The effect of illegal ‘resources’ on conflict depends on the country context, group competition, and the government’s capacity to enforce laws

The resource curse refers to a situation in which even though countries are endowed with an abundance of resources, they lag behind in development. One important reason for this is that resources are often linked to a higher probability of conflict (Bazzi and Blattman 2014, Berman et al. 2017). Some resources like specific minerals, mahogany, cocaine and opium, which are often illegally extracted, produced and traded, are particularly important for understanding ongoing conflicts in the often-poor producing countries. In Mexico alone, for example, estimates suggest that drug-related violence has caused 150,000 intentional homicides since 2006.1 While producer countries like Colombia, Mexico and Afghanistan share some common features, the degree to which laws are enforced and the extent of group competition over resource control are decisive in determining the net effect of illegal resources on conflict.

Opportunity costs versus contest effects

The literature on the economics of conflict describes two main mechanisms that link resource-related income shocks – caused by changing prices or new discoveries – to conflict:

- According to the opportunity costs effect, conflict becomes less desirable if there are better outside options (Grossman 1991).

- The contest model (Collier and Hoeffler 2004, Hirshleifer 1995), in contrast, posits that when resources become more profitable, group contests over resource control intensify and conflict increases.

Theoretical framework: The role of law enforcement and group competition

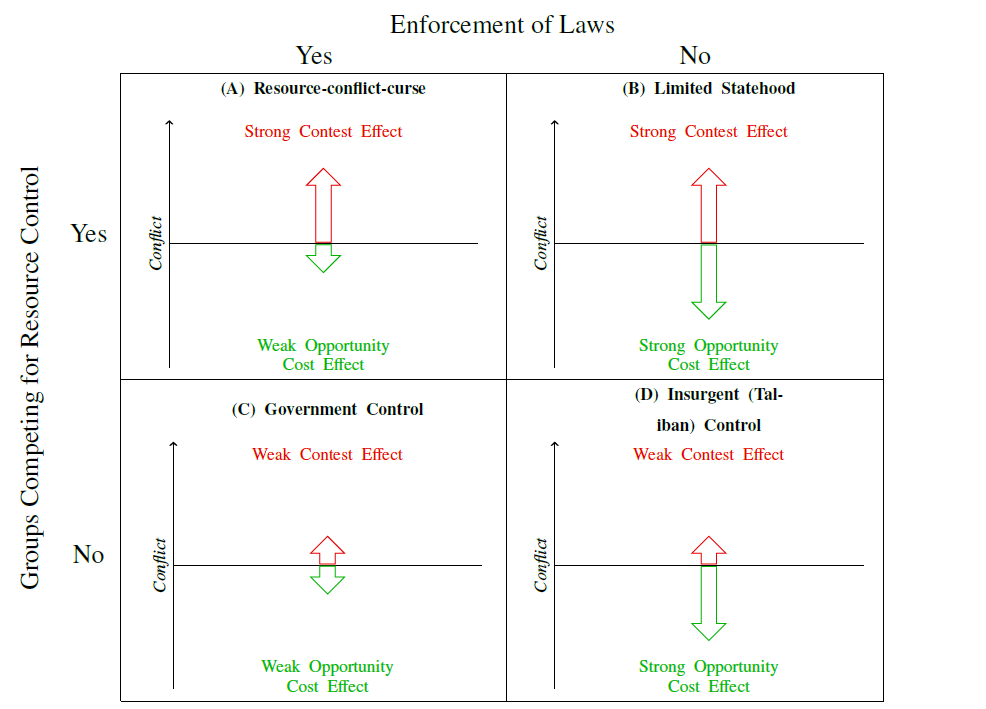

Based on these two main mechanisms (opportunity cost versus contest effects), we develop a new theoretical framework in Gehring et al. (2020) that helps explain the effect of illegal resources on conflict. We distinguish four different scenarios that differ along two dimensions: whether laws regarding the illegal production and trading of resources are enforced and the degree to which groups fight for resource control. We argue and show empirically that these distinctions are crucial.

Consider the production of an officially illegal drug. In many developing countries, the government’s capacity to enforce bans on the production is limited to selected areas. If laws are enforced – for instance through eradication campaigns against drug production – producers only profit a little or not at all from higher drug prices. Hence, the conflict-reducing opportunity cost effects are small. In contrast, if there is no enforcement, de jure illegality matters little, producers benefit from higher prices, and strong opportunity cost effects help reduce conflict.

The extent of contest effects depends on the degree of competition amongst different groups that are competing for control over lucrative production grounds. In many areas in Mexico or Columbia, for instance, several drug cartels are – often violently – fighting for control. Higher prices, meaning more profits, set an incentive for more fighting. In contrast, if one non-state or insurgent group controls an area, there is no reason to expect more fighting due to higher prices.

Figure 1 Scenarios for illegal resources

The first scenario, which we call the resource-conflict curse, seems to reflect the relationship between drugs and conflict in many regions in Mexico and Colombia rather well. In line with this, two existing studies suggest that higher prices of cocaine are indeed linked to more conflict in Colombia (Angrist and Kugler 2008, Mejía and Restrepo 2015). Our own study considers a different country, Afghanistan, and uses our framework to explain that higher drug prices do not necessarily lead to more conflict.

