A healthcare-based study suggests using loss-framed incentives can lead recipients to perceive them as more trustworthy

Wellness programmes at work, financial rewards for smoking cessation, lottery tickets for people who get vaccinated – financial incentives are an important policy tool to promote socially desirable behaviour. This is especially true in the presence of positive externalities or behavioural biases, such as in the decision to obtain preventive health care (Kane et al. 2004, Jochelson 2007, and Sutherland et al. 2008). Small changes to incentives, like presenting the reward using a loss-frame (you will lose the incentive if you don’t act) versus a gain-frame (you will get the incentive if you do act), can meaningfully affect how many people take up the intervention as well as the characteristics of those who do (Madrian 2014).

Our research (Beam et al. 2022) uses a randomised experiment to understand how the structure of incentives to obtain preventive healthcare affects people’s responses. Like researchers in other contexts, we find that a loss-frame is more effective than a gain-frame. Specifically, we find that individuals are more responsive to a Visa gift card that they can activate by going to a health clinic than to the promise of an activated Visa gift card upon visiting the clinic, even though these are equivalent payment schemes. We then investigate why the loss framing seems to matter.

Opting in or missing out: Gain framing versus loss framing

Traditional economic theory predicts that people should respond similarly to small gains and small losses. However, under the behavioural predictions of prospect theory, individuals feel the pain of losses more than they feel the joy or utility of an equally valued gain (Kahneman and Tversky 1984). Loss-averse individuals value things over which they feel ownership more highly than things they do not. This idea of ownership can apply to physical objects like coffee mugs and pens (Kahneman et al. 1991), and it can be extended to situations when people adjust their reference points more abstractly, such as how recent income can affect job-search decisions (DellaVigna et al. 2017).

Recent studies in the health and educational literature find that loss-framed messaging (Ganzach and Karsahi 1995) and incentives (Volpp et al. 2008, Freyer et al. 2012, Hossain and List 2012, Levitt et al. 2016) tend to be more effective than gain-framed ones. For example, Fryer et al. (2012) test two ways of offering performance-for-pay bonuses to teachers. The more traditional way was offering an end-of-year bonus if students met predetermined performance targets. The loss-framed approach was to provide the bonus at the beginning of the year and then require that teachers pay it back if students fail to meet the target. This shift to loss-averse framing led to a substantial rise in student maths test scores without any other additional program inputs.

The most common explanation for the effectiveness of loss framing is prospect theory – loss-averse people are reluctant to give up something once they feel they have ownership over it. However, loss framing may also affect recipients’ perceptions of the likelihood that a particular offer is valid. In a world in which respondents do not fully trust that the incentive offer is legitimate or believe that the implementing organisation may not follow through, the loss-framed incentive may be valued more highly, or, in this context, lead to higher take-up. This alternative ‘one in the hand is worth two in the bush’ explanation based on trust rather than loss aversion is consistent with a fully rational (i.e. non-behavioural) approach to decision-making. Understanding whether loss-framing works because of loss aversion or trust can help us improve the cost-effectiveness of incentives and potentially increase overall benefits to the target population.

Loss-frames to promote preventive healthcare

We worked with the Arab Community Center for Economic and Social Services (ACCESS), a social services non-profit that serves low-income metropolitan Detroit residents regardless of ethnicity. Together with the organisation, we designed and implemented an experiment with 2,004 randomly selected households in nearby neighbourhoods. In 17% of the households in our sample, no adults had received any preventive care in the past year, suggesting that there are barriers to routine care. These findings are consistent with other research on preventive healthcare usage in the region (Perlstadt et al. 2015). The study intervention aimed to reduce the barriers to seeking preventive healthcare, which may include the cost of services, transportation and time.

We went door-to-door to recruit study participants. After completing a survey to collect demographic information along with measures of loss-aversion and trust, respondents were offered a US$50 incentive that they could redeem by visiting the clinic to receive a preventive healthcare service. We randomly varied whether the $50 incentive was offered using a loss-frame – as a Visa gift card with a value respondents would lose if they did not visit the clinic – or whether it was presented using a gain-frame – a reminder card that they could exchange for a voucher. The messaging and description of the card of each version emphasised the gain versus loss aspects of the card. Regardless of framing, the financial incentive was fundamentally the same: participants who visited the clinic were given an active $50 gift card to use there or elsewhere.

Loss aversion and trust explain the effectiveness of loss-frames

We find that loss framing resulted in a two-percentage-point higher probability of visiting the health clinic (30% versus 28%, p-value = 0.05 when including controls). Why do people respond more to the Visa gift card? We examine two possibilities: loss aversion and trust.

