Trade-induced competition on final goods drove firms in the Peruvian apparel industry to upgrade the quality of their products and export more

How firms can compete with their counterparts in low-wage countries is a long-studied and complex question – part of the answer comes from affected firms innovating and developing new products, often of higher quality. This is known as quality upgrading.

Economists have identified two ways in which trade incentivizes quality upgrading. First, trade facilitates access to cheaper, more varied, and higher-quality inputs that firms can use to produce (Kugler and Verhoogen 2012, Bas and Strauss-Kahn 2015, Fieler et al. 2018). Second, trade provides firms with access to new markets and thus incentives for quality investment (Verhoogen 2008, Lileeva and Trefler 2010, Bustos 2011, Aw et al. 2011, Brambilla et al. 2012, Bastos et al. 2018). In both cases, quality upgrading results from increased profits due to trade integration. Production costs decrease in the first, while firms exploit new consumers and scale economies in the second, but are these the only mechanisms?

In my recent paper (Medina, 2022), I find a new way through which import competition at the final good level drives firms to i) produce high-quality goods; and ii) increase exports. Unlike the previous channels, these responses happen despite firms being negatively affected by the trade shock.

The Peruvian apparel case

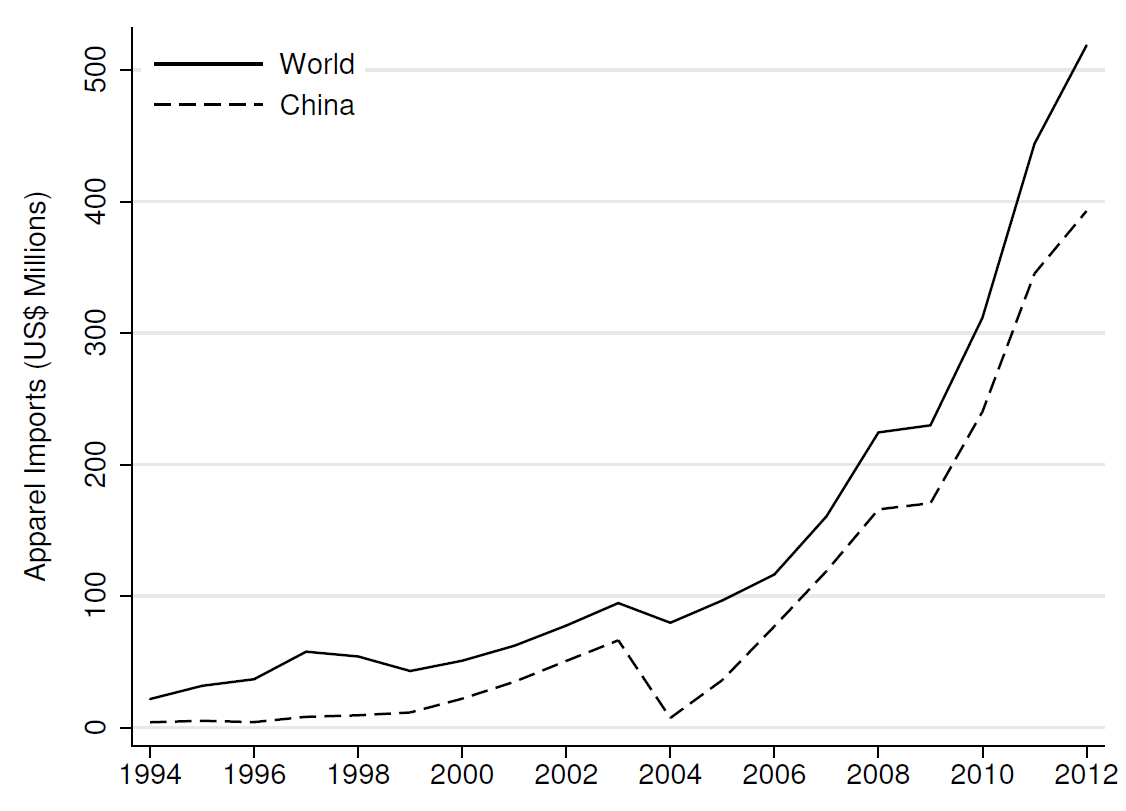

Import competition intensified for the Peruvian apparel industry after China joined the WTO in 2001. Before China entered the WTO, most of the clothes sold in Peru were made by Peruvian firms. As Panel (a) of Figure 1 shows, in just one decade, China inundated the domestic economy with cheaper clothing. As a result, Peruvian firms lost substantial domestic market share, and by 2011, half of the clothes sold in the country were of Chinese origin. The situation was no different in Peru’s most prominent export destinations: Chinese import competition also increased in the United States and other developed countries. This represented a massive negative shock for Peruvian producers.

