Improved transportation networks can enable export expansion by promoting interaction between exporting firms, facilitating knowledge spillovers. Better integrated exporters also export more and export products of higher quality at a lower price.

Editor's note: This article originally appeared on VoxEU.

The developing world has seen a significant surge in infrastructure investments, particularly in transportation networks like high-speed rail (HSR), aimed at bolstering internal market access (Egger et al. 2020, Jaworski et al. 2020, Redding and Turner 2015, Cosar and Fajgelbaum 2016, Lin 2017, Heuermann and Schmieder 2019, Fiorini et al. 2021, Fajgelbaum and Redding 2022). However, this infrastructure does more than just facilitate the movement of people and goods; it fosters geographic integration, enabling the exchange of ideas and information (Ahlfeldt and Feddersen 2018, Charnoz et al. 2018, Bernard et al. 2014, 2019, Dong et al. 2020). This is especially important for developing countries that are grappling with the challenges of information frictions in international trade. 1 For many firms, the intricacies of international trade extend beyond offering competitive products. They face barriers like discerning consumer preferences in unfamiliar markets, understanding nuanced trade regulations, and identifying trustworthy local partners (Rauch 1999, Lovely et al. 2005, Cai and Szeidl 2017, Steinwender 2018, Bergaud et al. 2020). HSR, with its transformative power, not only enhances domestic connectivity but also promotes face-to-face interactions among firms. Such interactions are pivotal in reducing information frictions, bridging the divide between local firms and global markets, and catalysing robust domestic knowledge spillovers and international collaborations.

High-speed rail: A means of knowledge sharing

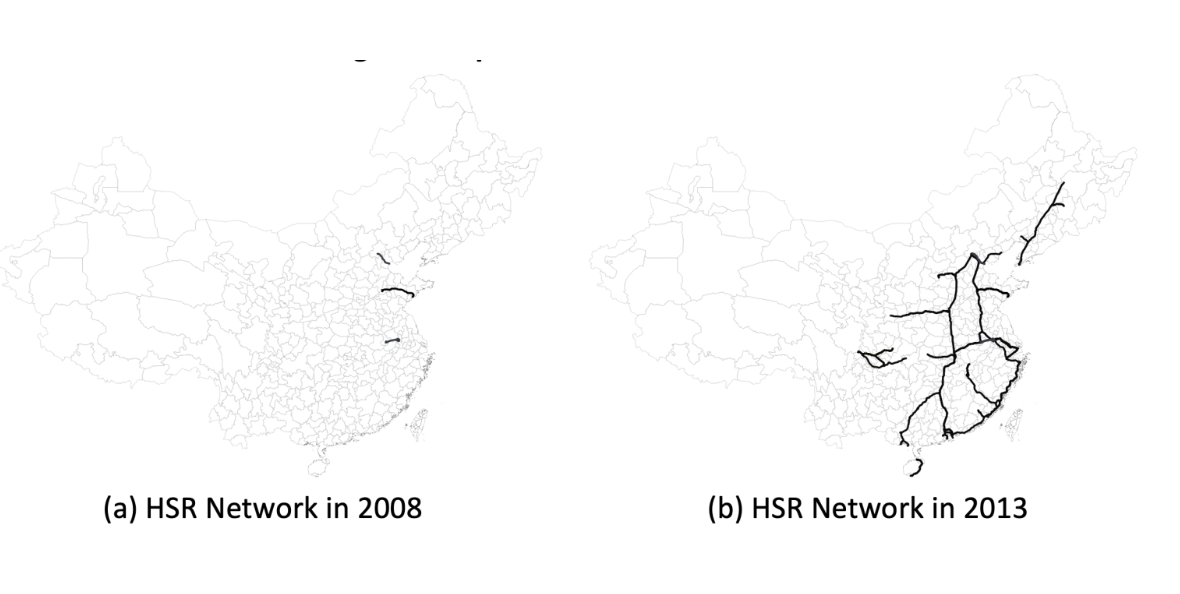

In our recent study (Tian and Yu 2023), we provide a new analysis to explore the impact of HSR on firm trade. China's meteoric rise as a global economic powerhouse offers a unique opportunity to study the interplay between infrastructure and trade. The nation's rapid HSR network expansion since 2008 – as shown in Figure 1 – served as a quasi-natural experiment, allowing us to dissect the relationship between domestic geographic integration and international market integration. We show that enhanced within-sector integration resulting from the infrastructure development significantly boosts firms’ export performance and provide further evidence consistent with the notion that HSR connections facilitate knowledge sharing, effectively bridging information gaps in foreign market access.