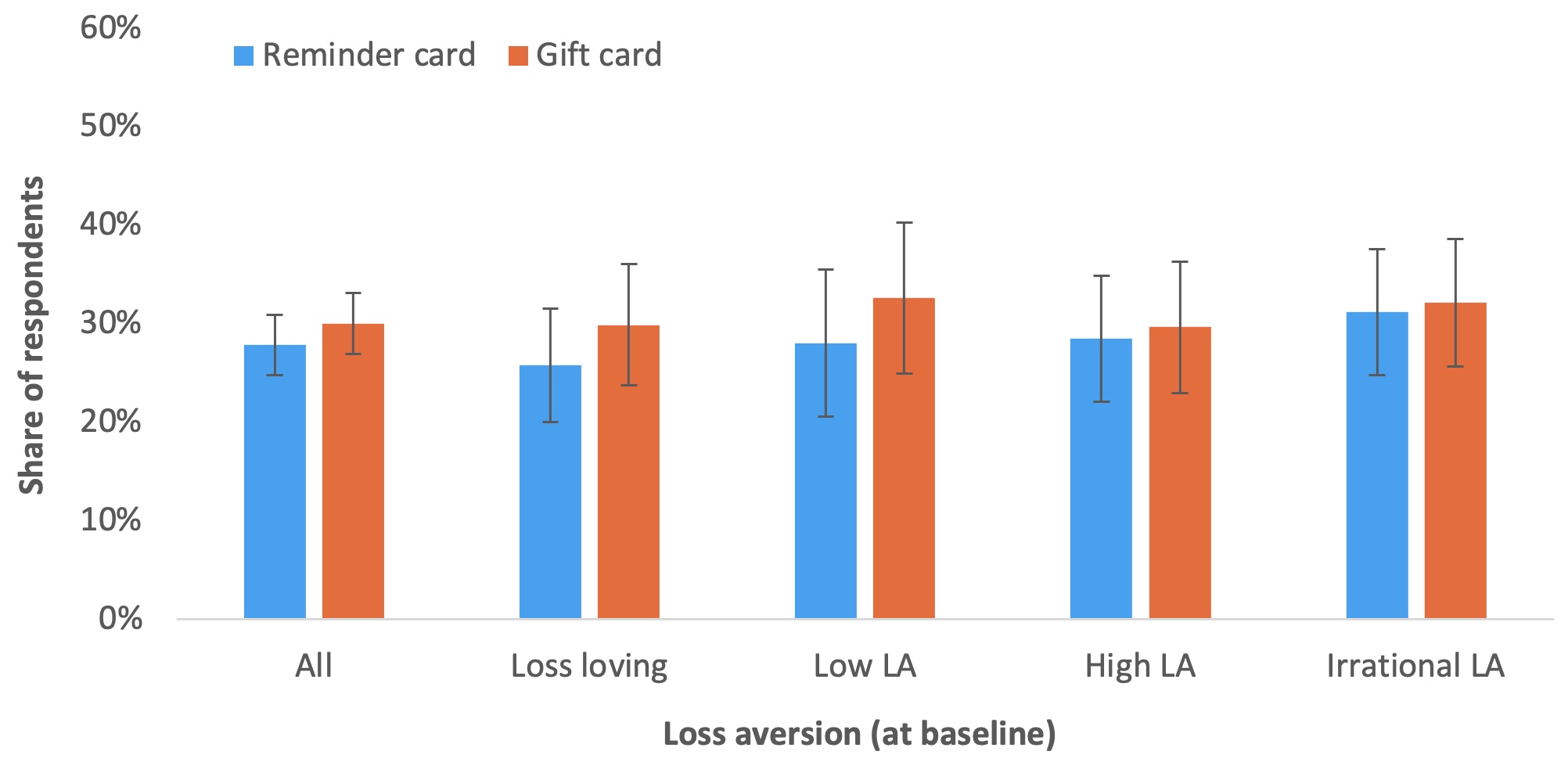

Prospect theory tells us it is because people don’t like losing things that they perceive themselves to already have. This pattern should be strongest for people who are loss-averse. Using a standard set of questions to measure loss aversion at the baseline, we examined whether the loss framing matters more for people we categorise as more loss-averse, but we find no evidence that is the case. As Figure 1 shows, we see no consistent pattern of responses between those with lower versus higher measured loss-aversion. If anything, those with lower measured loss aversion are more incentivised by the gift card loss-frame. In other words, the endowment effect driven by loss-aversion doesn’t seem to be operating in this context.

Figure 1 Loss-aversion does not affect response to the gift card

Note: The figure shows the main results for all respondents in the $50 treatments as well as sub-samples based on loss-aversion measures.