Opium and conflict in Afghanistan

Since 2002, more than 100,000 people have died as a consequence of the ongoing conflict in Afghanistan. The lack of stability and limited state capacity have detrimental effects on development. Most people work in the informal sector with opium being one of the few booming sectors. Estimates suggest that up to 1/7th of the workforce depends on the production of this illegal crop. The main alternative crop that can be feasibly produced across Afghanistan is wheat. If neither opium nor wheat are profitable enough, an alternative source of income is to work for pro-government forces or the Taliban, who are reported to pay a wage of about US$10 a day.

Simply put, if the opium price decreases relative to the wheat price, landowners switch from opium to wheat production. Since the production of opium is about four times as labour-intensive as wheat, labour demand would decrease. In such a situation, risky options like supporting the Taliban, – either in the form of fighting or by providing shelter, become more lucrative – this is the opportunity cost channel. At the same time, depending on the degree of group competition, higher prices coincide with more intense fighting over control of districts that are well-suited to produce opium – this is the contest channel.

Causal identification

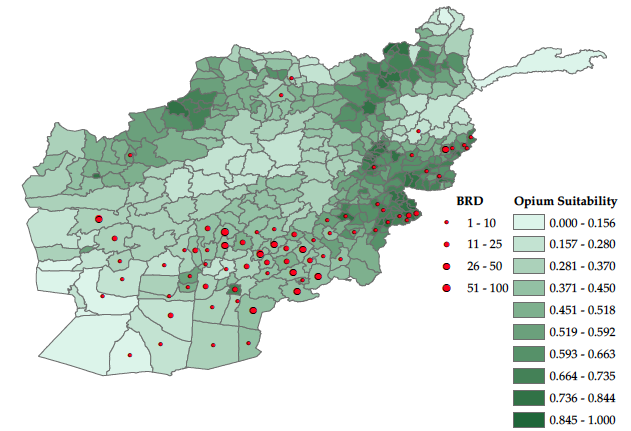

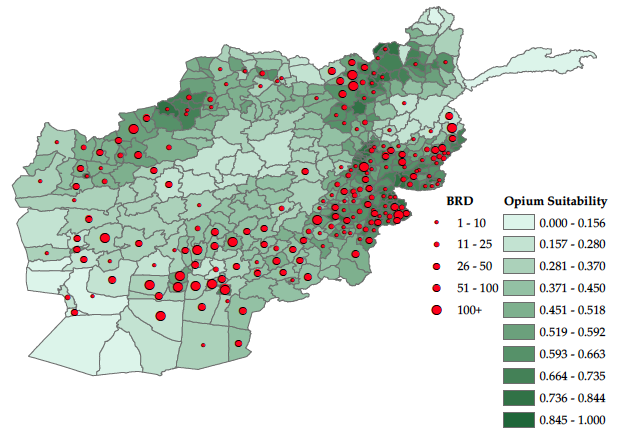

To identify the causal effect of opium prices on conflict, we combined temporal variation in international drug prices with spatial variation in the suitability to grow opium across districts over the 2002-2014 period. We exploited the fact that drug prices have a greater effect on districts that are more suitable for growing opium. To capture this, we interact the international price for opium (heroin) with a suitability index developed by Kienberger et al. (2016). Our approach can be illustrated using two maps that depict the regional variation in conflict in two different years.

Figure 2 Opium suitability, opium prices and changes in conflict intensity

a) Conflict in 2004: High opium prices

b) Conflict in 2009: Low opium prices

Figure 2 plots each district’s extent of conflict along with its suitability to grow opium. Districts in darker green have a higher suitability. We therefore expect a stronger effect of price changes in these regions. The red dots depict the conflict intensity. The larger the dot, the higher the number of battle-related deaths in a district and year. Comparing a year with high prices on the left to a year with lower prices on the right suggests two things:

- Lower prices seem to be related to more conflict. However, this could be due to many other factors that differ between those two years.

- The increase in conflict due to lower prices was stronger in the districts with a higher suitability in the Northwest, the Northeast, and the East.

Key finding: Higher opium prices increase household living standards and reduce conflict

The results from our main empirical analysis are in line with the graphical evidence from the two maps. They consistently show that a higher opium profitability leads to a reduction in conflict in Afghanistan, which corresponds to the actual conflict trends in Afghanistan over the 2002-2014 period. This effect is sizeable: in a district with the highest possible suitability, a 10% increase in opium prices would reduce the number of conflict-deaths by about 6.75%. We used data at the province-level to verify that higher opium revenues do not, on average, spill over and fuel conflict in other districts.

