Indices for the US, UK, France, and Germany show that recent levels of concern and uncertainty in European countries about migration are unprecedented

Europe’s recent waves of refugees from the Middle East and North Africa present difficult security challenges. They also create anxiety about the political, social and economic consequences of large population inflows (Halla et al. 2015). The Paris attacks on 13 November intensify security concerns and are likely to impede assimilation efforts (Gould and Klor 2014). Fears about terrorism and crime add to traditional economic worries about the effects of large immigration flows on labour markets, housing markets, schooling, social services, and government spending (Borjas 2003, Card 2005, Beerli and Perri 2015, and Boeri et al 2015). Major immigration policies, including the open border concept in the 26-country Schengen zone, are now in question (Pop 2015).

In light of these developments, we provide new quantitative indicators for the intensity of migration-related fears in France, Germany, the UK and the US. We inspect their time-series behaviour and compare them to indicators of migration-related policy uncertainty. These new indicators build on our recent efforts to measure economic policy uncertainty in countries around the world (Baker et al. 2015).

We define the following term sets:1

- Migration (M) – ‘border control’, Schengen, ‘open borders’, migrant, migration, asylum, refugee, immigrant, immigration, assimilation, ‘human trafficking’;

- Fear (F) – anxiety, panic, bomb, fear, crime, terror, worry, concern, violent;

- Economy (E) – economic, economy;

- Policy (P) – regulation, deficit, ‘white house’, legislation, congress, ‘federal reserve’;

- Uncertainty (U) – uncertainty, uncertain.

To construct our Migration Fear Index, we count the number of newspaper articles with at least one term from each of the M and F term sets, and then divide by the total count of newspaper articles (in the same calendar quarter and country). We construct our Migration Policy Uncertainty Index in the same way, except we instead count articles with at least one term from each of M, E, P and U term sets.2 We normalise each index to a mean value of 100 from 1995 to 2011. The counts reported here were obtained on 30 November 2015, but it can take several days or more to populate the underlying newspaper archives. So we may not capture the full effects of the Paris attacks in our November 2015 counts.

