Subsidising land rentals in Kenya increased land access equity and efficiency persistently, highlighting the importance of land markets for agricultural development.

Agriculture is the main source of livelihood for over half of all households in Sub-Saharan Africa, yet markets for its key input, land, function far from perfectly. Across many rural areas, land markets operate under multiple frictions and hence are often sparse, such that most plots are farmed by whoever inherited them (Deininger et al. 2017). Limited land reallocation has far-reaching consequences for the economic lives of the poor, and is often considered a major obstacle to increasing agricultural productivity and to economic development. Consequently, the repercussions of land markets participation and the policy question of whether it should be encouraged are topics of active debate.

The debate focuses on the effects on three sets of outcomes: Efficiency, equity, and structural transformation. On efficiency, some argue there is wide dispersion in productivity across farmers, and hence, large gains to be made from improving land markets (Adamopoulos et al. 2022, Chari et al. 2021, Aragon et al. 2022), while others argue that dispersion in productivity, and hence the potential gains, are much smaller (Gollin and Udry 2021). On equity, land markets may equalise access to land, inducing its transfer towards land-poor households, or they may foster ‘land grabs’, where wealthy households acquire land, increasing its concentration. On structural transformation, land markets untie landowners from their land - this may push them out of agriculture and into other activities. Alternatively, the constraints to such change may lie elsewhere, for example in other barriers to migration or simply a lack of non-agricultural employment (Gollin 2021, Asher et al. 2022).

Experimental design: Incentivising participation in land rental markets

To bring experimental evidence to this debate, we ran a randomised controlled trial in Western Kenya where we offered landowners subsidies to rent out one of their plots, thus inducing marginal land rentals (Acampora et al. 2022). Our design allows us to:

- Identify who selects into land markets at the margin.

- Compare renters to owners and contrast their agricultural choices and outcomes on the rented plots.

- Identify how owners’ outcomes, such as food security, non-farm labour, and migration, change upon renting out part of their land.

We began by interviewing 7,500 plot owners in 161 villages. We asked them about the planned use of each plot for the upcoming season and their interest in a subsidy to rent out one additional plot. The subsidy was 30% of the average rental price and covered up to three seasons. 17% of eligible owners expressed interest in the subsidy - we refer to the plot they chose for the subsidy as the ‘target plot’. Interested farmers owned more land, left a higher share of their plots unused, and mentioned cash needs and a lack of inputs for cultivation as the primary reasons for their interest in the rental subsidy.