Loss framing can substitute trust in the implementing organisation

If not for prospect theory, why do we see more responsiveness to loss framing? It appears to be because of trust in the organisation and, by extension, the incentive. At the baseline, approximately 80% of the people we surveyed were familiar with ACCESS, and 43% had previously used ACCESS’s services. Slightly more than one-third of all respondents (36%) reported that they trust ACCESS, and only 5% did not trust ACCESS. The remainder were neutral (21%), did not know (17%), or had not heard of ACCESS (20%).

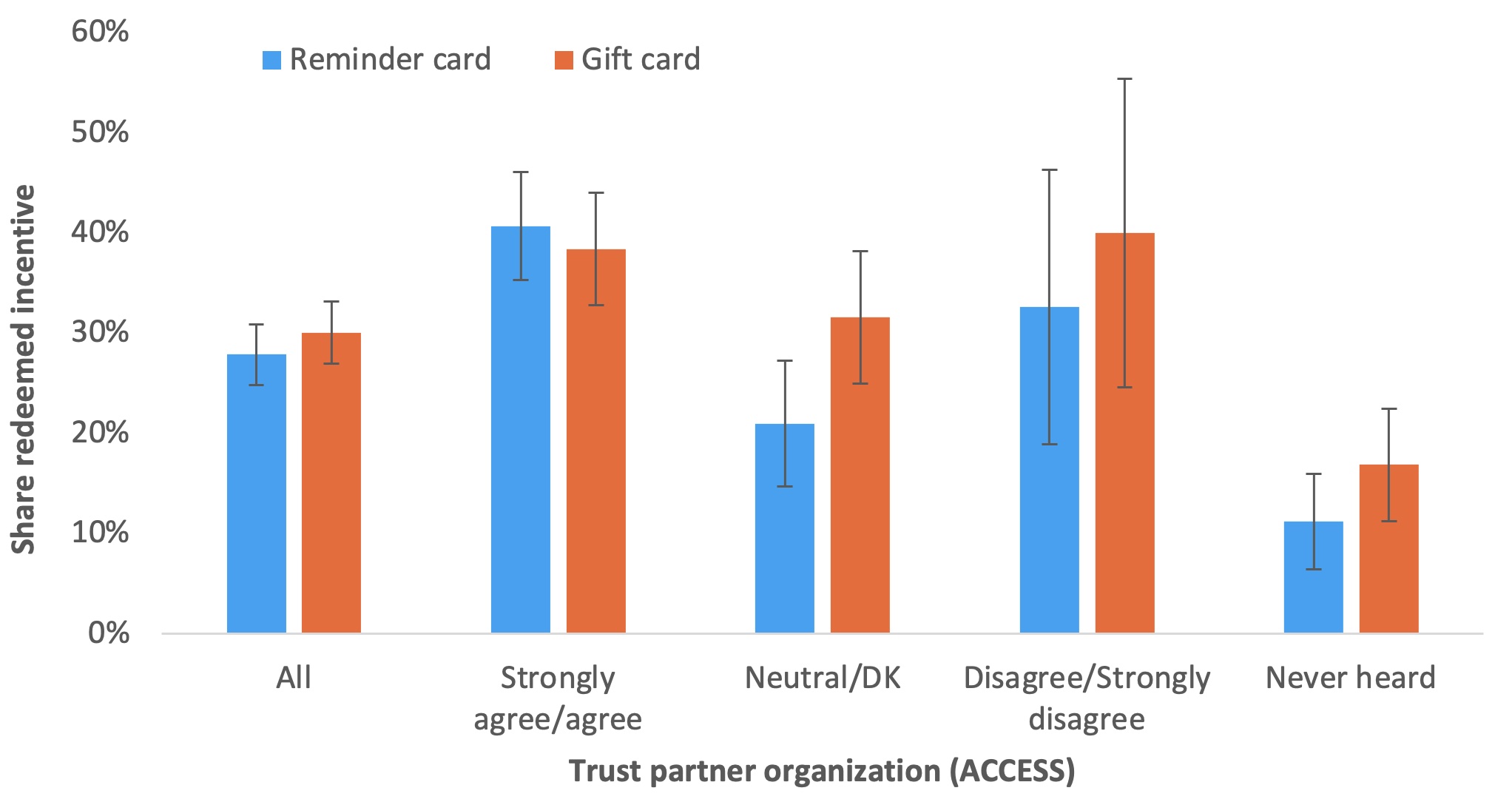

Looking across these groups, we see that it is those respondents with low baseline values of trust in the partner organisation who were responsive to the loss framing. As Figure 2 shows, this includes people who are either unfamiliar with the organisation or those who are familiar but report that they do not trust it. In contrast, those who are already familiar with and trust the partner organisation were more likely to use the incentive and were not more responsive to the gift card loss framing.

