Even formal firms evade payroll taxes, and workers can be effective monitors of their employers’ reports, with the right incentives.

Those of us who have grown up in rich countries often take for granted the ability of governments to carry out policy. There’s a debate about what governments should do, but not (usually) whether they are able do it. The same is not true in most developing countries. Policy options are severely limited by what is often referred to as a lack of state capacity.1 And a key element of the general lack of state capacity is the difficulty that many governments have in collecting taxes to fund their programmes.

One major challenge for government is to bring firms into the formal economy and the purview of the tax system. Even in middle-income countries like Mexico or Brazil, the best estimates are that 30-50% of economic activity is informal, outside of the tax system. In poorer countries, the share can be even higher (see Schneider and Enste 2000). Another important challenge, somewhat less appreciated, is to ensure compliance with taxes by firms that are already formally registered. Even once a firm is on the tax rolls, it can evade various taxes by under-reporting employment, or salaries, or revenues, or profits.

In a recent research project with Todd Kumler and Judith Frias, I focus on this second challenge in Mexico, a country that like many others has struggled to increase tax revenues (Kumler et al. 2015). One indicator of this is that Mexico has the lowest tax revenue relative to GDP of any country in the OECD (OECD 2011). The paper makes two basic points, one documenting that even formal firms evade payroll taxes, and the second taking advantage of a ‘natural experiment’ created by a 1997 pension reform to provide evidence for the effectiveness of a novel remedy: giving workers incentives to monitor their employers’ wage reporting.

Even formal firms evade payroll taxes

Tax professionals in rich countries will generally tell you that employers' reports of their employees’ wages — often referred to as “third-party reports” — are accurate. Rigorous studies tend to corroborate this view. An audit experiment in Denmark found almost no under-reporting of wages by firms. Studies in the US have usually found that under-reporting of salaries is concentrated among the self-employed.2 But there has been far less evidence on developing countries, in part because tax evasion is so hard to measure.

Our strategy is to compare wages in two different datasets that in principle should be equal but that in practice are not: the wages that employers report to the Mexican social security agency (called the Instituto Mexicano del Seguro Social, or IMSS), and the wages that employees say they have received in a standard household survey (called the Encuesta Nacional de Empleo Urbano or ENEU in the period we focus on). Firms have to pay payroll taxes on the former, but there are no tax consequences for workers’ reports on the latter. The household survey does not tell us where an individual worked, so we cannot compare the wage reports at the individual or firm level. But we can compare the reported wages for groups defined by demographic characteristics and location (for example, males aged 55 to 64 who work in formal jobs in Mexico City).

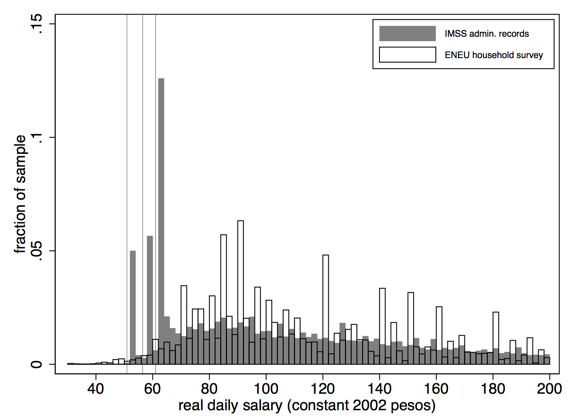

Here a picture is worth a large number of words. Figure 1 plots simple histograms of wages at different levels for men in the 1990s, using samples and wage measures that should be comparable across the two datasets.3 The grey bars are from the data firms reported to the social security agency. The hollow bars are from the household data. The three black vertical lines are the minimum wages in the three minimum-wage regions in Mexico. (Firms are required to pay a yearly bonus in December, so the legal minimum they can report is just above the minimum wage.) It is evident that the wages firms report for tax purposes (the grey distribution) is shifted to the left.4 What firms are reporting to the government is less than what workers say they are really getting paid. The paper looks at the extent of under-reporting in different ways and for different groups of firms and workers, but this main point always comes through clearly: even formal firms evade payroll taxes.

Figure 1 Wage histograms, men, 1990, low wage levels

Notes: Histogram only includes workers with wages less than 200 pesos/day in constant 2002 pesos. Vertical lines indicate minimum wages in the three minimum-wage zones in Mexico (A, B, C). Bins are 2 pesos wide.

Workers’ monitoring of employers can improve compliance

What can be done to improve compliance? A popular policy idea is to reduce tax rates, to make it less costly for firms to comply. Such reductions are indeed likely to increase compliance, but they are also likely to reduce revenues — not exactly the goal. Our research shows that another possibility is give workers an incentive to ensure more accurate reporting by their employers.

To examine how such employee incentives can be effective, we take advantage of a natural experiment generated by a major pension reform in Mexico in 1997. Before the reform, social-security benefits for workers (in the private sector, covered by IMSS) were not strongly tied to the wages reported by employers. For most benefits (health care and child care, for example), either you were in the system or you weren’t. Pensions worked similarly in practice – almost 80% of retirees received the minimum pension, and most people had no expectation of ever getting more than the minimum.5 That’s how companies could get away with the under-reporting we saw in Figure 1. Workers only had reason to care that firms reported some wage, not that the wage be accurate. So many companies reported the lowest reportable wage.

