How should policymakers design environmental markets when they might attract participants who were planning to conserve the environment regardless of the market?

Environmental markets like “Payments for Ecosystem Services” (PES) and offset markets have proliferated in recent decades. Examples span the globe and range from large-scale land conservation incentives to international offset mechanisms to burgeoning voluntary markets facilitating net-zero commitments (McKinsey Sustainability 2021, 2022). In principle, markets can be a powerful policy tool to reduce environmental degradation at low cost (e.g. Jayachandran et al. 2017, see VoxDev article here). In practice, however, many observers believe existing mechanisms have not met this potential (West et al. 2023, Jones et al. 2024, Calel et al. forthcoming). This is largely due to a complication called additionality.

When do markets encourage conservation?

Market participants’ additionality—the probability each participant will change behaviour due to the market incentive—is central to these markets’ performance: if a market incentivising conservation attracts only participants who are likely to conserve anyway, it will have no net environmental impact. The challenge facing a policymaker is that the value of the market depends on two unobserved characteristics: the probability that a participant changes her behaviour (her additionality) and how much she would need to be paid to participate in the market (her costs). Standard markets perform well when costs are the only unobserved dimension; then the private choices of landowners and the social goals of the policymaker can be easily aligned. If additionality varies as well, this is no longer the case, and market mechanisms may not always attract the most socially valuable landowners. The challenge of additionality is one of asymmetric information.

Our research (Aspelund and Russo 2024) explores this challenge and its implications for the design of environmental markets. The study focuses on the Conservation Reserve Program (CRP), one of the oldest and largest Payments for Ecosystem Services (PES) mechanisms in the world.

The Conservation Reserve Program (CRP)

The CRP is administered by the US Department of Agriculture and incentivises landowners to remove cropland from production and undertake conservation practices like grass- and tree-planting, maintenance or habitat creation. The total amount of cropland enrolled in the CRP is constrained by Congress, so the USDA uses a procurement auction to determine who receives a CRP contract. The study leverages detailed data, combining landowners’ bids for these contracts with measures of land use for both winners and losers of the auction.

Would landowners in the US have conserved land anyway?

First, our research explores whether additionality concerns are relevant: would some participants have conserved without the CRP? We compare CRP contract awards around the winning score in the auction by using a regression discontinuity design. Bidders with a score above the winning threshold are awarded a contract paying for land retirement; bidders just below are comparable but lost out on the CRP contract.

