When eligible for unemployment benefits, workers and firms make strategic layoffs in the presence of informal labour markets

Editor’s note: This article covers similar themes to those summarised in our recent VoxDevLit on Informality.

Experiencing shocks to labour income is one of the most salient risks faced by households (Rothstein and Valletta 2017). To allay adverse effects of job loss on household incomes, government-mandated unemployment insurance (UI) programmes have been in place in developed countries for decades. However, adverse labour supply effects of UI can generate a trade-off between providing insurance against income shocks and distorting labour supply.

More recently, the implementation of government-mandated UI programs has been spreading to an increasing number of low- and middle-income countries (Holzmann et al. 2011, ILO 2017). These countries often have specific labour market characteristics that may interact with the incentive effects of UI, but we have little evidence from these settings.

A prominent feature of labour markets in low- and middle-income countries is a high degree of informality, which may interact with UI provision in unique ways. For example, informal labour markets enable workers to receive UI benefits while also being employed informally.

UI benefits and strategic layoffs

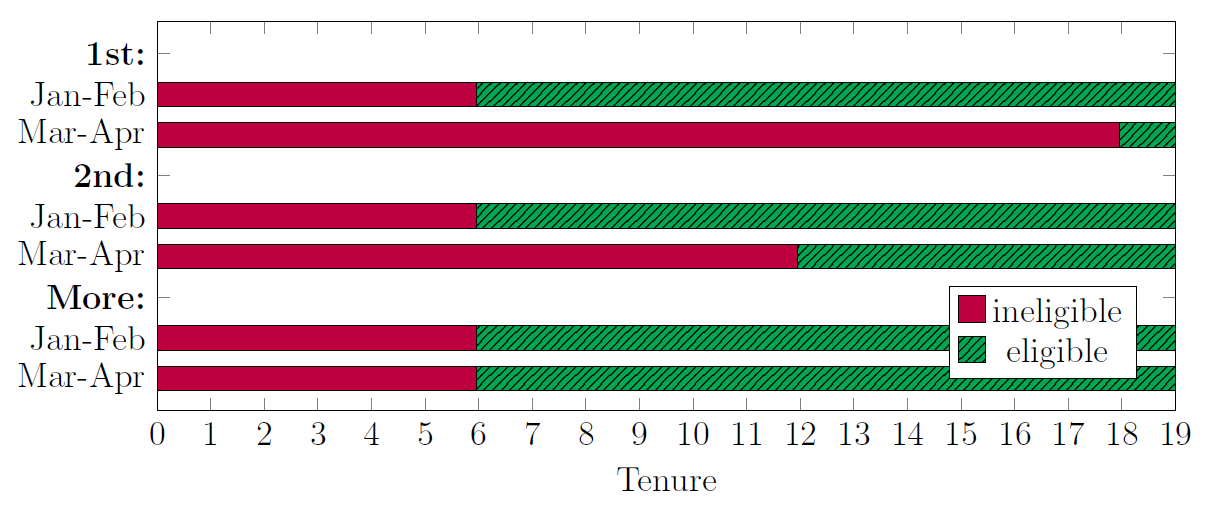

To learn about the incentive effects of UI in the presence of large informal labour markets, we examine a recent UI reform in Brazil (van Doornik et al. 2023). Figure 1 depicts the design of the reform, unexpectedly announced on 29 December 2014, and implemented on 1 March 2015. The reform affected workers with less than two successful prior applications for UI benefits, which are about 60% of all workers. Before the reform, all workers with previous job tenure of at least six months were eligible for UI benefits. To qualify for UI benefits after the reform, workers who were applying for the first time required documented employment of at least 18 months during the 24 months before layoff. Workers applying for the second time required 12 months of formal employment during the last 16 months.

Figure 1: UI Eligibility around the reform

Notes: This figure shows eligibility criteria for UI benefits before and after the reform based on workers' tenure for workers who apply for UI benefits for the first time, the second time, or the thrid time or more. Red bars indiciated tenure not satisfying eligibility criteria, green bars indicate tenure satisfying eligibility criteria.