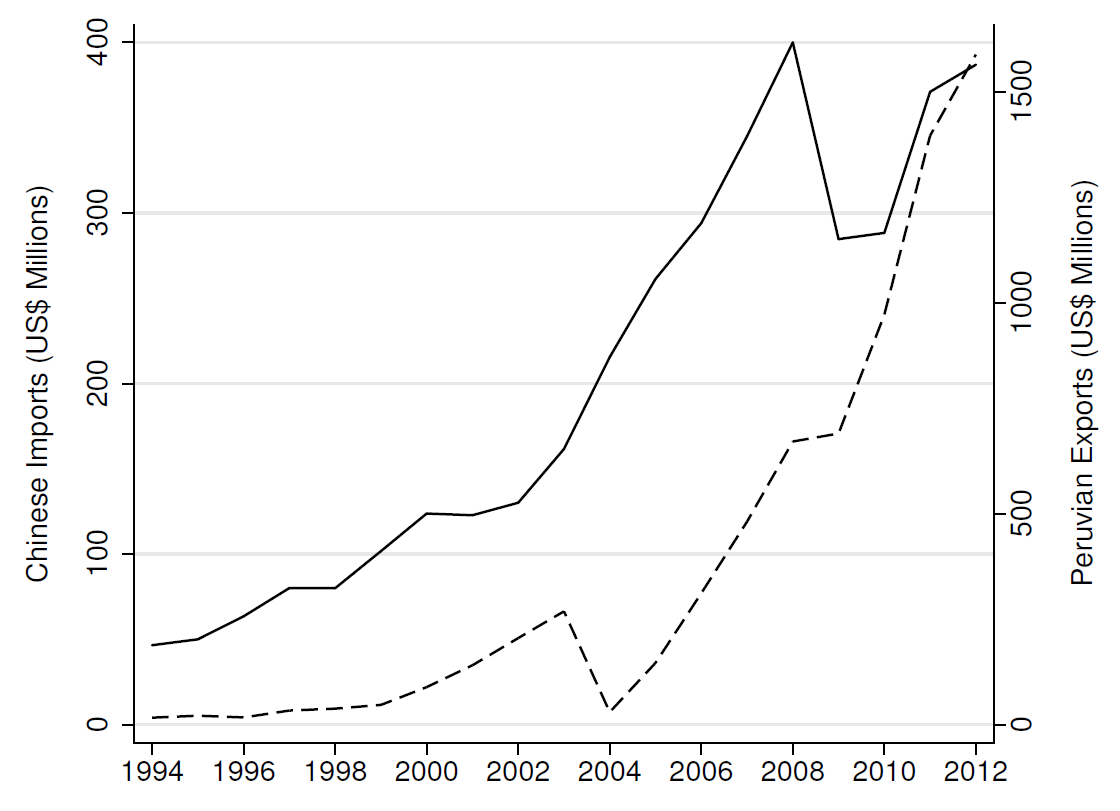

Consequently, the Peruvian apparel industry experienced a transformation, but did not take the bad turn everyone expected. Surprisingly, while Peruvian firms lost substantial domestic market share, the industry kept afloat, mostly thanks to unprecedented export growth (Panel (b) of Figure 1). The rise was such that between 2000 and 2008, the share of total industry sales that were exports rose from 56% to 71%. Interestingly, most of this export growth happened in garments made of a very high-quality material, the native Peruvian pima cotton. Peruvian firms were changing their product bundle towards these high-quality cotton garments, whether they were frequent exporters or had just started to sell abroad.

Figure 1: (a) Peruvian apparel imports (b) Peruvian imports and exports

Note: Panel (a) shows the total apparel imported by Peru from the rest of the world (solid line) and Peruvian apparel imports originated in China (dashed line) from 1994 to 2012. The drop in 2004 imports is due to the temporary tariffs imposed by the Peruvian government for 200 days. Panel (b) shows, in the primary y-axis, total imports originating in China (dashed line). The secondary y-axis (solid line) denotes Peruvian garment exports. The source for both panels is Peruvian customs.

Peruvian firms' shift towards producing high-quality products and increased exports were not accompanied by a significant investment in capital—including new machinery—nor the hiring of relatively more skilled workers. Instead, these firms were producing higher-quality goods with the same machinery and workers, paying more for higher-quality pima cotton fabric, all of this at a time when their profits were falling. These patterns suggest a new adjustment mechanism not explained by previous trade models used by economists (Bernard et al. 2010). The Peruvian case begs for a new channel to understand these responses.

Why did Peruvian firms upgrade their quality and increase exports despite the negative shock?

I examine the mechanism in a general equilibrium economic model. In the model, firms can be multi-product producers, i.e. fabricate low-quality goods, high-quality ones, or both. To produce those goods, every period, firms allocate machinery (cutting machines, sewing machines, etc.), workers, and materials (mostly fabric), to the production of different quality varieties. However, while firms can freely adjust the total amount of workers and fabric they use, this is not the case for machinery. In general, acquiring and selling this equipment is very hard. For instance, selling your used machinery might entail some time invested in finding a buyer, whereas buying might require firms to secure some credit; in either case, machinery is not immediately mobile across firms.

