 2016. Firms that are more exposed or attentive to climate risks are more likely to include them in their decision-making procedures. Based on existing evidence, we cannot rule out the possibility that there will be a significant reallocation of FDI due to climate risks.

References

Ait Soussane, J, D Mansouri, M Y Fakhouri, and Z Mansouri (2023), "Does climate change constitute a financial risk to foreign direct investment? An empirical analysis on 200 countries from 1970 to 2020", Weather, Climate, and Society 15(1): 31–43.

Albornoz, M, M A Cole, R J R Elliott, and M G Ercolani (2009), "In search of environmental spillovers", World Economy 32(1): 136–163.

Amendolagine, V, R Lema, and R Rabellotti (2021), "Green foreign direct investments and the deepening of capabilities for sustainable innovation in multinationals: Insights from renewable energy", Journal of Cleaner Production 310: 127381.

Arndt, C, D Arent, F Hartley, B Merven, and A H Mondal (2019), "Faster Than You Think: Renewable Energy and Developing Countries", Annual Review of Resource Economics 11(1): 149–168.

Bai, J, P J Barwick, S Cao, and S Li (2023), "Quid Pro Quo, Knowledge Spillover, and Industrial Quality Upgrading: Evidence from the Chinese Auto Industry", Working Paper.

Bai, Y, Q Qian, J Jiao, L Li, F Li, and R Yang (2020), "Can environmental innovation benefit from outward foreign direct investment to developed countries? Evidence from Chinese manufacturing enterprises", Environmental Science and Pollution Research International 27(12): 13790–13808.

Banares-Sanches, I, R Burgess, D Laszlo, P Simpson, J Van Reenen, and Y Wang (2024), "Ray of Hope? China and the Rise of Solar Energy", Working Paper.

Bartram, S M, K Hou, and S Kim (2022), "Real effects of climate policy: Financial constraints and spillovers", Journal of Financial Economics 143(2): 668–696.

Barua, S, S Colombage, and E Valenzuela (2020), "Climate change impact on foreign direct investment inflows: A dynamic assessment at the global, regional and economic level", SSRN Working Paper 3674777.

Behera, P and N Sethi (2022), "Nexus between environment regulation, FDI, and green technology innovation in OECD countries", Environmental Science and Pollution Research 29(35): 52940–52953.

Ben-David, I, Y Jang, S Kleimeier, and M Viehs (2021), "Exporting pollution: where do multinational firms emit CO2?", Economic Policy 36(107): 377–437.

Brucal, A, B Javorcik, and I Love (2019), "Good for the environment, good for business: Foreign acquisitions and energy intensity", Journal of International Economics 121: 103247.

Cai, X, Y Lu, M Wu, and L Yu (2016), "Does environmental regulation drive away inbound foreign direct investment? Evidence from a quasi-natural experiment in China", Journal of Development Economics 123: 73–85.

Cao, X and Y Zhang (2023), "Environmental regulation, foreign investment, and green innovation: A case study from China", Environmental Science and Pollution Research 30(3): 7218–7235.

Castro-Vincenzi, J (2023), "Climate hazards and resilience in the global car industry", Working Paper.

Chen, X and T Fang (2024), "Temperature anomalies and foreign direct investment: City-level evidence from China", International Review of Financial Analysis 91: 102983.

Chen, L, F Guo, and L Huang (2023), "Impact of Foreign Direct Investment on Green Innovation: Evidence from China’s Provincial Panel Data", Sustainability 15(4): 3318.

Chung, S (2014), "Environmental regulation and foreign direct investment: Evidence from South Korea", Journal of Development Economics 108(C): 222–236.

Clausing, K A and C Wolfram (2023), "Carbon border adjustments, climate clubs, and subsidy races when climate policies vary", Journal of Economic Perspectives 37(3): 137–162.

Cole, M A, R J R Elliott, and P G Fredriksson (2006), "Endogenous pollution havens: Does FDI influence environmental regulations?", Scandinavian Journal of Economics 108(1): 157–178.

Cole, M A, R J R Elliott, and L Zhang (2017), "Foreign direct investment and the environment", Annual Review of Environment and Resources 42: 465–487.

Colmer, J, R Martin, M Muûls, and U J Wagner (2023), "Does Pricing Carbon Mitigate Climate Change? Firm-Level Evidence From the European Union Emissions Trading Scheme", CRC TR 224 Discussion Paper Series.

Copeland, B R and M S Taylor (1994), "North-south trade and the environment", The Quarterly Journal of Economics 109(3): 755–787.

