Cities with export slowdowns had larger increases in crime rates, driven by weakened labour markets

In the past decade, the annual growth of China’s exports has dropped sharply from an average of 25% during 2001–2008 to less than 5% during 2011–2018. The slump in exports is largely due to sluggish foreign demand (World Bank 2020). Indeed, since the Global Financial Crisis of 2008, the world economy has remained highly prone to secular stagnation (Summers 2014, 2015). Home to the largest working-age population in the world, China relies heavily on global demand to sustain growth and generate jobs (Feenstra and Hong 2010). This has raised strong concerns that not enough jobs are being created, which may have substantial socioeconomic costs such as increased criminal activity (Bignon et al. 2017, Khanna et al. 2021, Bhalotra et al. 2021).

China’s recent export slowdown

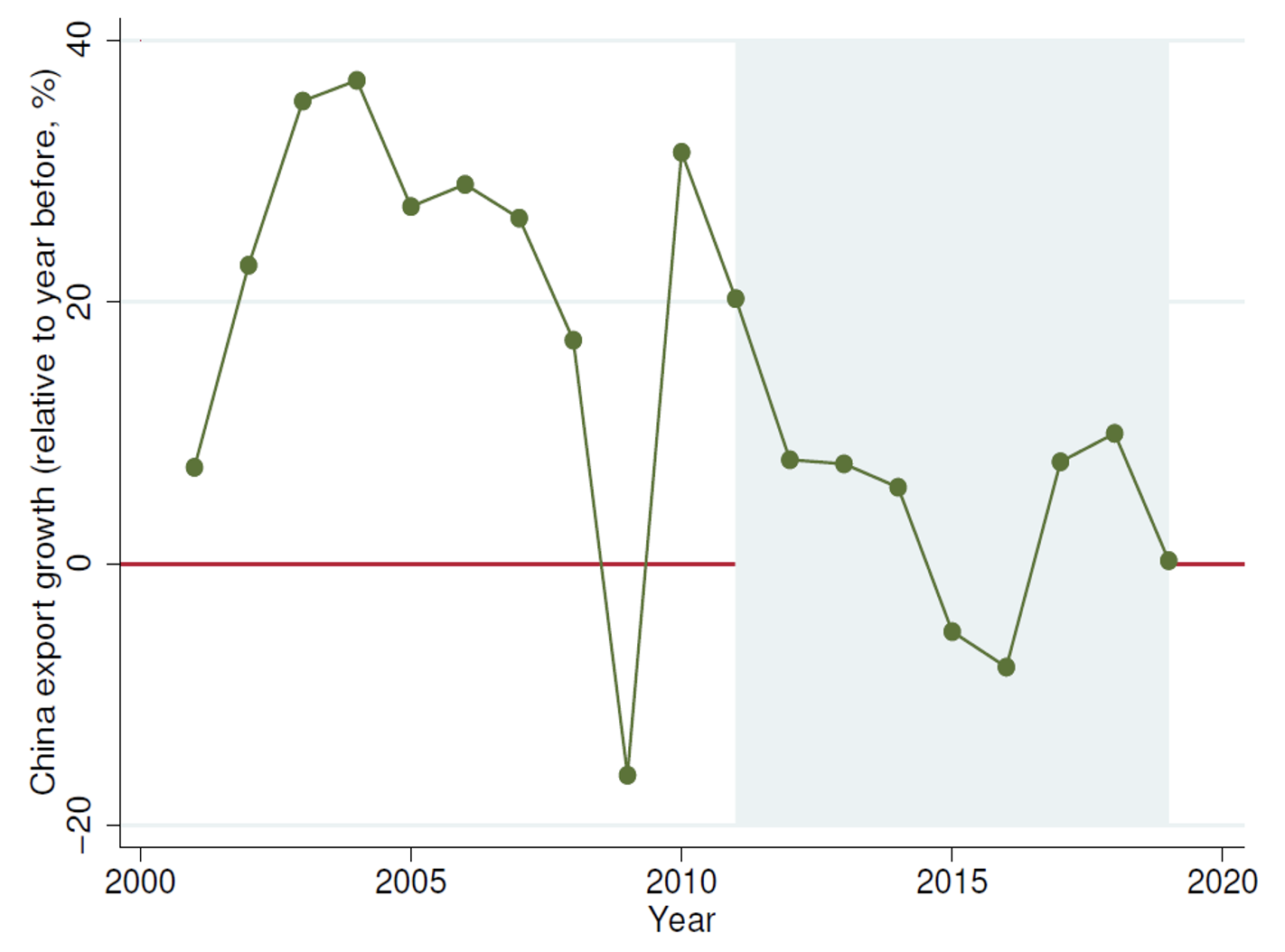

Figure 1 plots the annual growth rates of China’s manufacturing exports from 2001 to 2019. Following China’s accession to the WTO in 2001, Chinese merchandise exports grew rapidly, with an average annual rate of 25% between 2001 and 2008. However, the high growth trend in manufacturing exports underwent a sharp reversal, beginning in 2011, with the annual growth rate declining from 20% in 2011 to 0.24% in 2019. The average annual growth rate remained at a low level of 5% between 2011 and 2019. The slowdown was quite significant before 2016, when the growth rate hit rock bottom at −7.9%. Although there has been a subsequent recovery, trade disputes between China and the US began in 2018, leading to a further drop in China’s manufacturing export growth rate.

Figure 1 Manufacturing export growth of China

Note: The figure plots China’s manufacturing export growth rate between 2001 and 2019. The growth rate is computed as the annual change in China’s manufacturing exports to the rest of the world relative to the previous year. Export data come from China’s General Administration of Customs.

Using judgement documents to evaluate the impacts of the export slowdown on crime

The slump in exports may have impacted the local economy by forcing firms out of business and deteriorating labour market conditions, which potentially added to social unrest, protests, and criminal activities. Although the socioeconomic consequences of an export slowdown seem evident, the impact has rarely been quantified in the Chinese context. In our paper (Ma, Pan and Xu 2022), we assemble a unique and comprehensive dataset that links city-level measures of crime rates (by detailed criminal activities) with measures of exposure to adverse export shocks in the global market. Our crime rates are constructed based on verdicts posted on China Judgments Online (CJO), the first