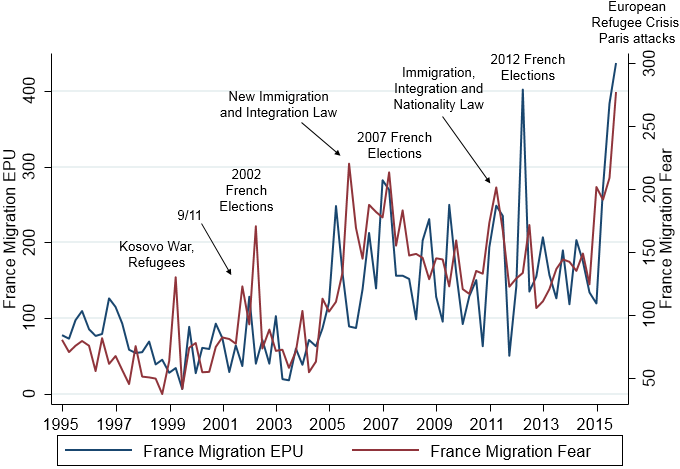

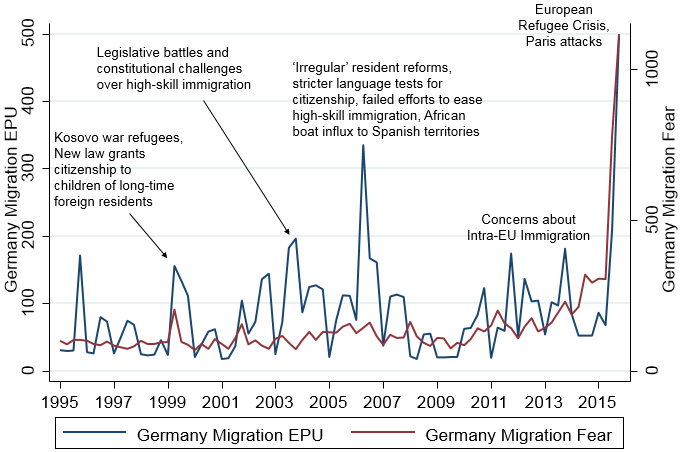

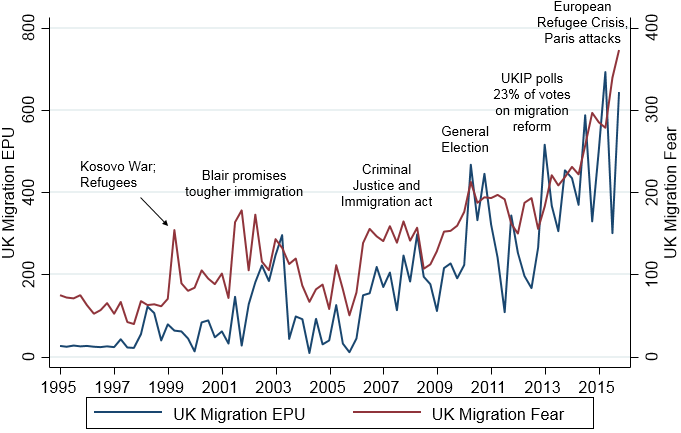

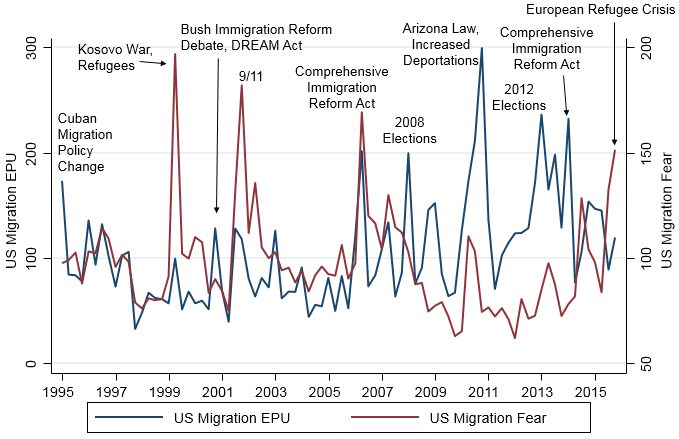

Figures 1 to 4 display the Migration Fear and Migration Policy Uncertainty Indices for France, Germany, the UK and the US, respectively.3 Several observations about these figures warrant attention:

- European countries show unprecedented levels of migration-related worries in recent months. The Migration Fear Index for October-November 2015 is roughly three-to-four times higher than the baseline in France and the UK, and more than ten times higher in Germany.

- The US shows a much more modest elevation of migration-related fears in late 2015, despite much attention to immigration and border control issues among US presidential candidates.

- Since 2005, migration-related fears have trended upward strongly in the UK (alongside rising levels of actual migration).

- Migration related fears have also risen in France, while migration-related fears in Germany do not show persistent upward movements until 2014.

- The data for each country strongly suggest that migration-related fears can spill over into migration-related policy uncertainty. The US shows roughly coincident spikes in each series in 1999, 2001, 2006, and 2010, while all three European countries show highly elevated migration-related policy uncertainty and fears in 2015.

The recent European experience with respect to migration concerns and policy uncertainty illustrates a broader pattern that we see in our measures of overall economic policy uncertainty for a dozen countries (Baker et al 2015). In particular, large unforeseen shocks can present policymakers with extraordinary challenges. Questions about how policymakers will respond and what the consequences will be then become an important source of economic uncertainty. For example, the Global Crisis confronted central banks and financial regulators with difficult policy decisions in an exceptionally volatile environment. Not surprisingly, our earlier work finds high levels of policy-related economic uncertainty in the US and many other countries in late 2008 and early 2009. Similarly, our measurement work suggests that difficult challenges in responding to the Greek debt crises have been a major source of policy-related economic uncertainty in the Eurozone.

As these examples suggest, the institutional setting and policymaking environment can influence the extent to which negative shocks and developments lead to bad outcomes and difficult policy challenges. This theme emerges clearly in the ‘consensus narrative’ of the Eurozone crisis described by Baldwin et al. (2015). As they remark, “there was nothing in EZ institutional infrastructure to deal with a crisis on this scale.” Likewise, the Schengen zone’s institutional infrastructure seems poorly equipped to respond to the recent massive immigration inflows in Europe. The weak institutional infrastructure contributes to the high levels of migration-related fears and policy uncertainty in Figures 1-3.