Figure 1 Expansion of China’s HSR network

Research methods and key findings

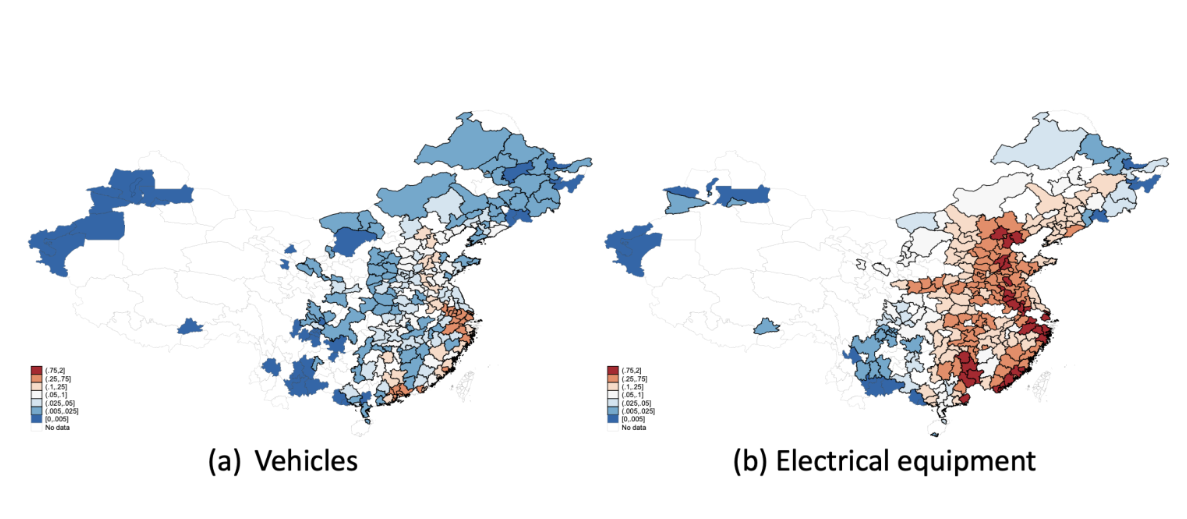

Our research is anchored on a parsimonious model that links a firm’s geographic integration to its export performance, primarily through the reduction of information acquisition cost. To empirically validate this, we utilised the expansion of China's HSR network between 2008 and 2013 as a quasi-experiment. The measures of exporter integration we adopt are derived from the model and capture a firm’s access to export activities within the same sector in all the surrounding locations via the railway transportation network available(2). Central to our empirical strategy is a triple-difference estimation model. The strategy leverages the staggered opening of HSR stations and lines by comparing the differential export growth of firms located in the same location but exporting in different sectors. This approach allows us to address location-specific shocks and concerns about endogenous placement and timing of transport infrastructure. Figure 2 illustrates the spatial contrasts in exporter integration levels between the two sectors.

Figure 2 Changes in exporter integration

Our findings reveal that a one-standard-deviation increase in exporter integration leads to a 4% rise in a firm’s export revenue. Furthermore, this is driven by a 5% reduction in the unit price of exported products and a 9% increase in export volume. Firms also expand their reach, exporting to more destination countries, updating their export product varieties more frequently, and broadening their export product menu.

Mechanisms driving the impact

But what are the mechanisms that drive this transformative impact of HSR on trade? Our study suggests a compelling answer: the development of HSR facilitates the geographic integration of exporters, which in turn significantly mitigates information frictions that firms face when accessing foreign markets.

To substantiate this proposition, we conducted a series of empirical tests:

- Exporter-specific spillovers: Our findings indicate that the benefits of geographic integration accrue specifically to exporters. Within a firm, exports to certain destinations grow more when the firm is intensively integrated with other same-sector exporters that have a specialisation in exporting to those very destinations. Furthermore, firms connected by HSRs demonstrate a convergence in their choices of export destinations, reflecting the targeted influence of integration on decisions specific to exporters.

- Knowledge acquisition and firm size: Delving deeper, we discovered that firms which traditionally face greater challenges in knowledge acquisition — notably smaller firms or those dealing with products characterised by rapidly changing styles, located in more remote regions, or exporting to less open destinations— register a more pronounced improvement in their export performance. This suggests that HSR-facilitated geographic integration significantly enhances a firm's access to vital trade knowledge.

- Nature of export-specific knowledge: To understand the kind of knowledge these firms acquire, we examined shifts in export product quality post the HSR connection. The evidence was clear: firms were not just exporting more, but they were exporting better. They acquired knowledge that not only elevated the quality of products exported to existing destinations but also enabled them to venture into higher-quality markets.

Policy implications

The surge in infrastructure investments, especially in developing economies, has been primarily directed towards enhancing internal market access for both consumers and firms. Our study underscores the pivotal role of such infrastructure in mitigating information barriers that often hinder firms in developing economies from entering foreign markets. The policy implications of our findings are manifold:

- Promotion of exporter integration: Our findings underscore the potential benefits of policies that foster exporter integration, such as export-cluster subsidy programs. These clusters facilitate knowledge sharing among firms and mitigate the costs associated with penetrating foreign markets.

- Redefining export clusters: Traditional industrial parks have been the norm for export clusters. However, our research suggests a shift towards a more modern approach: a network of firms interconnected by high-speed transit systems (Glaeser et al. 2015).