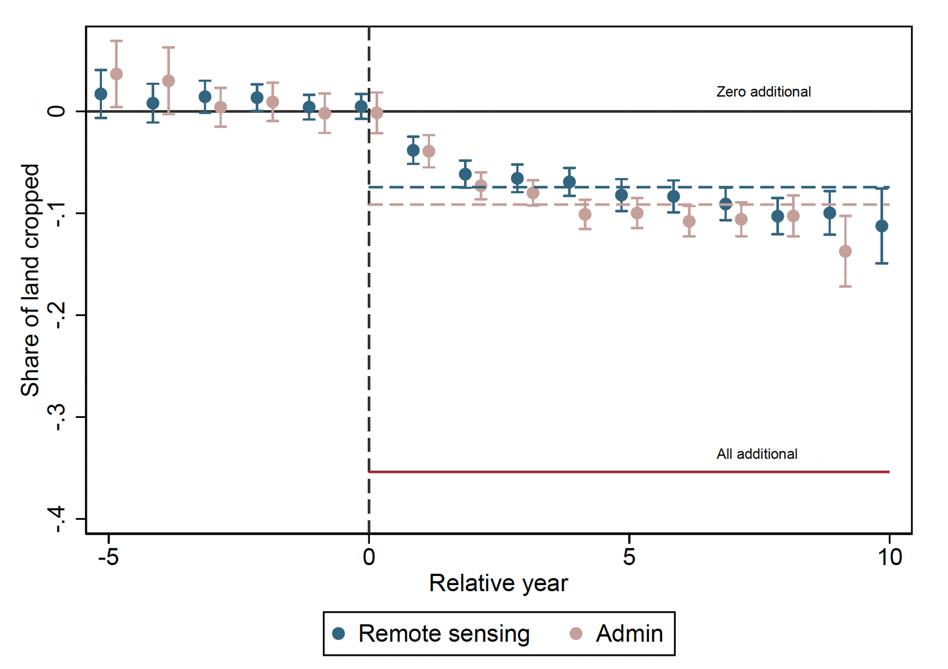

Figure 1 displays our estimates separately for each year relative to the auction. Each point estimates the effect of a CRP contract on the share of a marginal winner’s land that is cropped (measured in satellite and administrative data). The CRP impacts land use: marginal winners crop approximately 8% less of their land than bids that just lose. But at the same time, a large share of land is not additional: compare the regression discontinuity estimates in Figure 1 to the total share of land that is submitted in the auction to receive a CRP contract, displayed in the maroon line. If all bidders were additional, these would coincide. Instead, about three quarters of marginally winning land would have been conserved without the CRP or is not additional.

Figure 1: Estimates of Additionality

There is no evidence of non-compliance; land participating in the CRP is taken out of crop production. Rather, the lack of additionality documented in Figure 1 is due to land conservation absent the CRP, an unobservable counterfactual that cannot be specified in a contract.

This poses a challenge if conservation behaviour absent the CRP varies within the population of bidders. For example, landowners may have low bids in part because they are more likely to conserve absent the CRP. In principle, this possibility could undermine the performance of the CRP auction and, more broadly, other markets incentivising conservation.

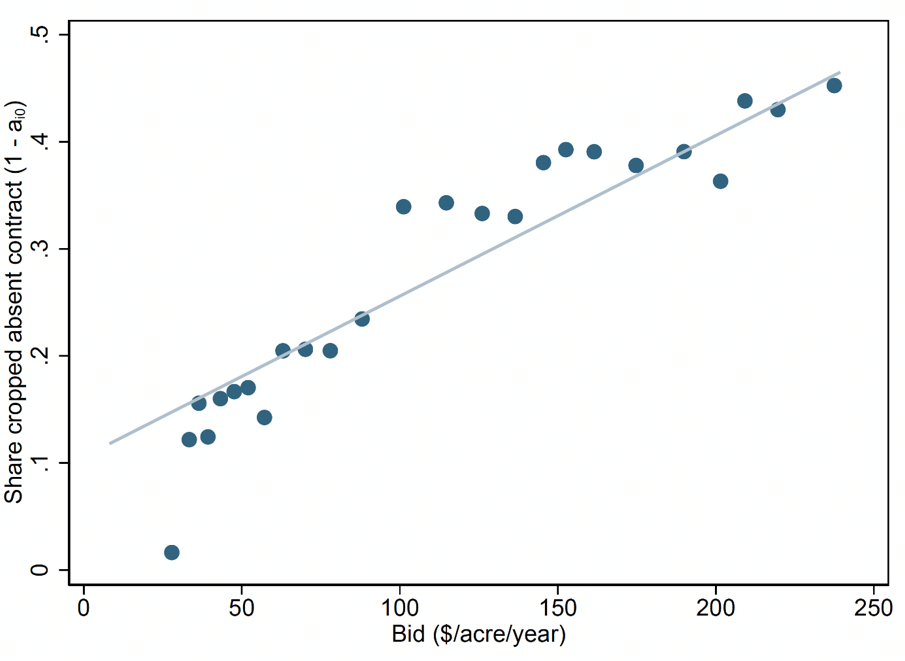

Our research can evaluate this possibility empirically using the fact that the land use choices of rejected bidders, a counterfactual for land-use choices when not in the CRP, are observed. Figure 2 correlates the dollar bid (per acre, per year) with a measure of each landowner’s additionality, conditional on characteristics in the auction’s scoring rule. The positive correlation in Figure 2 is indicative of adverse selection: the first participants to select into the market—those who place the lowest bids—may provide the lowest net environmental benefits.