Dai, L, S Mu, C-C Lee, and W Liu (2021), "The impact of outward foreign direct investment on green innovation: The threshold effect of environmental regulation", Environmental Science and Pollution Research 28(26): 34868–34884.

Dardati, E and M Saygili (2012), "Multinationals and environmental regulation: Are foreign firms harmful?", Environment and Development Economics 17(2): 163–186.

Dechezleprêtre, A, C Gennaioli, R Martin, M Muûls, and T Stoerk (2022), "Searching for carbon leaks in multinational companies", Journal of Environmental Economics and Management 112: 102601.

Di, W (2007), "Pollution abatement cost savings and FDI inflows to polluting sectors in China", Environment and Development Economics 12(6): 775–798.

Dijkstra, B R, A J Mathew, and A Mukherjee (2011), "Environmental regulation: An incentive for foreign direct investment", Review of International Economics 19(3): 568–578.

Dong, Y, S Shao, and Y Zhang (2019), "Does FDI have energy-saving spillover effect in China? A perspective of energy-biased technical change", Journal of Cleaner Production 234: 436–450.

Doytch, N (2020), "Upgrading destruction? How do climate-related and geophysical natural disasters impact sectoral FDI", International Journal of Climate Change Strategies and Management 12(2): 182-200.

Escaleras, M and C A Register (2011), "Natural disasters and foreign direct investment", Land Economics 87(2): 346–363.

Eskeland, G S and A E Harrison (2003), "Moving to greener pastures? Multinationals and the pollution haven hypothesis", Journal of Development Economics 70(1): 1–23.

Farrokhi, F, and A Lashkaripour (2025), "Can Trade Policy Mitigate Climate Change?", Working Paper.

Fowlie, M and M Reguant (2018), "Challenges in the measurement of leakage risk", AEA Papers and Proceedings 108: 124–129.

Friedt, F L and A Toner-Rodgers (2022), "Natural disasters, intra-national FDI spillovers, and economic divergence: Evidence from India", Journal of Development Economics 157: 102872.

Fu, X and J Zhang (2011), "Technology transfer, indigenous innovation and leapfrogging in green technology: The solar-PV industry in China and India", Journal of Chinese Economic and Business Studies 9(4): 329–347.

Garcia-Lembergman, E, N Ramondo, J Shapiro, and A Rodriguez-Clare (2023), "The carbon footprint of multinational production", Working Paper.

Goldberg, P K and T Reed (2023), "Presidential Address: Demand-Side Constraints in Development. The Role of Market Size, Trade, and (In)Equality", Econometrica 91(6): 1915–1950.

Grubb, M, N D Jordan, E Hertwich, K Neuhoff, K Das, K R Bandyopadhyay, H van Asselt, M Sato, R Wang, W A Pizer, and H Oh (2022), "Carbon leakage, consumption, and trade", Annual Review of Environment and Resources 47(1): 753–795.

Gu, G W and G Hale (2023), "Climate risks and FDI", Journal of International Economics 146: 103731.

Hanna, R (2010), "US environmental regulation and FDI: Evidence from a panel of US-based multinational firms", American Economic Journal: Applied Economics 2(3): 158–189.

Hoon Oh, C and J Oetzel (2010), "Multinationals’ response to major disasters: How does subsidiary investment vary in response to the type of disaster and the quality of country governance?". Working Paper.

Jia, R, X Ma, and V W Xie (2022), "Expecting floods: Firm entry, employment, and aggregate implications", NBER Working Paper No. w30250.

Jorgenson, A, R Clark, J Kentor, and A Rieger (2022), "Networks, stocks, and climate change: A new approach to the study of foreign investment and the environment", Energy Research & Social Science 87: 102461.

Kanagaretnam, K, G Lobo, and L Zhang (2022), "Relationship between climate risk and physical and organizational capital", Management International Review 62(2): 245–283.

Kathuria, V (2018), "Does environmental governance matter for foreign direct investment? Testing the pollution haven hypothesis for Indian states", Asian Development Review 35(1): 81–107.

Kato, H and T Okubo (2022), "The resilience of FDI to natural disasters through industrial linkages", Environmental and Resource Economics 82(1): 177–225.

Koch, N and H Basse Mama (2019), "Does the EU emissions trading system induce investment leakage? Evidence from German multinational firms", Energy Economics 81: 479–492.

Kouloukoui, D, S M da Silva Gomes, M M de Oliveira Marinho, E A Torres, A Kiperstok, and P de Jong (2018), "Disclosure of climate risk information by the world’s largest companies", Mitigation and Adaptation Strategies for Global Change 23: 1251–1279.