comprehensive official database of judicial judgment documents in China that covers almost all types of judgment documents from 2011 to 2018.1 In the analysis, we focus on criminal cases that violate the ‘Criminal Law of the People’s Republic of China’ because criminal activities induce high social costs (Loayza et al. 2000). To assign each case to a type of crime, we perform a textual analysis of the transcripts of the verdicts.

Figure 2 shows the similarity of our CJO crime rates aggregated at the national level with two official statistics published by the Supreme People’s Court of China (SPC). The upper panel (Figure 2a) compares our constructed crime rates with the number of criminal cases concluded at first instance; the bottom panel (Figure 2b) compares these crime rates with the number of sentenced criminals. In both panels, our constructed measure exhibits a similar trajectory with the official data. The key advantage of using the CJO judgment documents is that this approach allows us to measure crime rates for each Chinese city by specific categories of criminal activity. The vast difference in crime rates across various cities is then compared with the exposure of the aforementioned cities to negative export demand shocks.

Figure 2 Crime rate comparison, CJO and the SPC of China

a) Number of criminal cases (national level)

b) Number of sentenced criminals (national level)

Note: Figure 2 compares national crime rates computed from the CJO database and the annual work reports given by the SPC at the National People’s Congress. Our crime rates are measured by the number of criminal cases per million working-age individuals. In Figure 2a, we compare CJO-based crime rates to SPC crime rates (measured by the number of concluded criminal cases in the first instance per million workers). Figure 2b compares CJO-based crime rates with those reported by the annual work report (measured by the number of sentenced criminals per million workers).

Cities with a deeper export slowdown see significant increases in crime rates

Using a shift-share instrumental variable approach for our estimation, we find robust evidence that China’s export slowdown led to increased crime rates. In particular, cities that experienced a deeper slowdown in export growth have seen a greater incidence of criminal activity relative to their working-age population. This effect is more pronounced in regions that specialise in manufacturing or have a larger share of young and migrant residents. Regarding types of crime, larger effects are found in resource appropriation activities, such as robbery, theft, fraud, counterfeiting and intellectual property infringement, as well as in criminal activities involving violence, felony traffic offenses, drugs, prostitution, and gambling.