Figure 2: Additionality vs. Bids

These facts illustrate challenges to environmental market design but do not mean that the CRP or other markets for conservation are doomed to fail. We therefore develop a model of bidding and land use to evaluate the performance of the CRP auction and alternative market designs.

The implications of alternative market design for conservation

The results of the model provide three conclusions relevant to the CRP directly and to other environmental market settings.

The first is an optimistic view of the market’s potential in light of the facts in Figures 1 and 2. While the documented adverse selection could make the lowest bidders the least desirable to include in the market, the study finds that this is not the case for most types of contracts in the CRP. Despite low additionality and adverse selection, the status-quo auction is able to generate net social benefits. Simple mechanisms like posted prices also deliver improvements.

Second, while the potential gains of the market are considerable, pricing that ignores the possibility of non-additionality can erode most of these potential gains. This logic applies to the CRP’s scoring auction—and other U.S. conservation programmes—which score participants without considering their additionality (Claassen 2018).

Third, the study shows how the status-quo CRP auction can be redesigned to improve its performance. Relatively “light-touch” changes to the current auction design—re-weighting the scoring rule, adding in observable predictors of additionality, like soil characteristics, and reducing the quantity of land procured—can together improve the performance of the programme substantially. These improvements are achieved by adjusting the auction’s design—its scoring rule and quantity procured—to incorporate estimates of expected additionality. This allows the auction mechanism to select participants based on both dimensions relevant to the market’s performance: costs and additionality.

General lessons for designing environmental markets

Debates about the performance of environmental markets often make binary distinctions: markets are successful if participants are additional and fail if they are not. This influences market design: considerable effort is spent on defining who is eligible to participate with the hopes of restricting to only “additional” participants.

Our research (Aspelund and Russo 2024) presents a slightly different view. Variations in additionality is inherent to many environmental settings. Markets will inevitably attract participants who are not additional with some probability, but this alone is not evidence of failure. Rather, the rules of the market—e.g. prices, auction rules, etc.—should be designed to account for this additional dimension of heterogeneity (see Groom and Venmans 2023 for a related discussion). When designed successfully, the many PES schemes and offset markets worldwide can indeed be useful tools to meet environmental goals at low cost.

References

Aspelund, K. M., and A. Russo (2024), “Additionality and Asymmetric Information: Evidence from Conservation Auctions,” https://annarusso.github.io/papers/aspelund_russo_crp.pdf.

Calel, R., J. Colmer, A. Dechezlepretre, and M. Glachant (forthcoming), “Do carbon offsets offset carbon?” American Economic Journal: Applied Economics.

Claassen, R., E. N. Duquette, and D. J. Smith (2018), “Additionality in U.S. Agricultural Conservation Programs,” Land Economics, 94(1): 19–35.

Groom, B. and F. Venmans (2023), “The social value of offsets,” Nature, 619: 768–773.

Jayachandran, S., J. de Laat, E. F. Lambin, C. Y. Stanton, R. Audy, and N. E. Thomas (2017), “Cash for carbon: A randomized trial of payments for ecosystem services to reduce deforestation,” Science, 357(6348): 267–273.

Jones, J. P. G. and S. L. Lewis (2023), “Forest carbon offsets are failing,” Science, 381(6660): 830–831.

McKinsey Sustainability (2021), “A blueprint for scaling voluntary carbon markets to meet the climate challenge,” Technical Report, January 2021.

McKinsey Sustainability (2022), “The net-zero transition: what it would cost, what it could bring,” Technical Report.

West, S., E. O. Sills, J. Börner, S. W. Rifai, A. N. Neidermeier, G. P. Frey, and A. Kontoleon (2023), “Action needed to make carbon offsets from forest conservation work for climate change mitigation,” Science, 381(6660): 873–877.