Agricultural markets in developing countries might be insufficiently competitive. A case study of cigarette manufacturer reforms in China casts new light on the adverse consequences of imperfect competition on rural poverty and economic growth.

Of the more than 700 million people who live in extreme poverty, 80% live in rural areas, and are mainly employed in agriculture (World Bank 2018). Although there are many reasons for rural poverty, there has recently been an increased interest among economists in how the concept of `monopsony power’ affects rural development. Monopsony power implies that buyers of goods or services abuse their dominance over their suppliers in order to push down the prices they pay for those goods or services.

Power and frictions on agricultural markets

The usual arena for the economic study of monopsony power is labour markets, as in the recent VoxDev article `How the wage-setting power of firms shapes Peru’s economy’. However, farmers are often not employees with a formal job contract, but rather small business owners who sell their products on agricultural markets. There are many reasons to suspect that these markets are not competitive, particularly in developing countries. First, transportation costs make markets very localised, thereby decreasing the number of buyers per market. Second, farmers in developing countries often have little or imperfect information about current prices in different marketplaces. Third, many low and middle-income countries impose strict regulations that hinder trade in agricultural products across rural markets. In the case of India, Chatterjee (2023) finds that eliminating interregional trade restrictions would increase agricultural prices by 11% and agricultural output in India by 7%.

Another important policy instrument is how governments regulate the ownership of agricultural buyers. Important agricultural buyers, such as wholesalers or industrial processing firms, are often state-owned. Countries such as China and Indonesia have been increasingly consolidating their State-Owned Enterprises (SOEs) over the past two decades in order to increase their profitability, thereby merging smaller enterprises into large centrally-led monoliths (Naughton 2008). Although such policies can be growth- and welfare-enhancing in well-functioning markets (Hsieh and Song 2015, Chen et al. 2021), their effects can be totally different if markets are imperfectly competitive.