As for the mechanism, we demonstrate that sluggish export growth leads to shrinking job opportunities and lower wages in the manufacturing sector, which drives the increase in crime rates. Consistent with these findings, we identify heterogeneous impact of the export slowdown on crime rates across regions. We find the export slowdown has an insignificant effect in regions with large (non-tradable) service sectors, where employment and earnings respond less elastically to export shocks. The worsening labour market is also reflected by a rising number of labour disputes, and a falling net inflow of migrant workers in regions with more severe contraction in exports. As an alternative channel, export contraction may induce crime by reducing governments’ expenditure on public security or surveillance equipment. However, our estimations lend less support to this possible mechanism: we do not find evidence that that the export slowdown had significantly decreased fiscal spending on public security (e.g., the expenses by the Armed Police, the judicial system, and the public security organs), and social services (e.g., the expenditure on public education, social security, public hospitals, urban and rural affairs, and public housing).

Two contributions of our paper are noteworthy. First, we construct a time-varying measure of the crime rate at the city level, which is used for investigating the socio-economic effects of the export slowdown. For this purpose, we innovatively apply textual analysis to millions of judgment documents at all levels of courts in China. Most related studies have mainly used the province-level crime statistics from the China Procuratorial Yearbooks, and focused on the aggregated rather than specific types of crime. We take advantage of the universe of judgment documents make public by the Supreme Court of China and generate rich information on city-level crime rate that varies by time and by crime types. Second, our focus on the rising crime rate in Chinese cities has rarely been explored in previous work. We find that an export slowdown. induces more crime, primarily through its effects on the labour market conditions, thus corroborating the Brazilian experience documented by Dix-Carneiro et al. (2018).

Conclusion

Our paper is among the first to examine the rising social conflicts caused by export slowdowns after the Global Financial Crisis. In this regard, one closely related study is that by Campante et al. (2019), who examine rising labour strikes in Chinese prefectures as a result of the export slowdown. Taken together, in the context of China, our work highlights the crucial role of improving labour market conditions in reducing crime, a solution with which society can maintain low crime rates and ever-greater well-being. A back-of-envelope calculation based on our estimation shows that on average each one percentage point increase in export growth would reduce incidence of crime by 2 cases per million residents, or about 0.43% of the national average crime rate between 2011 and 2018.

References

Bhalotra, S, D GC Britto, P Pinotti and B Sampaio (2021), “Job displacement, unemployment benefits and domestic violence”, CEPR Discussion Paper No. 16350.

Bignon, V, E Caroli and R Galbiati (2017), “Stealing to survive? Crime and income shocks in nineteenth century France”, The Economic Journal 127(599): 19-49.

Campante, F R, D Chor and B Li (2019), “The Political Economy Consequences of China's Export Slowdown”, NBER Working Paper No. 25925.

Dix-Carneiro, R, R R Soares and G Ulyssea (2018), “Economic shocks and crime: Evidence from the Brazilian trade liberalization”, American Economic Journal: Applied Economics 10(4): 158-95.

Feenstra, R C and C Hong (2010), “China’s exports and employment”, China’s growing role in world trade: 167-199.

Khanna, G, C Medina, A Nyshadham, C Posso and J Tamayo (2021), “Job Loss, Credit, and Crime in Colombia”, American Economic Review: Insights 3(1): 97-114.

Loayza, N, P Fajnzylber and D Lederman (2000), “Crime and victimization: An economic perspective”, Economia 1(Fall 2000): 219-302.

Summers, L H (2014), “Reflections on the ‘new secular stagnation hypothesis’”, Secular Stagnation: Facts, causes and cures, CEPR Press.

Summers, L H (2015), “Demand side secular stagnation”, American economic review 105(5): 60-65.

World Bank (2020), “Trading for Development in the Age of Global Value Chains”.

Ma, H, Y Pan and M Xu (2022), “Work or Crook: The Socioeconomic Consequences of the Export Slowdown in China”, SSRN Working paper No. 4232616.

Endnotes

1 Cases involving national security, juvenile delinquency, divorce litigation, resolution through mediation, and any other types that the people’s court considers inappropriate for release are not posted in CJO.