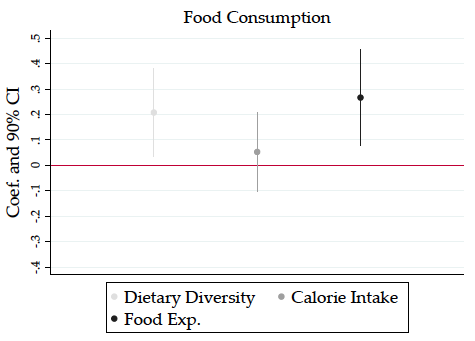

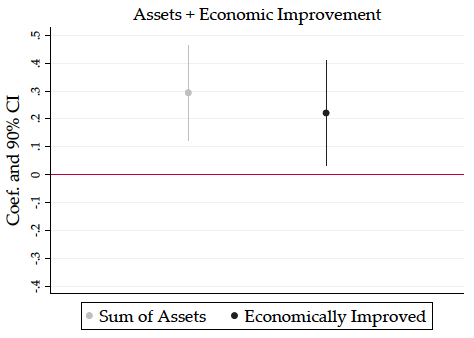

- The first explanation of our main finding is that a households’ living standard increases when opium prices go up. The figure below, based on the National Risk and Vulnerability Assessment household survey, shows that food consumption, assets, as well as self-assessed economic well-being increase with higher prices.

Figure 3 Empirical test of opportunity cost channel at household level

a) Food consumption

b) Assets + Economic improvement

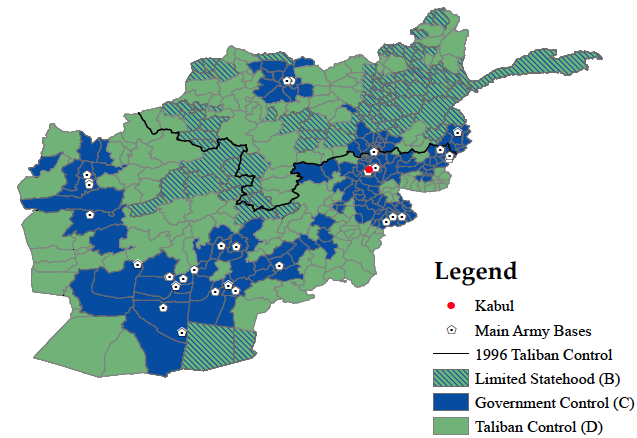

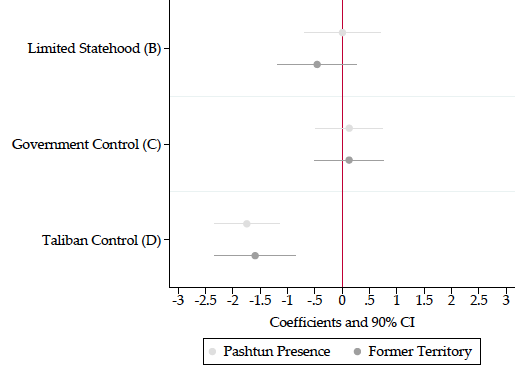

- In a second step, we empirically tested the predictions from our model. To do so, we focused on scenarios B, C, and D (in Figure 1), given that scenario A does not reflect the Afghan context well. Using georeferenced data on the drug production network, and Taliban versus pro-government control, highlights the importance of opportunity cost effects, and reveals heterogeneous effects in line with our theory. We categorised all 398 districts of Afghanistan according to the scenarios in Figure 1. In line with our predictions, the strongest conflict-reducing effect is found in scenario D, where there is no law enforcement and only one group (the Taliban) is likely to control production.

Figure 4 Empirical test of scenarios B, C and D from Figure 1

a) Scenarios B, C and D across districts

b) Marginal effect of opium profitability

Policy implications

Our results highlight that the effect of illegal ‘resources’ on conflict depends on the country context. In particular, group competition and the government’s capacity to enforce bans on the production matter. In an environment with weak labour markets and few outside opportunities, enforcement through eradication measures is unlikely to lead to the desired outcomes, and potentially leads to more conflict or a strengthening of insurgent groups.

Editors’ note: We would like to encourage the readers to read columns on the rise of violent crimes in Mexico and the effect of exposure to illegal markets on the life of children alongside this column.

References

Angrist, J D and A D Kugler (2008), “Rural windfall or a new resource vurse? Coca, income, and civil conflict in Colombia”, The Review of Economics and Statistics 90(2): 191–215.

Bazzi, S and C Blattman (2014), “Economic shocks and conflict: Evidence from commodity prices”, American Economic Journal: Macroeconomics 6(4): 1–38.

Berman, N, M Couttenier, D Rohner and M Thoenig (2017), “This mine is mine! How minerals fuel conflicts in Africa”, American Economic Review 107(6): 1564–1610.

Collier, P and A Hoeffler (2004), “Greed and grievance in civil war", Oxford Economic Papers 56(4): 563–595.

Gehring, K, S. Langlotz and S Kienberger (2020), “Stimulant or depressant? Resource-related income shocks and conflict", CRC-PEG Discussion Paper No. 269.

Grossman, H I (1991), “A general equilibrium model of insurrections”, American Economic Review 81(4): 912–921.

Mejía, Daniel, & Restrepo, Pascual. 2015. Bushes and Bullets: Illegal Cocaine Markets and Violence in Colombia. Documento CEDE Working Paper No. 2013-53.

Endnotes

1 See https://edition.cnn.com/2013/09/02/world/americas/mexico-drug-war-fast-facts/index.html (last accessed 04/21/2020).