Agricultural market reforms in China

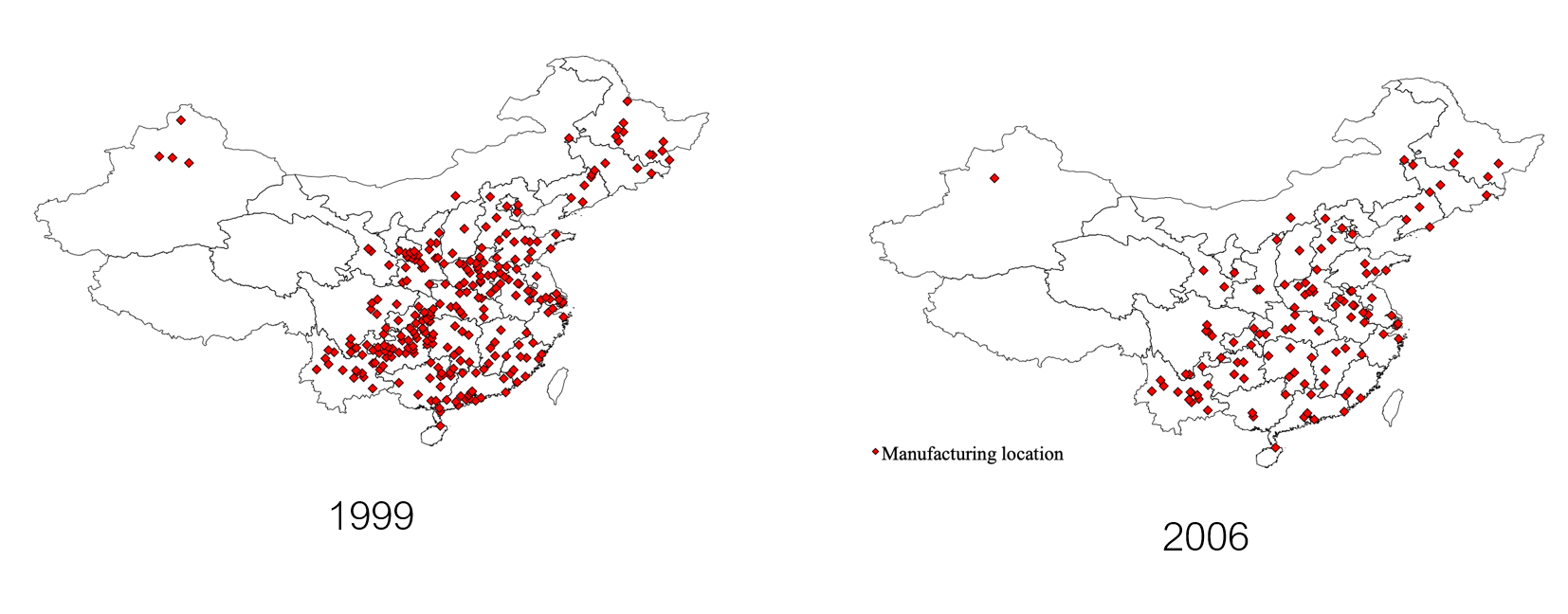

In my research (Rubens 2023), I investigate this question in the context of the Chinese tobacco industry. This specific industry provides an interesting case study because it underwent a large-scale consolidation episode starting in 2002, which was initiated by the Chinese government. Firms producing below certain production thresholds were forced to close down or merge with the market leader. This led to a significant reduction in the number of cigarette production locations, as can be seen in Figure 1, which shows tobacco manufacturing locations in China. The total number of cigarette manufacturing plants decreased from around 350 to 150 from 1998 to 2007. Although this reform could have increased the efficiency of cigarette producers, as was the official policy aim, it could also have led to increased monopsony power of these producers over the millions of small farmers from which they buy tobacco leaf.

To tackle these questions, I analyse detailed and confidential plant-level data on prices, quantities, and input usage, among other variables. There are two unique features of the Chinese tobacco reform that allow pinning down the `causal’ effects of the consolidation on tobacco prices and quantities. First, the fact that the government decided on exit and mergers following objective size thresholds provides clear cutoffs along which the effects of firm exit on monopsony power and productivity can be studied. Usually, one would worry that monopsony power affects entry and exit, and vice versa. Having regulated changes in exit allows for the pinning down of the latter effect, while holding the former mechanism fixed. Second, the Chinese government outlaws transporting raw tobacco leaf across county boundaries; effectively making these markets local. Combined, these two features allow for a study of the consolidation’s effects by comparing local markets that were not affected by the reform, because none of the firms produced below the exit threshold to begin with, to markets that were affected by firm exit.