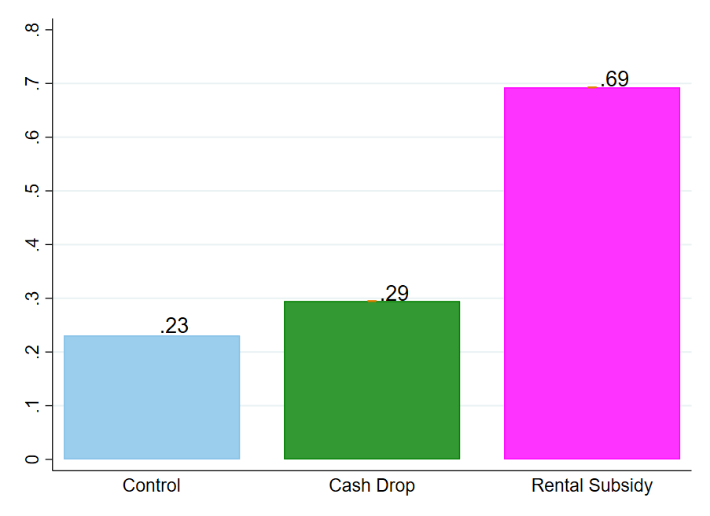

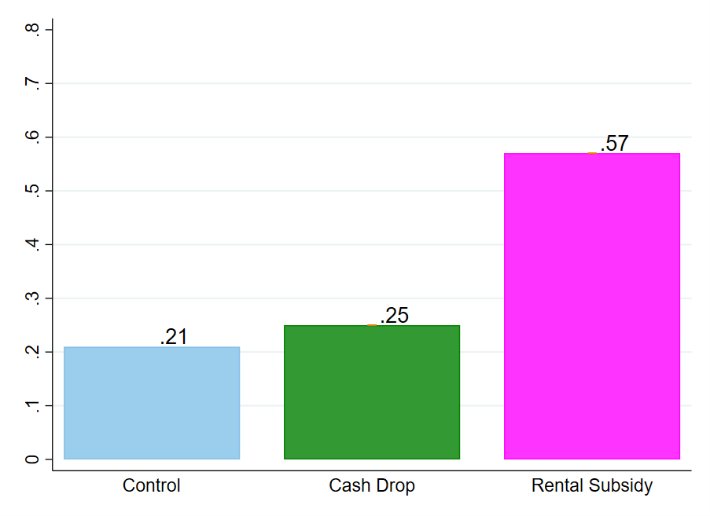

We then randomised 521 of these interested owners into three groups: a control group, a rental subsidy group who received the subsidy if they rented out, and an unconditional cash transfer group who received the subsidy regardless. As shown in Figure 1, the rental subsidy led to a large increase in the likelihood that the target plot was rented out, from 23% in the control group to 69% in the rental subsidy group, and this effect persisted when the subsidy ended, with 57% of owners in the rental subsidy group continuing to rent out, almost always to the same renter. In contrast, the unconditional transfer had little effect.

Figure 1: Probability of target plot rental by treatment.

a) During subsidy period (seasons 1-3) b) After subsidy period (seasons 4-5)

Induced rentals and treatment effects on land distribution, agricultural production, and owner outcomes

Participation in the rental market reduced inequality in land access. Among rentals induced by the subsidy, renters owned 1.9 fewer plots than the 3.2 owned by owners on average, despite having similar household sizes. Renters were also 7.6 years younger on average, more likely to be male, more educated than owners, and more market-oriented, devoting a greater fraction of their plots to cash crops and being more likely to have borrowed.

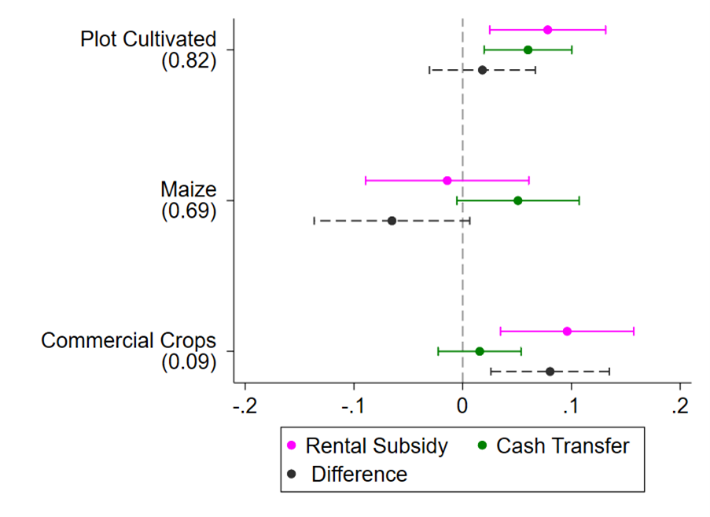

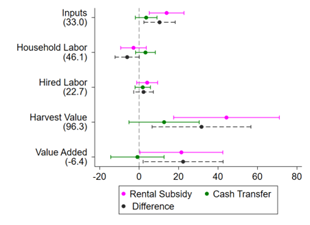

To identify the effects of the interventions on agricultural production, we surveyed each target plot manager at the end of each of the four crop seasons following the intervention. Both the rental subsidy and the unconditional cash transfer similarly increased the likelihood that the plot was cultivated. However, while the unconditional cash transfer increased maize cultivation (the subsistence crop), the rental subsidy induced the cultivation of commercial crops. The rental subsidy also increased the value of non-labour inputs on the target plot (seeds, fertiliser, and chemicals), but had no significant effect on labour, despite renter households having higher labour-land ratios.

The changes increased the value of harvest by US$31.5 (47%) and value added by $23. These effects were much larger than, and significantly different from those of the unconditional cash transfer to the owner, which were mostly small. Degradation of soil quality is a potential cost of more intensive cultivation, but two rounds of soil testing indicated no evidence for it. Finally, while the interventions could have affected agricultural production on the non-target plots that belonged to the owners, we do not find meaningful spillovers to them.

The rental subsidy affected the non-agricultural economic activity of owners, leading to 9.1 fewer person-days per season of non-agricultural work. This decrease is inconsistent with land market participation leading to structural transformation, but is consistent with seasonal income effects on labour supply, as is the negative but insignificant effect of the cash drop. The rental subsidy had no detectable effect on food security, a non-land wealth index, or household finances.