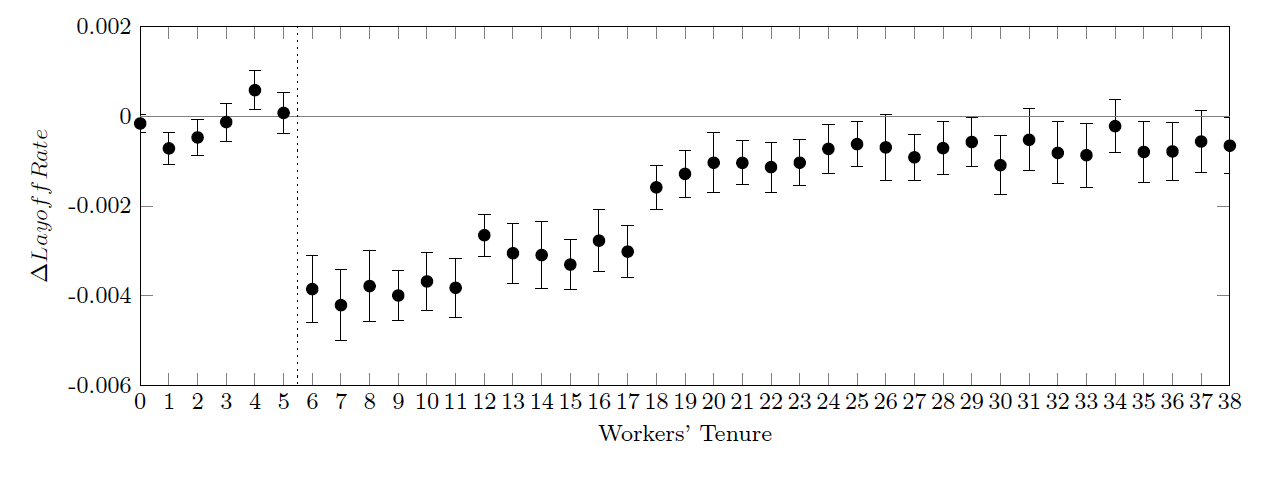

This policy design provides a sharp tenure cutoff at six months, at which some workers lose eligibility for UI benefits. We find that layoff rates for affected workers above the six-month threshold drop by 0.4 percentage points (11%) when they lose eligibility for UI benefits after the reform (Figure 2). In contrast, for workers below the six-month threshold, we do not observe systematic changes in layoff rates. Together, this suggests that eligibility for UI benefits does not merely affect the timing of layoffs, but that 11% of layoffs at the eligibility threshold would not occur in the absence of UI benefits.

Figure 2: Formal layoffs by tenure

Notes: This figure estimates changes in layoff rates for affected and unaffected workers around the reform (March 2015 to February 2016 relative to March 2014 to February 2015) for each tenure from 0 to 38 months. The vertical bars represent 99 percent confidence intervals.

The role of informal labour markets

To assess the role of informal labour markets in generating strategic layoffs, we exploit cross-sectional variation in labour market informality across industries and municipalities in Brazil. We find that a ten percentage point increase in labour market informality leads to a 0.1 percentage point increase in strategic layoffs. In addition, survey evidence suggests that laid-off workers are about 9 to 10 percentage points more likely to transition to informal employment when they are eligible for UI benefits at layoff. Our estimates suggest that about 95% of strategic layoffs are related to informal employment.

Firm-worker collusion

A possible explanation of these empirical results is that firms and workers devise strategies to extract rents from the UI system. We focus on two strategies. First, firms may temporarily lay off workers to allow them to receive UI benefits while they work informally at other firms and recall them once their benefits payments cease. Second, a firm may keep a formally laid-off worker as an informal employee.

Timing of layoffs and recalls

We find that strategically laid off workers are more likely to be recalled by their former employer when their benefits cease. After the reform, when workers with 6 to 11 months' tenure at layoff are no longer eligible for UI benefits, they are 9.56% less likely to be recalled by the same firm. Thus, firms are not only more likely to lay off workers when they qualify for UI benefits, but are also more likely to recall these workers when their benefits cease. This is consistent with formal unemployment spells being timed to precisely coincide with workers' eligibility for UI benefits.

Maintaining an informal relationship

Next, we assess whether workers who are laid off just as they qualify for UI benefits remain informally employed by their employer. Since informal employment is not recorded in administrative data, we resort to indirect evidence. When firms lay off a worker, they often hire another worker as a replacement. However, if firms continue to employ a worker informally, they do not need to hire a worker to replace them. We find that when workers are laid off as they are no longer eligible for UI benefits after the reform, firms are more likely to hire a replacement worker. This suggests that firms are less likely to replace laid-off workers if they are eligible for UI benefits, consistent with some firms and workers maintaining an informal relationship while the workers receive UI benefits.