Figure 1: Cigarette plant locations in China

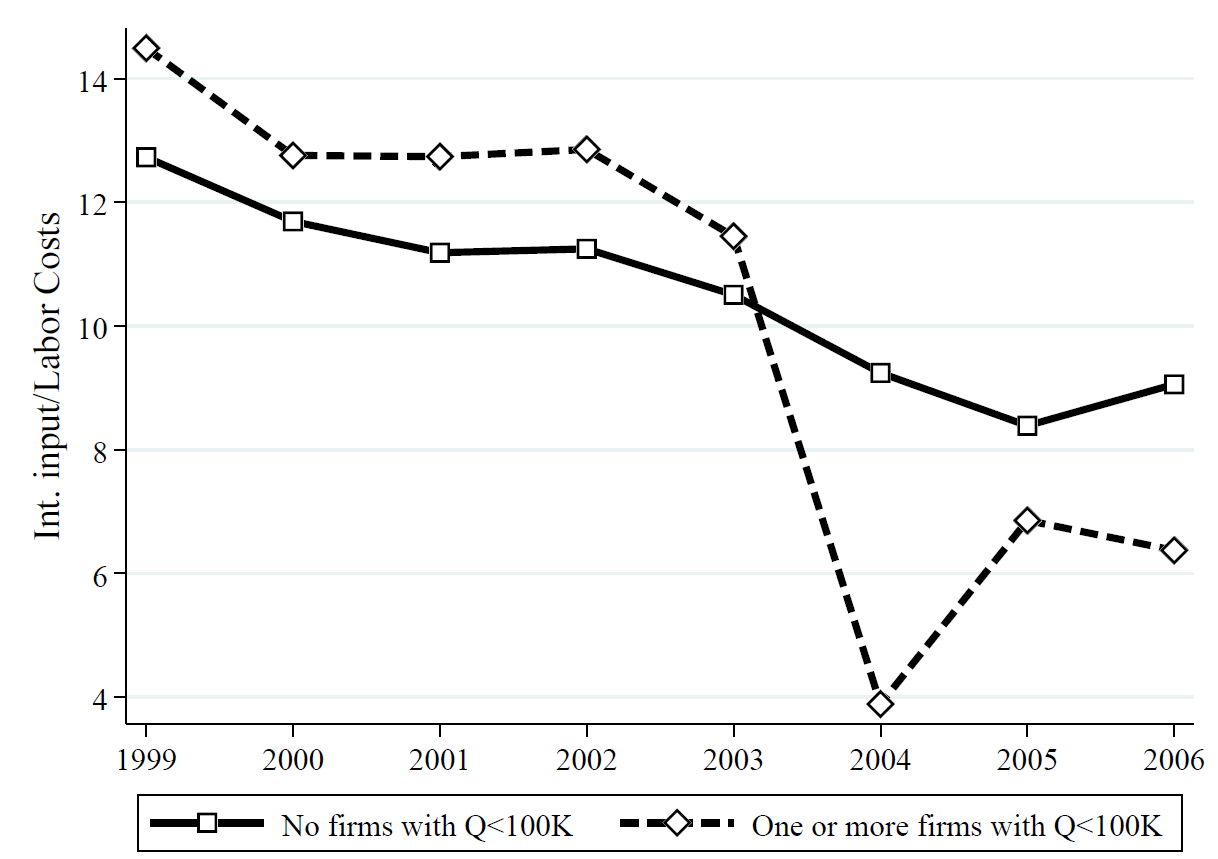

A first interesting outcome to consider is the relative expenditure on tobacco leaf compared to labour expenditure. If relative leaf expenditure falls, this indicates falling leaf prices, as leaf-to-labour quantities are roughly fixed due to the inability of firms to substitute tobacco leaf when producing cigarettes. Figure 2 shows that relative leaf expenditure indeed fell sharply in markets affected by the 2002 ownership consolidation, compared to the `control group’ of unaffected markets. This suggests that leaf prices fell sharply in response to the consolidation.

Figure 2: Leaf expenditure fell in consolidated markets

Consequences for economic growth and redistribution

Although this evidence is consistent with the monopsony model, it is not hard evidence. A key welfare-decreasing aspect of the monopsony model is that buyers push down leaf prices by buying less tobacco leaf. This is what economists call `deadweight loss’. Moreover, even if there are welfare losses from monopsony power, these could be offset by increased efficiency of manufacturers, for instance due to the existence of scale economies. Therefore, I build and estimate a model that disentangle these forces, and quantifies scale economies, productivity effects of consolidation, and monopsony power.

The model estimates reveal three important facts. First, the median farmer is paid around half of the competitive leaf price, which indicates a significant degree of monopsony power. The manufacturers’ consolidation reform led to an increase in this leaf price ‘markdown’ by 37% on average. Second, total output of cigarettes also decreased in consolidated markets, as well as in the entire industry, so deadweight losses increased. Third, average manufacturing productivity did not increase in response to the reform despite this being its main policy objective. In fact, total industry productivity even decreased. The explanation of this effect is that the most efficient firms gained the most monopsony power after the reform, thereby decreasing their leaf usage to push down leaf prices. This led to increased market shares at less productive manufacturers, who would have produced much less in a competitive market. Therefore, monopsony power allowed inefficient firms to survive because highly efficient firms produce less than they should.

In addition to these efficiency losses, the reform also had adverse equity consequences by redistributing income away from farmers towards owners and employees of manufacturing firms. This contributed to the rural-urban income gap in this industry, which is concerning given that this margin of inequality has sharply increased overall in China over the last decades (Yang 1999, Ravallion and Chen 2009).

Policy lessons

Taken together, these results imply three main conclusions. First, ensuring that rural markets are competitive should be a first order concern of policy-makers in order to ensure both economic growth and its equitable distribution. This calls for making these markets as frictionless as possible, by eliminating trade restrictions and by ensuring fair competition between buyers. Second, commonly-used consolidation policies that are likely to foster productivity growth in well-functioning markets can have the opposite effect when input markets are imperfectly competitive. Third, the exertion of monopsony power is not just a distributional concern, but can also harm welfare by reallocating market share to less-efficient firms, hence lowering industry productivity. This implies that lower input prices and wages are not necessarily beneficial to consumers, and can even be harmful to the welfare of both input suppliers and final consumers.

References

Amodio, F, P Medina, and M Morlacco (2023), "Labor Market Power, Self-Employment, and Development," Working Paper.

Chatterjee, S (2023), "Market Power and Spatial Competition in Rural India," The Quarterly Journal of Economics, 138(3): 1649–1711.

Chen, Y, M Igami, M Sawada, and M Xiao (2021), "Privatization and productivity in China," The RAND Journal of Economics, 52(4): 884–916.

Hsieh, C-T and Z Song (2015), "Grasp the large, let go of the small: The transformation of the state sector in China," Working Paper Spring, Brookings Papers in Economic Activity.

Naughton, B (2008), "SASAC and rising corporate power in China," China Leadership Monitor, 24(2): 1-9.

Ravallion, M and S Chen (2009), "China’s (uneven) progress against poverty," Routledge, pp. 65–111.

Rubens, M (2023), "Market Structure, Oligopsony Power, and Productivity," American Economic Review, 113(9): 2382-2410.

World Bank (2018), "Poverty and shared prosperity 2018: Piecing together the poverty puzzle."

Yang, D T (1999), "Urban-biased policies and rising income inequality in China," American Economic Review: Papers and Proceedings, 89(2): 306–310.