Barriers to entry facing new firms are a major source of regional economic differences. Removing these barriers can play an important role in economic convergence and growth.

New firms can be an important source of aggregate economic growth (Decker et al. 2014, Syverson 2011). Less understood is their role in explaining gaps in regional economic development, and the source of differences in new firm creations. In recent research (Brandt, Kambourov and Storesletten 2024), we combine firm-level data from China’s Industrial Census with a model to quantify the role of three distortions to new firm entry that can differ across regions: capital market frictions, output market frictions, and a novel entry barrier, which reflects the probability that a potential entrepreneur will be allowed to operate a firm.

Regional differences in China’s non-state sector

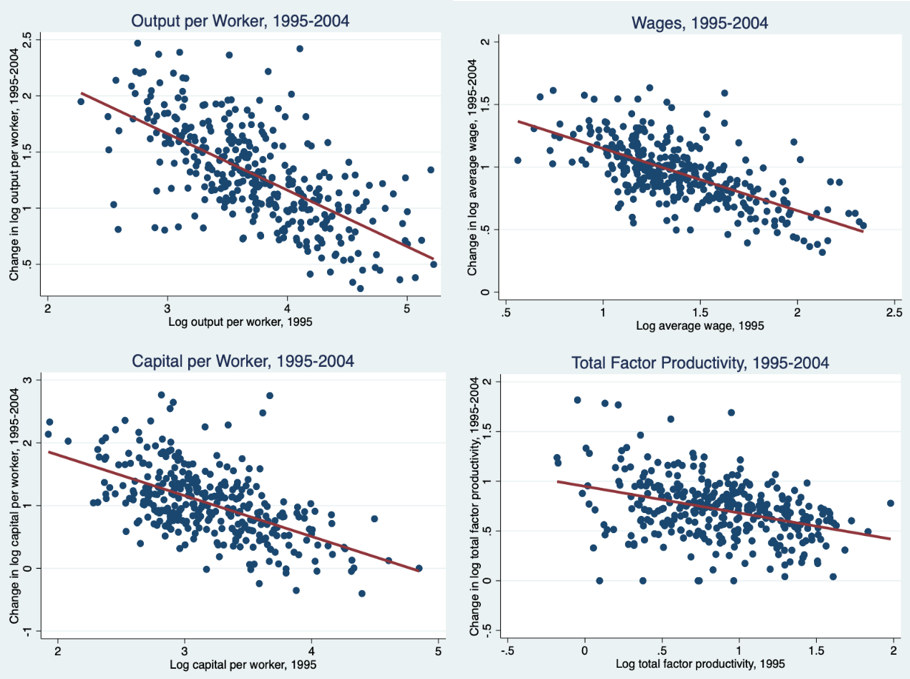

The rapid expansion of the non-state sector has been the major source of China’s economic success (Zhu 2012). This growth has been highly uneven with significant differences across regions and localities. By the mid-1990s, this was reflected in sizeable differences between China’s prefectures in productivity, wages, and the number and size of non-state enterprises or NSOEs in manufacturing (see Figure 1). Subsequently, differences between localities in the non-state manufacturing sector began to disappear and from the mid-1990s through the late 2000s, China experienced a remarkably rapid economic convergence between localities, not only in value added per worker in non-state firms, but also in total factor productivity (TFP), capital per worker, and wage rates. In the case of wages, for example, the estimated slope of the red line in Figure 1 implies that it took nine years to reduce by half the average wage differences between two prefectures.

Figure 1: Convergence in the Non-state Sector, 1995-2004

Notes: Each dot represents a prefecture, and the solid red line is the fitted regression line.

A framework

We examine the initial dispersion and subsequent convergence in the performance of the non-state sector through the lens of a macroeconomic model where the distribution and selection of firms matter for productive efficiency. We use this framework to determine which factors drove the initial dispersion across locations and the subsequent convergence. The theoretical framework is motivated by the empirical observation that the creation and selection of new firms in China’s non-state sector have been the most important source of productivity and output growth in the manufacturing sector (Brandt et al. 2012).

Several factors might be responsible for differences in new firm creation and growth, including human capital differences and distortions, taxes, and subsidies imposed by local governments. To quantify the role of these channels we construct a model (based on Hopenhayn 1992), extended to include three types of market failures namely capital and output wedges and a barrier to entry. These wedges or frictions reflect the extent to which marginal products are not equalised across producers.

Measurement

By aggregating firm-level data from the Chinese Industrial Census (CIC) for 1995, 2004, and 2008, we construct data on value added, employment, capital, and average wage rates for each prefecture.