Rent-sharing through salaries

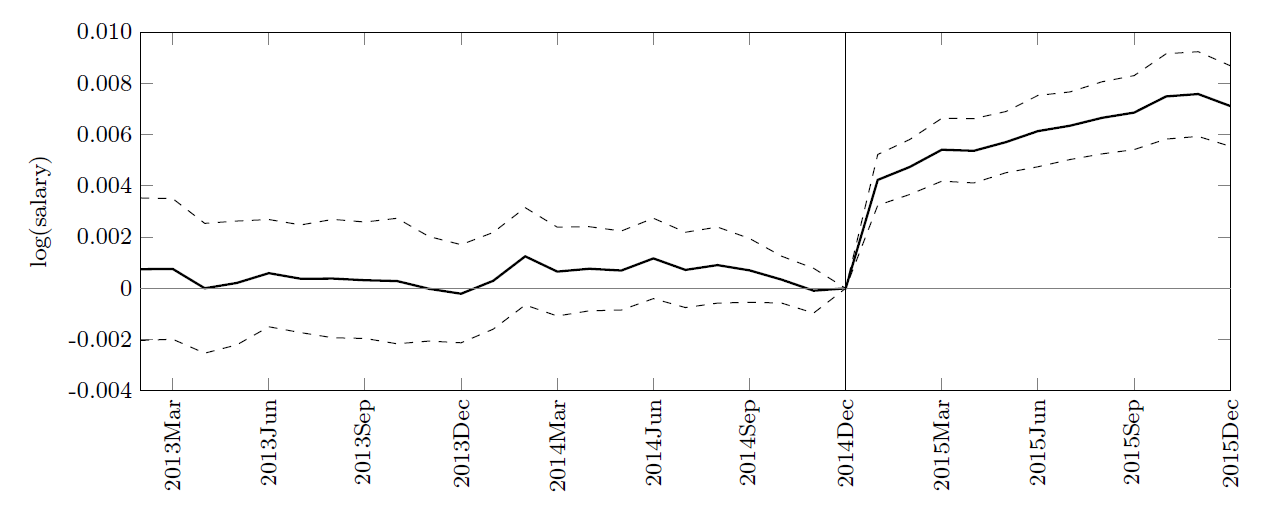

To assess whether workers and firms share rents from the UI system through salaries, we examine changes in salaries for affected and unaffected workers around the reform in Figure 3. We find that the salaries of workers who lose eligibility for UI benefits increase by about 0.8% relative to unaffected workers, consistent with workers having previously passed on rents from the UI system to firms through lower salaries.

Figure 3: Salaries

Notes: This figure plots the log difference in salaries for affected and unaffected workers from January 2013 to December 2015 normalized to zero in December 2014. The dashed lines represent 99 percent confidence intervals.

Costs of strategic layoffs to the UI system

Rent extraction from the UI system generates a transfer scheme to firms for whom it is easier to game the system (Anderson and Meyer 1997), and reduces funds available for insurance purposes. Our estimates suggest that 2.16 to 11.11% of all UI payments, or 0.013 to 0.067% of GDP, go to strategically formally-unemployed workers. The costs and distortions from strategic formal unemployment increase with the size of informal labour markets. We depict the degree of strategic formal layoffs (solid line) and a range of costs to the UI system (dotted lines) as a function of labour market informality in Figure 4. For markets with low informality, costs to the UI system due to strategic formal unemployment are negligible. However, they can reach more than 0.03% of GDP for high levels of labour market informality even under the most conservative assumptions, and more than 0.15% of GDP under the least conservative assumptions.

Policy implications

Our findings have several implications for UI design. The timing of layoffs and recalls to match workers' UI eligibility suggests that part of the UI system transfers rents toward firms and workers who exploit the system. Reducing potential rents could reduce the adverse incentive effects of UI in the presence of informal labour markets, which can be achieved through lowering replacement rates (the percentage of an individual's employment income that is replaced by UI benefits, which is about 70-80% in Brazil) and the duration of benefits, or by increasing experience rating to increase the cost of layoffs. More nuanced policy implications include tweaks to the UI system that prevent repeated temporary layoffs of the same worker by the same firm.

The strong correlation with labour market informality suggests that these considerations are particularly important for low- and middle-income countries with large informal labour markets, and that reducing labour market informality, or better monitoring in combination with higher fines, may also reduce the adverse incentive effects of unemployment insurance. It is important, however, to weigh these benefits of reducing the gaming of the system against overall welfare concerns.

References

Anderson, P M, and B D Meyer (1997), “The Effects of Firm Specific Taxes and Government Mandates with an Application to the U.S. Unemployment Insurance Program”, Journal of Public Economics 65(2): 119–145.

Chetty, R, J N Friedman, T Olsen, and L Pistaferri (2011), “ Adjustment Costs, Firm Responses, and Micro vs. Macro Labour Supply Elasticities: Evidence from Danish Tax Records”, The Quarterly Journal of Economics 126(2): 749–804.

Holzmann, R, Y Pouget, M Vodopivec, and M Weber (2011), “Severance Pay Programs Around the World: History, Rationale, Status, and Reforms”, IZA Working Paper.

ILO (2017), World Social Protection Report 2017-19. ILO Publications.

Kleven, H J, and M Waseem (2013), “Using Notches to Uncover Optimization Frictions and Structural Elasticities: Theory and Evidence from Pakistan”, The Quarterly Journal of Economics 128(2): 669–723.

Rothstein, J, and R G Valletta (2017), “Scraping By: Income and Program Participation After the Loss of Extended Unemployment Benefits”, Journal of Policy Analysis and Management 36(4): 880–908.

Van Doornik, B, D Schoenherr, and J Skrastins (2023), “Strategic Formal Layoffs: Unemployment Insurance and Informal Labour Markets”, American Economic Journal: Applied Economics 15(1): 292–318.