Barrier-free inter-state trade can boost Indian farmers' income on average by increasing competition among intermediaries, but some farmers may lose out

The lack of competition in developing countries’ agricultural markets has emerged as a central policy concern amongst governments, donors, and researchers over the last decade (Swinnen 2020). Of particular interest is the role of intermediaries' market power in contributing to low farmer incomes. Such concerns motivate regulation of agricultural trade, often leading to policies that restrict the role of “middlemen.” For example, distrust of private traders led to the establishment of marketing boards in many developing countries in the 1950s and 1960s. More recently, in 2011, the Bangladesh government banned delivery order traders in edible oil supply chains (Emran et. al. 2021).

Agricultural regulation in India

Unsurprisingly, this has been a topic of intense political and policy debate in India, where a large fraction of the 1.4 billion people are engaged in the agriculture sector. In India, domestic agricultural trade is regulated by the Agricultural Produce and Marketing Committee (APMC) acts of various states. In particular, these laws require that the first sale and purchase of agricultural produce take place in government-regulated marketplaces (or mandis) within the state. These laws were formulated in the 1960s with the intention of protecting farmers from exploitative traders (Chatterjee and Krishnamurthy 2021, Krishnamurthy 2015). However, regulation of cross-state trade has led to segmented and less competitive markets (Bera 2014, Government of India 2015). Moreover, over time, collusion amongst incumbent traders and limited public investments have turned these institutions extractive (Chatterjee and Mahajan 2021).

Policymakers in India have thus long called for reforms (Bera 2014, Patnaik and Roy 2019). The most heroic attempt was made in the summer of 2020, when the central government, using COVID-19 as a pretext, tried to push through multiple reforms on agricultural marketing. This was hailed as the “1991 moment” for Indian agriculture by many economists (Gulati 2020). However, amidst protests from various quarters due to fears of the corporatisation of Indian agriculture, the reforms had to be rolled back (Bera 2020 and Sharma 2021).

This research studies a particular slice of this very complex problem by examining the economic consequences of the removal of inter-state barriers to agricultural trade in India. This was one of the many changes that the 2020 reforms had proposed. To understand the economic consequences of such a trade liberalisation, it is imperative that we first understand the economic mechanism through which such reform will operate.

How could inter-state trade liberalisation impact farmers?

The key economic mechanism proposed in my research (Chatterjee 2023) is that of spatial competition. The idea is that when many buyers (intermediaries) bid for a seller’s (farmer’s) produce, the farmer is likely to get a higher price. For example, imagine two districts, one with few markets and the other with many. Where are farmer prices going to be higher on average, and why?

When a farmer negotiates with intermediaries in a market and they don’t offer a good price, the farmer’s alternative is to try and get a better deal in another nearby market. Thus, what the farmer can sell for in an alternative market is the threat they can use to get a better price in any negotiation. This outside option is presumably larger when there are many alternative markets, and hence in a district with many markets, the average price that the farmer receives is likely to be higher.

This research first establishes that this is indeed the case in the data. By using microdata on the location of mandis and the prices of various commodities, my work shows that a one standard deviation increase in market density causes the prices received by farmers to increase by about 3%. The paper then proceeds to study the effects of removing inter-state trade barriers to agricultural produce.

Crucially, trade liberalisation increases the outside options available to farmers living close to state borders. Once inter-state trade barriers are removed, they can claim to have access to a larger set of buyers while negotiating with intermediaries, so one would expect an increase in prices, at least for farmers closer to state borders.

However, the force of spatial competition is stronger. Once prices in markets close to state borders increase, farmers negotiating in markets farther from borders also have an improved outside option, as for them, the border markets are the “alternatives.” Thus, via a process of diffusion, the removal of inter-state barriers can increase prices in markets even in the interiors of states, although the magnitudes of these increases would be smaller since transportation is costly.

Furthermore, once farmers get better prices, they can afford to use better inputs like seeds, fertilisers, pesticides, etc. This contributes to increased agricultural output leading to a further increase in incomes. However, in general equilibrium, this can simultaneously reduce the price farmers receive. Since farmers are small relative to the aggregate economic market, they do not internalise a downward-sloping demand curve where higher quantities lead to lower prices. Therefore, an increase in agricultural output can push down retail prices too much in some locations, reducing farmer incomes.

Which effects are relatively stronger?

I build and estimate a spatial model with bargaining and trade to understand the relative strength of each of the forces described above, shed light on the distributional consequences, and understand the spatial locations of gains and losses from trade liberalisation.