What are the consequences of being unable to downsize your machinery for the effects of trade? An unanticipated import competition shock in low-quality product markets decreases firms' profits. For these multi-product firms, it is optimal to reduce the production of low-quality goods, which frees up resources. While labour and materials used on those goods can be immediately reallocated to other firms, firms find it hard to downsize and resell their machinery, which is seen as fixed in the short run. Since firms need to pay a per-period cost to use this machinery, it is efficient to reallocate this idle resource within the firm to other production lines: high-quality goods. Moreover, firms' sales shift to exports because the foreign market places a higher value on higher-quality products. Thus, this difficulty to downsize their machinery–or as economists call it, “capital reallocation frictions”–lead firms to quality upgrade and increase their exports.

Was this channel in place in Peru and is it significant?

The first step is to understand how firms are affected by China. Intuitively, import competition affects firms differently depending on whether they produce low-, high-, or both types of goods. For instance, if a Peruvian firm only makes high-quality clothes, it will not be directly affected by Chinese import competition, which is primarily composed of low-quality garments. However, a firm selling low-quality clothes will be in direct competition. Generally, a Peruvian firm's exposure will highly depend on the mix of clothes it sells; thus, a firm-level measure of exposure to import competition should combine how directly a firm's products compete with Chinese clothing and their relative importance to the firm's product mix.

Using disaggregated micro data to construct this measure, and an instrumental variables (IV) approach, I establish a causal relationship between firm-level import competition exposure and measures of firm performance in line with the model's main predictions. The results are striking.

1. An increase in exposure to Chinese import competition from relatively low (25th percentile) to relatively high (75th percentile) leads to an average increase of 42% in firm-level annual exports, entirely driven by the increase of high-quality exports (46% increase). Firms specialize in exports of high quality, with an increase in high-quality firms' export value and quantity shares. This within-firm adjustment encompasses several margins:

- An increase in the number of (high-quality) varieties exported.

- The introduction of new (high-quality) products.

- An increase in the probability of exporting.

2. Total sales are not affected by import competition as firms compensate losses in domestic sales with a shift to export markets.

3. Import competition did not lead Peruvian firms to make significant investments in capital or change their labour composition. Although firms’ material expenditures did not change due to Chinese competition, the shock led firms to pay higher prices for materials (higher price per kilo), while using less quantity of them.

This new mechanism indicates that, in response to import competition, firms shifted their production to high-quality garments, ultimately selling them in foreign markets. Underlying this shift is the re-optimisation of idle machinery across product lines and markets. Note that even with these responses, lower demand and more expensive materials still caused profits to decrease.

Policy implications

With the estimated model, I consider two policy-relevant questions. First, I ask whether Peruvian firms would have escaped low-wage competition if they did not have access to a low-priced, high-quality input (e.g. pima cotton). Second, I ask how Peruvian firms would have fared if they did not have access to a foreign destination for their high-quality goods (e.g. the United States). I find that if Peruvian firms had to import pima cotton, or lacked a destination market for high-quality goods (key conditions for this to work), annual industry sales would have decreased by 4%-13%, firm’s profits by 4%-12% and industry employment by 8%-15%. Both results point to significant losses if firms cannot change their product mix following an increase in import competition, and highlight the need to promote access to high-quality upstream supply chains as well as foreign downstream buyers.

References

Aw, B Y, M J Roberts, and D Y Xu (2011), “R&D Investment, Exporting, and Productivity Dynamics,” American Economic Review, 101(4): 1312–44.

Bas, M, and V Strauss-Kahn (2015), “Input-trade liberalization, export prices and quality upgrading,” Journal of International Economics, 95(2): 250 – 262.

Bastos, P, J Silva, and E Verhoogen (2018), “Export Destinations and Input Prices,” American Economic Review, 108(2): 353–92.

Bernard, A B, S J Redding, and P K Schott (2010), “Multiple-Product Firms and Product Switching,” American Economic Review, 100(1): 70–97.

Brambilla, I, D Lederman, and G Porto (2012), “Exports, Export Destinations, and Skills,” American Economic Review, 102(7): 3406–38.

Bustos, P (2011), “Trade Liberalization, Exports, and Technology Upgrading: Evidence on the Impact of MERCOSUR on Argentinian Firms,” American Economic Review, 101(1): 304–40.

Fieler, A C, M Eslava, and D Y Xu (2018), “Trade, Quality Upgrading, and Input Linkages: Theory and Evidence from Colombia,” American Economic Review, 108(1): 109–46.

Kugler, M, and E Verhoogen (2012), “Prices, Plant Size, and Product Quality,” Review of Economic Studies, 79(1): 307–339.

Lileeva, A, and D Trefler (2010), “Improved Access to Foreign Markets Raises Plant-level Productivity ... For Some Plants,” The Quarterly Journal of Economics, 125(3): 1051.

Medina, P (2022), “Import Competition, Quality Upgrading, and Exporting: Evidence from the Peruvian Apparel Industry,” The Review of Economics and Statistics.

Verhoogen, E (2008), “Trade, Quality Upgrading, and Wage Inequality in the Mexican Manufacturing Sector,” The Quarterly Journal of Economics, 123(2): 489–530.