The reform created a new system of personal retirement accounts. Under the new system, the amount of money available at retirement depends on the accumulated contributions to an individual’s account, which are a function of the reported wage. In addition, account holders receive a statement every four months indicating the level of contributions and the resulting balance in the account, making it easier for employees to figure out what firms reported. In order to minimise disruption and sell the reform politically, the congress guaranteed anyone who was already in the system as of 1st July, 1997, the right to choose — at the time of retirement — between the pay-out from the new retirement account and what he or she would have received under the old system if it still existed. This ‘grandfathering’ generated a very different effect of the reform on older workers than on younger workers. Older workers could be sure that they would not accumulate sufficient contributions for the personal retirement account to be more attractive than the old pension. By contrast, younger workers who expected to be in the labour force for 25 or more years under the new system could expect to use the new system. The upshot was that younger workers had a much stronger incentive than older workers to make sure that employers were reporting their wages accurately.

Our paper uses this difference between younger and older workers to estimate the effect of the change in incentives. Figure 2 illustrates the key patterns. It plots one measure of evasion, the difference in median wages between the social security records and the household surveys, over time for five age groups. Differences in the general level of evasion by metropolitan area and year have been subtracted out. The dotted vertical line indicates the date that the reform was passed by Congress (21 December, 1995) and the solid vertical line the date that the reform took effect (1 July, 1997). The figure shows that evasion in the oldest age group, ages 56-65, increased relative to the other age groups following the reform. The group with the second-largest relative increase in evasion was the 46-55 age group. Given the subtracting-out of common metro area-year levels, this is equivalent to saying that evasion in the younger groups declined relative to the oldest age group. This supports our story – the amount of under-reporting declined more for workers who had a greater increase in their incentive to monitor their firms.

Figure 2 Wage gaps (medians) by age group, men, deviated from metro-year means

Notes: 1. Wage gap is the difference in wages recorded in the social security records and the household surveys. 2. Each wage gap is the difference between the log median net wage from the ENEU survey and the log median post-tax reported wage from the IMSS administrative records, using the ENEU and IMSS baseline samples. To calculate deviated wage gaps, we calculate wage gaps separately by age group-year-metro area, regress them on a full set of metro-area-year dummies, and average the residuals at the age-group level. The dashed vertical line indicates the date the pension reform was passed by Congress (21 December 1995), while the solid vertical line indicates the date the reform took effect (1 July 1997). Observations correspond to the second quarter of each year.

Reinforcing a general principle

Our findings in Mexico reinforce other recent research on the desirability of what we might call decentralised tax monitoring. The idea is not to rely on audits by tax authorities, but instead to give private individuals or firms the incentive to monitor others. This is part of the reason for the success of value-added taxes (VATs), an increasingly popular form of taxation. In a VAT system, a company may have an incentive to over-report costs, to reduce reported value-added, but their suppliers have the opposite incentive and also report to the tax authority (see Slemrod 2007 for an overview). Recently, a number of countries — Argentina, Bolivia, Brazil, China, Chile, Colombia, Indonesia, Italy, Portugal, Puerto Rico, South Korea, and Slovakia, among others — have given consumers monetary incentives to request receipts from retail establishments (and report their purchases to the government), precisely to encourage such cross-reporting (see Naritomi 2016). Our work in Mexico shows that a similar approach may help get firms to comply with payroll taxes as well. The general principle is, to the extent possible, to make tax systems self-enforcing. That objective is a long way off, but the evidence suggests it is the right goal to shoot for, especially in countries with weak states.

Authors' note: The views in this column are those of the author, and do not necessarily reflect the views of the Instituto Mexicano del Seguro Social.

References

Besley, T, and . Persson (2011), Pillars of Prosperity: The Political Economy of Development Clusters, Princeton University Press.

Internal Revenue Service (2006), “Updated Estimates of the Tax Year 2001 Individual Income Tax Underreporting Gap. Overview”, Washington DC.

Kleven, H, M Knudsen, C T. Kreiner, S Pedersen, and E Saez (2011), “Unwilling or Unable to Cheat? Evidence from a Tax Audit Experiment in Denmark”, Econometrica, 79, 651–692.

Kumler, T, E Verhoogen, and J A Fr´ıas (2015), “Enlisting Workers in Improving Payroll-Tax Compliance: Evidence from Mexico”, NBER working paper no. 19385.

Naritomi, J (2016), “Consumers as Tax Auditors”, unpublished paper, LSE.

OECD (2011), OECD Economic Surveys: Mexico 2011, OECD Publishing.

Saez, E (2010), “Do Taxpayers Bunch at Kink Points?”, American Economic Journal: Economic Policy, 2(3), 180-212.

Schneider, F, and D H Enste (2000), “Shadow Economies: Size, Causes, and Consequences”, Journal of Economic Literature, 38(1), 77–114.

Slemrod, J (2007), “Cheating Ourselves: The Economics of Tax Evasion”, Journal of Economic Perspectives 21(1), 25–48.

Endnotes

[1] For a leading statement of this view, see Besley and Persson (2011).

[2] See Kleven et al. (2011) on Denmark, and Internal Revenue Service (2006) and Saez (2010) on the US.

[3] The heights of the bars indicate the fractions of the samples in each wage bin. We chose an early year before the pension changes discussed below. For visual clarity, the graph only includes men earning less than 200 pesos per day, about 80% of the male workforce. We focus on men because women’s labour force participation was changing quickly over the period, making the empirical patterns more difficult to interpret.

[4] The IMSS reports pre-tax salaries, while the ENEU household data report post-tax salaries, so if anything, the true leftward shift is even greater than pictured.

[5] This situation came about due to high inflation, especially in the late 1980s, which tended to reduce the value of pensions, coupled with political pressure on the Mexican congress to prop up the minimum pension. See our paper for more details.