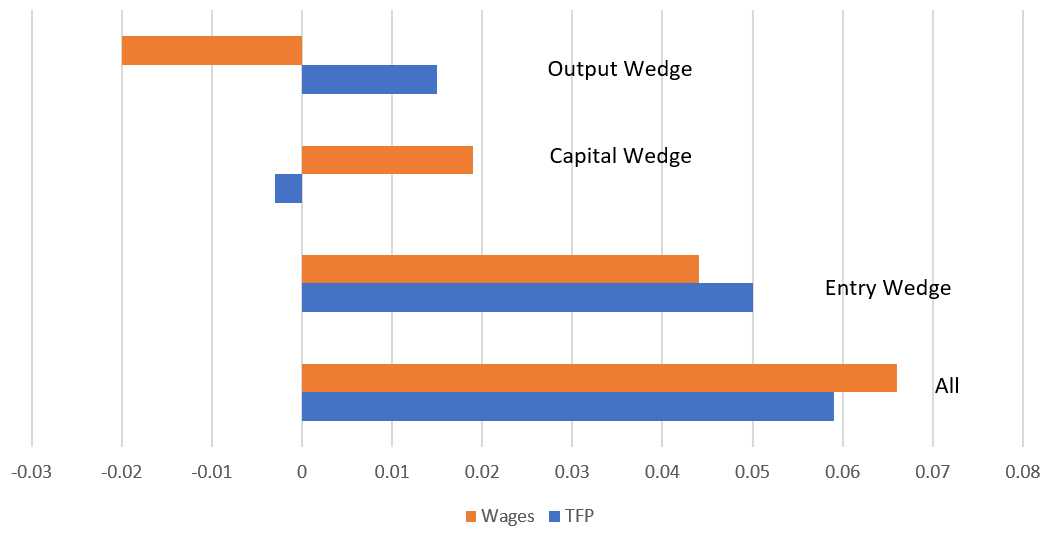

By bringing our framework to this data, we can explore what frictions are most important for accounting for the aggregate differences and convergence across prefectures in China. We find that the entry barrier is the main driver of both the initial (1995) dispersion and the subsequent convergence in wages and TFP across locations in China, which is shown in Figure 2. The importance of barriers for limiting entrepreneurship and the creation of new firms is in line with results found in European countries (Klepper et al. 2006). The influence of capital or output market distortions, which in the Chinese context have also been identified as important (Hsieh and Klenow 2009, Song et al. 2011), seems to be secondary for explaining the regional convergence of the non-state sectors in China. Overall, we find that the reduction in the entry barrier explains 15% of the growth in TFP, and 35% of the growth in wages between 1995-2008.

Figure 2: Annual Rate of Convergence, 1995-2008

Notes: The figure illustrates the contribution of entry barriers and output and capital wedges to the regional convergence in wages and TFP between 1995-2008. We exclude from the figure several other factors, including the regional labor share, the share of the NSOE sector, and the relative supply of workers and entrepreneurs, which have negligible effects.

External validation of the entry barrier

Given the importance of entry barriers in accounting for regional convergence, we show that these theoretical distortions can be tied to real-world evidence on distortions. Our measured entry barriers match up closely with measures of the formal costs of starting a business in China reported in the World Bank (2008) “Doing Business in China 2008” report for provincial capitals in China. We can also tie aggregate wage growth directly to entry barriers: lower entry barriers should be associated with more firm entry, higher selection, lower firm age and higher wages. We document that higher regional wage growth is indeed associated with significantly lower firm age and more firm entry. Note that other drivers of wages besides entry barriers such as agglomeration, general TFP shifts, and capital and output wedges, should affect incumbents and entrants equally and should therefore not have any effect on the age distribution of firms and firm entry. This external evidence provides validation both for our estimates of the entry barriers and for the main mechanism of our paper, i.e. that regional growth is driven by entry barriers and selection.