- Infrastructure's role in overcoming trade barriers: While there is extensive literature linking infrastructure to regional economic outcomes, our study illuminates a novel aspect. Enhanced infrastructure, especially those promoting frequent face-to-face interactions, can be instrumental in helping exporters navigate informal trade barriers in foreign markets.

- Adaptable empirical strategy: The empirical approach we've employed, centred on changing commuting infrastructure, can be tailored to other contexts. This adaptability can be pivotal in exploring various location-specific externalities.

Conclusion

In conclusion, as the global community seeks strategies to bolster international trade, the role of domestic factors, especially infrastructure, cannot be sidelined. While trade agreements and tariff reductions are vital, the power of domestic geographic integration in shaping a country's export landscape is undeniable. As we navigate this interconnected world, infrastructure investments, like HSR, promise to drive economic growth and enhance global trade. It's time for policymakers to recognise and harness the transformative potential of infrastructure, ensuring a prosperous future for all.

References

Ahlfeldt, G M, and A Feddersen (2018), “From periphery to core: measuring agglomeration effects using high-speed rail”, Journal of Economic Geography 18(2): 355–390.

Allen, T (2014), “Information frictions in trade”, Econometrica 82(6): 2041–2083.

Atkin, D, and A K Khandelwal (2020), “How distortions alter the impacts of international trade in developing countries”, Annual Review of Economics 12(1): 213–238.

Atkin, D, and A K Khandelwal (2022), “International Trade”, VoxDevLit.

Bernard, A B, A Moxnes, and Y U Saito (2014), “Fast Trains, Supply Networks, and Firm Performance”, VoxEU.org, 24 September.

Bernard, A B, A Moxnes, and Y U Saito (2019), “Production networks, geography, and firm performance”, Journal of Political Economy 127(2): 639–688.

Bergeaud, A, C Criscuolo, K Ikeuchi, K Ito, J Timmis (2020), “Central Hubs in Global Value Chains and Knowledge Creation”, VoxEU.org, 23 April.

Cai, J, and A Szeidl (2017), “Interfirm relationships and business performance*”, Quarterly Journal of Economics 133(3): 1229–1282.

Charnoz, P, C Lelarge, and C Trevien (2018), “Communication costs and the internal organisation of multi-plant businesses: evidence from the impact of the French highspeed rail”, Economic Journal 128(610): 949–994.

Cosar, A K, and P D Fajgelbaum (2016), “Internal geography, international trade, and regional specialization”, American Economic Journal: Microeconomics 8(1): 24–56.

Donaldson, D, and R Hornbeck (2016), “Railroads and American economic growth: a market access approach”, Quarterly Journal of Economics 131(2): 799–858.

Dong, X, S Zheng, and M E Kahn (2020), “The role of transportation speed in facilitating high skilled teamwork across cities”, Journal of Urban Economics 115: 103212.

Egger, P, G Lomeau, N Lomeau (2020), “Unbridled Transport Infrastructure Growth in China”, VoxEU.org, 3 November.

Fajgelbaum, P, and S J Redding (2022), “Trade, structural transformation and development: evidence from Argentina 1869-1914”, Journal of Political Economy 130(5): 1249–1318.

Fiorini, M, M Sanfilippo, and A Sundaram (2021), “Trade liberalization, roads and firm productivity”, Journal of Development Economics 153: 102712.

Glaeser, E L, G A M Ponzetto, and Y Zou (2015), “Urban Networks: Connecting Markets, People, and Ideas”, NBER Working Paper No. 21794.

Heuermann, D F, and J F Schmieder (2019), “The effect of infrastructure on worker mobility: evidence from high-speed rail expansion in Germany”, Journal of Economic Geography 19(2): 335–372.

Jaworski, T, C Kitchens, S Nigai (2020), “Globalisation and the Value of Domestic Highway Infrastructure”, VoxEU.org, 1 November.

Lin, Y (2017), “Travel costs and urban specialization patterns: evidence from China’s high speed railway system”, Journal of Urban Economics 98: 98–123.

Lovely, M E, S S Rosenthal, and S Sharma (2005), “Information, agglomeration, and the headquarters of US exporters”, Regional Science and Urban Economics 35(2): 167–191.

Rauch, J E (1999), “Networks versus markets in international trade”, Journal of International Economics 48(1): 7–35.

Redding, S J, and M A Turner (2015), “Transportation costs and the spatial organization of economic activity”, Handbook of Regional and Urban Economics 5: 1339–1398.

Startz, M (2016), “The value of face-to-face: Search and contracting problems in Nigerian trade,” Working Paper SSRN No. 3096685.

Steinwender, C (2018), “Real effects of information frictions: when the states and the kingdom became united”, American Economic Review 108(3): 657–96.

Tian, L and Y Yu (2023), “Geographic Integration and Firm Exports: Evidence from China”, CEPR Discussion Paper 2023.

Footnotes

- See Atkin and Khandelwal (2020, 2022) for reviews of recent literature and Allen (2014) and Startz (2016) for direct empirical evidence.

- Our integration measure resembles the market access measure in international trade literature (e.g. Donaldson and Hornbeck 2016).