Figure 2 Gift card increases take-up for those without established trust of partner organisation (ACCESS)

Note: The figure shows the fraction redeeming the incentive for those receiving the reminder card and those receiving the Visa gift car by baseline responses to questions about whether they have heard of the organisation and if so, agree that the organisation can be trusted.

Takeaways

When governments or organisations offer a future payment or other incentives, they are implicitly relying on recipients’ perception that they will make good on that offer. Even in the absence of behavioural biases, recipients may rationally perceive a reduced probability of receiving the offer if they do follow through with the incentivised action. In the presence of uncertainty or distrust, the use of loss-frames may be a tool to increase the credibility of such offers, in turn increasing take-up. However, research shows that such products must be designed carefully: in a laboratory experiment, Hannan et al. (2005) find that participants will perceive ‘punishment’ contract as unfair, and in turn, reduce their effort. Financial incentives and negative messaging also reduced vaccination rates among some vaccine-hesitant sub-groups (Chang et al. 2021)

This result highlights that using loss-framed incentives – which typically resemble a metaphorical bird in the hand – can lead to recipients perceiving them as more trustworthy. This may be especially important in healthcare settings like ours, given recent research on high levels of mistrust towards medical systems (Blendon et al. 2014) and its associations with worse health outcomes (LaVeist et al. 2009, Alsan and Wannamaker 2018). Just as trust is an important general determinant of health behaviours, designing reward programs that increase trust in the incentive itself can increase take-up and enable policy to reach those who are most likely to be sceptical.

References

Alsan M and M Wanamaker (2018), “Tuskegee and the health of black men”, The Quarterly Journal of Economics 133(1): 407–455.

Beam E A, Y Masatlioglu, T Watson and D Yang (2022), “Loss aversion or lack of trust: why does loss framing work to encourage preventative health behaviors?”, NBER Working Paper No. W29828.

Blendon, R J, J M Benson and J O Hero (2014), “Public trust in physicians—US medicine in international perspective”, New England Journal of Medicine 371(17): 1570–1572.

Chang T, M Jacobson, M Shah, R Pramanik and S B Shah (2021),“Financial incentives and other nudges do not increase COVID-19 vaccinations among the vaccine hesitant”, NBER Working Paper No. W29403.

DellaVigna S, A Lindner, B Reizer and J F Schmieder (2017), “Reference-dependent job search: Evidence from Hungary”, The Quarterly Journal of Economics 132(4): 1969–2018.

Fryer R G, S D Levitt, J List and S Sadoff (2012), “Enhancing the efficacy of teacher incentives through loss aversion: A field experiment”, NBER Working Paper No. 18237.

Ganzach Y and N Karsahi (1995), “Message framing and buying behavior: A field experiment”, Journal of Business Research 32(1):11–17.

Hannan R L, V B Hoffman and D V Moser (2005), “Bonus versus penalty: does contract frame affect employee effort?”, Experimental Business Research, pp. 151–169.

Hossain T and J A List (2012), “The behavioralist visits the factory: Increasing productivity using simple framing manipulations”, Management Science 58: 2151–2167.

Jochelson K (2007), “Paying the patient: Improving health using financial incentives”, London: Kings Fund.

Kahneman D A and A Tversky (1984), "Choices, values, and frames", American Psychologist 39(4): 341–350.

Kahneman D, J L Knetsch and R H Thaler (1991), “Anomalies: The endowment effect, loss aversion, and status quo bias”, Journal of Economic Perspectives 5(1): 193–206.

Kane, R L, P E Johnson, R J Town and M Butler (2004), “A structured review of the effect of economic incentives on consumers’ preventive behavior”, American Journal of Preventive Medicine 27(4): 327–352.

LaVeist T A, L A Isaac and K P Williams (2009), “Mistrust of health care organizations is associated with underutilization of health services”, Health Services Research 44(6): 2093–2105.

Levitt S D, J A List, S Neckermann and S Sadoff (2016), “The behavioralist goes to school: Leveraging behavioral economics to improve educational performance”, American Economic Journal: Economic Policy 8(4): 183–219.

Madrian B C (2014), “Applying insights from behavioral economics to policy design”, Annual Review of Economics 6(1): 663–668.

Perlstadt H, M McNall, L Hembroff and K Lee (2015), “Healthcare Access and Insurance among Arab/Chaldean Americans in Michigan”, prepared for 7th International Conference on Health Issue in Arab Communities.

Sutherland K, J B Christianson and S Leatherman (2008), “Impact of targeted financial incentives on personal health behavior: A review of the literature”, Medical Care Research and Review 65(6): 36S–78S.

Volpp K G, L K John, A B Troxel, L Norton, J Fassbender and G Loewenstein (2008), “A randomized controlled trial of financial incentives for weight loss”, JAMA: The Journal of the American Medical Association 300(22): 2631.