Our earlier work and work by others (e.g. Julio and Yook 2012, Handley and Limao 2012, Gulen and Ion 2015, Kelly et al. 2015) finds evidence that high levels of policy uncertainty raise stock-price volatility and reduce investment rates and employment growth. This evidence underscores the need for sound institutional design to mitigate policy-related economic uncertainty – whether in the face of large migration flows, financial crises, or other shocks.

Figure 1. Migration fear and policy uncertainty indices, France, 1995-2015

Notes: The Migration Policy Uncertainty Index reflects scaled quarterly counts of articles in Le Monde that satisfy the M, E, P and U criteria specified in the text. Similarly, the Migration Fear Index reflects scaled quarterly counts that satisfy the M and F criteria. We obtain article counts on 30 November 2015 and normalize each index to 100 from 1995 to 2011.

Figure 2. Migration fear and policy uncertainty indices, Germany, 1995-2015

Notes: The Migration Policy Uncertainty Index reflects scaled quarterly counts of articles in Frankfurter Allgemeine Zeitung and Handelsblatt that satisfy the M, E, P and U criteria. Similarly, the Migration Fear Index reflects scaled quarterly counts that satisfy the M and F criteria. We obtain article counts on 30 November 2015 and normalize each index to 100 from 1995 to 2011.

Figure 3. Migration fear and policy uncertainty indices, United Kingdom, 1995-2015

Notes: The Migration Policy Uncertainty Index reflects scaled quarterly counts of articles in the Financial Times and the Times of London that satisfy the M, E, P and U criteria. Similarly, the Migration Fear Index reflects scaled quarterly counts that satisfy the M and F criteria. We obtain article counts on 30 November 2015 and normalize each index to 100 from 1995 to 2011.

Figure 4. Migration fear and policy uncertainty indices, United States, 1995-2015

Notes: The Migration Policy Uncertainty Index reflects scaled quarterly counts of articles in US newspapers indexed by the Access World News Newsbank database that satisfy the M, E, P and U criteria specified in the text. Similarly, the Migration Fear Index reflects scaled quarterly counts that satisfy the M and F criteria. We obtain article counts on 30 November 2015 and normalize each index to 100 from 1995 to 2011.

References

Baker, S R, N Bloom and S J Davis (2015) “Measuring economic policy uncertainty”, NBER Working Paper No. 21633.

Baldwin, R, T Beck, A Bénassy-Quéré, O Blanchard, G Corsetti, P de Grauwe, W den Haan, F Giavazzi, D Gros, S Kalemli-Ozcan, S Micossi, E Papaioannou, P Pesenti, C Pissarides, G Tabellini and B Weder di Mauro (2015) “Rebooting the Eurozone: Step 1 – agreeing a crisis narrative”, VoxEU.org, 20 November.

Boeri, T, M De Phillippis, E Patacchini and M Pellizzari (2015) “Immigrants, residential concentration and employment in eight Italian cities”, VoxEU.org, 24 November.

Borjas, G (2003) “The labor demand curve IS downward sloping”, Quarterly Journal of Economics, 118(4): 1335-1374.

Card, D (2005) “Is the new immigration really so bad?” The Economic Journal, 115: F300-F323.

Gould, E D and E F Klor (2014) “The long-run effect of 9/11: Terrorism, backlash and the assimilation of muslim immigrants in the West”, The Economic Journal, forthcoming.

Gulen, H and M Ion (2015) “Policy uncertainty and corporate investment”, working paper, Purdue University.

Halla, M, A Wagner and J Zweimüller (2015) “Immigration and far-right voting: New evidence”, VoxEU.org, 29 November.

Handley, K and N Limao (2012) “Trade and investment under policy uncertainty: Theory and firm evidence”, American Economic Journal: Policy, forthcoming.

Julio, B and Y Yook (2012) “Political uncertainty and corporate investment cycles”, Journal of Finance, 67(1): 45-83.

Kelly, B, L Pastor and P Veronesi (2015) “The price of political uncertainty: Theory and evidence from the option market”, Journal of Finance, forthcoming.

Pop, V (2015) “EU set to pressure Greece on border controls”, Wall Street Journal, 3 December.

Footnotes

1 These are our US term sets, which we translate into German and French with the assistance of native speakers. The P term set differs across countries, as detailed in Baker et al (2015).

2 See Baker et al. (2015) for a fuller discussion of how we obtain these types of counts.

3 These data are available for download on the Policy Uncertainty website at http://www.policyuncertainty.com/immigration_fear.html.