Lema, R and A Lema (2012), "Technology transfer? The rise of China and India in green technology sectors", Innovation and Development 2(1): 23–44.

Lema, R, D Fu, and L Rabellotti (2020), "Green windows of opportunity: Latecomer development in the age of transformation toward sustainability", Industrial and Corporate Change 29(5): 1193-1209.

Li, X and K P Gallagher (2022), "Assessing the climate change exposure of foreign direct investment", Nature Communications 13(1): 1451.

Lin, L and W Sun (2016), "Location choice of FDI firms and environmental regulation reforms in China", Journal of Regulation Economics 50: 207–232.

Linnenluecke, M K, A Stathakis, and A Griffiths (2011), "Firm relocation as adaptive response to climate change and weather extremes", Global Environmental Change 21(1): 123–133.

Liu, L, Z Zhao, B Su, T S Ng, M Zhang, and L Qi (2021), "Structural breakpoints in the relationship between outward foreign direct investment and green innovation: An empirical study in China", Energy Economics 103: 105578.

Luo, Y, M Salman, and Z Lu (2021), "Heterogeneous impacts of environmental regulations and foreign direct investment on green innovation across different regions in China", The Science of the Total Environment 759: 143744.

López Santiago, L A, M A Cadarso, J Zafrilla, and G Arce (2019), "The carbon footprint of the U.S. multinationals’ foreign affiliates", Nature Communications 10(1).

Naegele, H and A Zaklan (2019), "Does the EU ETS cause carbon leakage in European manufacturing?", Journal of Environmental Economics and Management 93: 125–147.

Neise, T, F Sohns, M Breul, and J R Diez (2022), "The effect of natural disasters on FDI attraction: A sector-based analysis over time and space", Natural Hazards 110: 999–1023.

Ni, L, L Li, X Zhang, and H Wen (2022), "Climate policy and foreign direct investment: Evidence from a quasi-experiment in Chinese cities", Sustainability 14(24): 16469.

Nordhaus, W (2015), "Climate clubs: Overcoming free-riding in international climate policy", American Economic Review 105(4): 1339–1370.

Pankratz, N and C Schiller (2021), "Climate change and adaptation in global supply-chain networks", Proceedings of Paris December 2019 Finance Meeting EUROFIDAI-ESSEC, European Corporate Governance Institute–Finance Working Paper 775.

Sanna-Randaccio, F and R Sestini (2012), "The impact of unilateral climate policy with endogenous plant location and market size asymmetry", Review of International Economics 20(3): 580–599.

Sanna-Randaccio, F, R Sestini, and O Tarola (2017), "Unilateral climate policy and foreign direct investment with firm and country heterogeneity", Environmental Resource Economics 67: 379–401.

Sasidaran Gopalan, B G and R S Rajan (2023), "Do climate risks influence foreign direct investment inflows to emerging and developing economies?", Climate Policy 23(6): 722–734.

Saussay, A and M Sato (2018), "The impacts of energy prices on industrial foreign investment location: Evidence from global firm-level data", Working Papers.

Sautner, Z, L Van Lent, G Vilkov, and R Zhang (2023), "Firm-level climate change exposure", Journal of Finance 78(3): 1449–1498.

Shao, H, X Huang, and H Wen (2023), "Foreign direct investment, development strategy, and green innovation", Energy & Environment: 0958305X231164674.

Shi, X, Y Zeng, Y Wu, and S Wang (2023), "Outward foreign direct investment and green innovation in Chinese multinational companies", International Business Review 32(5): 102160.

Steenbergen, V and A Saurav (2023), The Effect of Multinational Enterprises on Climate Change: Supply Chain Emissions, Green Technology Transfers, and Corporate Commitments. Washington D.C.: The World Bank.

Wang, P, H Zhang, and J Wood (2021), "Foreign direct investment, natural disasters, and economic growth of host countries", in Chaiechi, T, ed. Economic Effects of Natural Disasters, Academic Press.

Wu, L, L Wang, and L Lin (2023), "Learn to be green: FDI spillover effects on eco-innovation in China", Industrial and Corporate Change 32(5): 1192–1216.

Yang, D (2008), "Coping with disaster: The impact of hurricanes on international financial flows, 1970-2002", The BE Journal of Economic Analysis & Policy 8(1).

Zheng, Y (2023), "Knowledge Spillover from Green FDI: Evidence from Green Innovation in China", Working Paper.

Contact VoxDev

If you have questions, feedback, or would like more information about this article, please feel free to reach out to the VoxDev team. We’re here to help with any inquiries and to provide further insights on our research and content.