Figure 2: Treatment effects.

a) Plot cultivation & crop choice b) Inputs, output and value added (US$)

Notes: These represent Treatment On the Treated (TOT) effects of the interventions and their difference. `Plot cultivated’ is 1 if the target plot was cultivated, 0 otherwise. `Maize’ and `Commercial Crop’ are 1 if the respective crop was cultivated on the target plot, 0 otherwise. In panel b, all outcomes are reported in US $. Numbers in parentheses on the y-axis report the average in the control group.

Understanding and quantifying land market frictions

Regarding the barriers to rentals, the persistence of the rentals after the subsidy ended suggests a fixed cost component, plausibly driven by significant search costs. Many owners and renters reported difficulty in finding rentals. Rentals which persisted had higher value added than those which did not, despite no difference in rental prices or baseline revenues. This is consistent with renters experimenting and learning about their own productivity on plot, and not suggestive of asymmetric information of plot quality. Further, we found little evidence of land disputes or soil degradation, both key concerns for owners at baseline.

Our results allow us to quantify land frictions, under additional assumptions. Relatively low interest in the subsidy shows that for most farmers, the perceived costs of renting were large relative to any potential gains. Among interested farmers, we estimate the (per-acre per-season) size of the barrier is $45 - $56, larger than the average rental price ($34), and find that owners bear a large share (90%) of these frictions. We also identified alternative rentals that would have led to substantially larger gains, underscoring the potential heterogeneity in frictions.

Conclusion

Our work brings experimental evidence to an active debate on the significance of land rental markets. Inducing rentals increased land access equity by shifting access to younger, more land-poor individuals during and after subsidy allocation. Renters raised output and value added on rented plots by increasing non-labour inputs and the cultivation of commercial crops. Although owners cultivate less land under the rental subsidy, their non-agricultural labour also decreases, indicating little evidence of structural transformation stemming from rentals untying owners from their land.

Our goal was to learn about land markets, not to propose a scalable policy - there may of course be more cost-effective ways to improve the functioning of land markets. Further work may aim to study the impact of addressing specific frictions or how interventions at scale may have different results. The experimental exploration of large-scale and long-term rentals remains an important area for future research, including their role in reducing plot fractionalisation, which may unlock greater returns to scale (Foster and Rosenzweig 2022, Bryan et al. 2019). Finally, while we focused on rural land markets, frictions in urban land markets may also have important implications for development (Ghani et al. 2016).

Editor's Note: This paper was released as WP026 of the STEG Working Paper Series.

References

Acampora, M, L Casaburi, and J Willis (2022), “Land Rental Markets: Experimental Evidence from Kenya”, STEG Working Paper.

Aragon, F M, D Restuccia, and J P Rud (2022), “Limitations of yields as a measure of farm productivity: Evidence from Uganda”, VoxDev.org, 25 March.

Adamopoulos, T, L Brandt, J Leight, and D Restuccia (2022), “Misallocation, selection, and productivity: A quantitative analysis with panel data from China”, Econometrica 90(3): 1261–1282.

Asher, S, A Campion, D Gollin, and P Novosad (2022), “The long-run development impacts of agricultural productivity gains: Evidence from irrigation canals in India”, VoxDev.org, 21 October.

Bryan, G, J de Quidt, T Wilkening, and N Yadav, 2019. “Can Market Design Help the World’s Poor? Evidence from a Lab Experiment on Land Trade”, Working Paper.

Chari, A, E M Liu, S Wang, and Y Wang (2021), “Property rights, land misallocation, and agricultural efficiency in China”, The Review of Economic Studies 88(4): 1831–1862.

Deininger, K, S Savastano, and F Xia (2017), “Smallholders’ land access in Sub-Saharan Africa: A new landscape?”, Food Policy 67: 78–92.

Foster, A D and M R Rosenzweig (2022), “Are There Too Many Farms in the World? Labor Market Transaction Costs, Machine Capacities, and Optimal Farm Size”, Journal of Political Economy 130(3): 636–680.

Ghani, E, G Duranton, A G Goswami, and W Kerr (2016), “Land and financial misallocation in India”, CEPR.org.

Gollin, D (2021), “Agricultural Productivity and Structural Transformation: Evidence and Questions for African Development”, STEG Pathfinding Paper.

Gollin, D and C Udry (2021), “Heterogeneity, measurement error, and misallocation: Evidence from African agriculture”, Journal of Political Economy 129(1): 1–80.