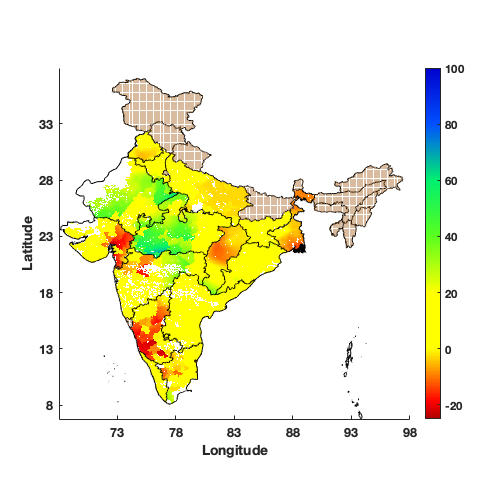

Quantitative estimates from this model suggest that removing inter-state trade restrictions can increase average farmer prices by about 9% overall. The largest gains occur amongst farmers near state borders, but forces of spatial competition reap substantial gains for farmers in remote locations as well. However, in general equilibrium, some farmers lose out as output expansion dampens prices in the economy – the average decline in prices among those who lose is about 10%. Thus, the reform creates winners and losers (see Fig 1). However, gains outweigh losses, as the value of national crop output increases by about 18%.

Figure 1: General Equilibrium price effects of removing border restrictions to agricultural trade during Kharif reason. The figure plots farmer price changes in %.

Putting these results in context

Policymakers should read these results with caveats. Model simulated effects do not consider political and social complexities, which can increase or exacerbate these effects. For example, politics can itself respond to the policy change (as happened with the 2020 reforms), which the model assumes is fixed. While assuming a perfectly competitive input market with an inelastic supply and a fixed supply of labour is reasonable to a degree, large changes can affect these factors and have a bearing on the quantitative counterfactuals.

Finally, the model assumes that farmers directly sell in markets which is not always the case, especially for very small farmers. Results are robust if the relationship between the farmer and the person who buys from the cultivator farmer and sells in a market does not change. This person could be a larger farmer of the village aggregating from smaller farmers or an intermediary buying from farmers and selling to licensed intermediaries in the market. Without further information on this relationship, it is impossible to make any further inferences.

Key takeaways

Despite these considerations, an important lesson that policymakers must be aware of is the distributional consequences of this type of reform.

This research also contributes to the understanding of the market power of agricultural intermediaries in a more fundamental way. The empirical evidence on the market power of intermediaries in agricultural markets in low- and middle-income countries is rather mixed (Dillon and Dambro 2016). Many recent papers find sizable market power among intermediaries (Bergquist and Dinerstein 2020 and Mitra et al. 2018), while others indicate little market power at the farmgate (Casaburi and Reed 2022).

This body of research has focused on testing the competitiveness of agricultural markets without regard to their spatial locations. My work shows that the interaction of economic geography with spatial competition can generate spatially varying market power for intermediaries. It, therefore, provides a possible rationale for isolated studies finding different estimates of the market power of intermediaries.

References

Bera, S (2014), “Will a National Common Market for Farm Products Curb Price Rise?,” Mint. [Online] Available here.

Bera, S (2020), “Hope and a Prayer as Reform Rains Down on India’s Farms,” Mint. [Online] Available here.

Bergquist, L F, and M Dinerstein (2020), “Competition and Entry in Agricultural Markets: Experimental Evidence from Kenya,” American Economic Review, 110: 3705-3747. https://doi.org/10.1257/aer.20171397

Casaburi, L., and T Reed (2022), “Using Individual Level Randomized Treatment to Learn about Market Structure,” American Economic Journal: Applied Economics, 14: 58-90. https://doi.org/10.1257/app.20200306

Chatterjee, S (2023) “Market Power and Spatial Competition in Rural India”, Quarterly Journal of Economics, forthcoming.

Chatterjee, S and M Krishnamurthy (2021), “Farm Laws Versus Field Realities: Understanding India's Agricultural Markets,” Sikh Research Journal, 6(1).

Chatterjee, S and A Mahajan (2021), “Why Are Indian Farmers Protesting the Liberalization of Indian Agriculture?,” ARE Update, 24: 1-4. [Online] Available here.

Dillon, B and C Dambro (2016), “How Competitive Are Food Crop Markets in Sub Saharan Africa? A Review of the Evidence,” University of Washington, Evans School of Public Policy and Governance Working Paper.

Emran, M S, D Mookherjee, F Shilpi, and M H Uddin (2021), “Credit rationing and pass-through in supply chains: theory and evidence from Bangladesh,” American Economic Journal: Applied Economics, 13(3): 202-236.

Government of India (2015), “Economic Survey of India 2014–15.”

Krishnamurthy, M (2015), “The Political Economy of Agricultural Markets: Insights from Within and Across Regions,” in IDFC Foundation (Ed.), India Rural Development Report 2013–14 (pp. 61–79). Hyderabad: Orient Black Swan.

Mitra, S, D Mookherjee, M Torero, and S Visaria (2018), “Asymmetric Information and Middleman Margins: An Experiment with Indian Potato Farmers,” Review of Economics and Statistics, 100: 1-13.

Patnaik, I and S Roy (2019), “Want to Help Farmers, Remove Middlemen? Scrap the Law Governing Agri Markets,” ThePrint. [Online] Available here.

Sharma, H (2021), “Explained: Why PM Modi Withdrew from the Three Farm Laws And the Precedent from Six Years Ago,” Indian Express. [Online] Available here.

Swinnen, J (2020), “Competition, market power, surplus creation and rent distribution in agri-food value chains – Background paper for The State of Agricultural Commodity Markets (SOCO) 2020,” FAO. https://doi.org/10.4060/cb0893en.