Entry barriers and the size of the state sector

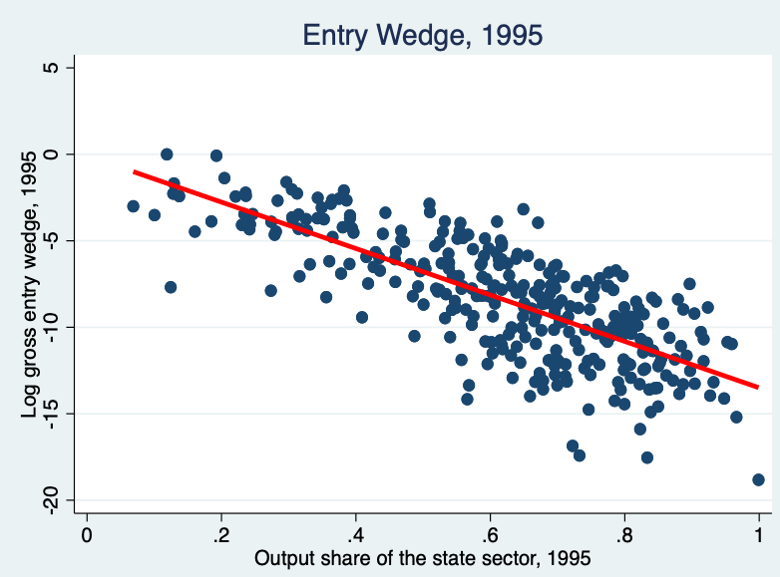

We link the size of these entry barriers and their changes to the size of China’s state-owned enterprise (SOE) sector. In the mid-1990s, SOEs were the source of more than half of industrial output, but there were significant differences between localities. Figure 3 shows the relationship between the entry wedges, which reflect the probability that an entrepreneur will be able to operate a firm, and the size of the state in the mid-1990s: probabilities of operating a firm were sizably smaller in localities with a larger SOE presence, demonstrating that entry barriers were sizably larger in these places.

In almost every dimension – the rate of start-up of new firms, size of firms, TFP, and wages – we find that new NSOE firms are weaker where SOEs are more dominant. However, after the mid-1990s, fortunes turned to the better for prefectures which originally had a large state sector: on average, output per worker, TFP, wages, and capital per worker in non-state firms grew faster in these prefectures than elsewhere. This process is related to the fact that these same locations experienced large reductions in entry barriers because of a downsizing of the state sector and large reductions in state employment as part of China’s “Grab the Big, Let Go of the Small” policy for the state sector.

Figure 3: Barriers to entry and the size of the state sector

Our results on the effect of the state sector on new firm entry are robust to potential concerns about endogeneity, omitted variables, and measurement error. Using a Bartik (1991) instrumental variable approach, we examine the impacts of a major policy change in 1997, when the Chinese government allowed SOEs to be crowded out by non-state firms in some but not all industrial sectors. We find that the 1995-2004 reduction in SOE employment is systematically related to the reduction in entry barriers: larger predicted declines in SOE employment are associated with larger reductions in entry barriers.

A political economy story

To motivate the empirical link between observed entry barriers and the size of the SOE sector,

we develop a simple political economy model of local governments’ incentives to influence the three wedges. Local officials, e.g. party secretaries and mayors, are appointed by higher levels of government and are tasked with multiple objectives. Much of the focus in previous research is on growth. In our model, local authorities face pressure to protect state-owned firms who are important to higher levels of government and the Chinese Communist Party. Since nonstate firms compete with SOEs in product markets and for scarce resources, including managers and workers, local governments use the three wedges to distort NSOEs’ behavior to help SOEs. If local cadres care about the profits of local entrepreneurs - a potential source of rents - then restricting NSOE entry provides the best trade-off between ensuring that SOEs remain sufficiently competitive and supporting the NSOE profits.

Policy implications for regional economic growth

Our findings have clear policy implications. Barriers to starting new firms can be an important source of regional economic differences. Levelling the playing field between firms in lagging regions will lead to more and better entrants. These forces can help narrow the economic gap between regions and be an important source of productivity growth in the aggregate.

References

Bartik, T. (1991), "Who Benefits from State and Local Economic Development Policies", Technical Report, W.E. Upjohn Institute.

Brandt, L., G. Kambourov, and K. Storesletten (2024), "Barriers to Entry and Regional Economic Growth in China".

Brandt, L., J. Van Biesebroeck, and Y. Zhang (2012), "Creative Accounting or Creative Destruction? Firm-level Productivity Growth in Chinese Manufacturing", Journal of Development Economics, 97: 339-51.

Decker, R., J. Haltiwanger, R. Jarmin, and J. Miranda (2014), "The Role of Entrepreneurship in US Job Creation and Economic Dynamism", Journal of Economic Perspectives, 28: 3-24.

Hsieh, C.-T. and P.J. Klenow (2009), "Misallocation and Manufacturing TFP in China and India", Quarterly Journal of Economics, 124: 1403-1448.

Klapper, L., L. Laeven, and R. Rajan (2006), "Entry regulation as a barrier to entrepreneurship", Journal of Financial Economics: 591-629.

Song, Z., K. Storesletten, and F. Zilibotti (2011), "Growing Like China", American Economic Review, 101: 202-241.

Syverson, C. (2011), "What Determines Productivity", Journal of Economic Literature, 49: 326-365.

Zhu, X. (2012), "Understanding China’s Growth: Past, Present, and Future", Journal of Economic Perspectives, 26: 103-124.