Members of the 'Network of Chief Economists of Development Agencies and Finance Institutes' explore how we can unlock progress on the big issues for global development in 2025.

The outlook for the global economy and development is troubling for 2025. However, there is scope for optimism if the international development community plays its part by backing the right evidence-based policies for better lives. We see three ways forward:

1. Make inclusive and sustainable growth a top global priority

As we see it, there are ways forward on three main challenges.

Global economic growth will be subdued at around 3% in the medium term (World Bank 2024 and OECD 2024). Currently, Asia leads global growth at 5% (Asian Development Bank (ADB) 2024), Europe faces risks from deglobalisation and regionalisation, while most countries are grappling with high debt and sticky core inflation. Stalled economic reforms in Middle-Income Countries (MICs) are slowing their progress and demographic pressures and weak state capacity are hindering structural reforms for higher and inclusive growth in sub-Saharan Africa.

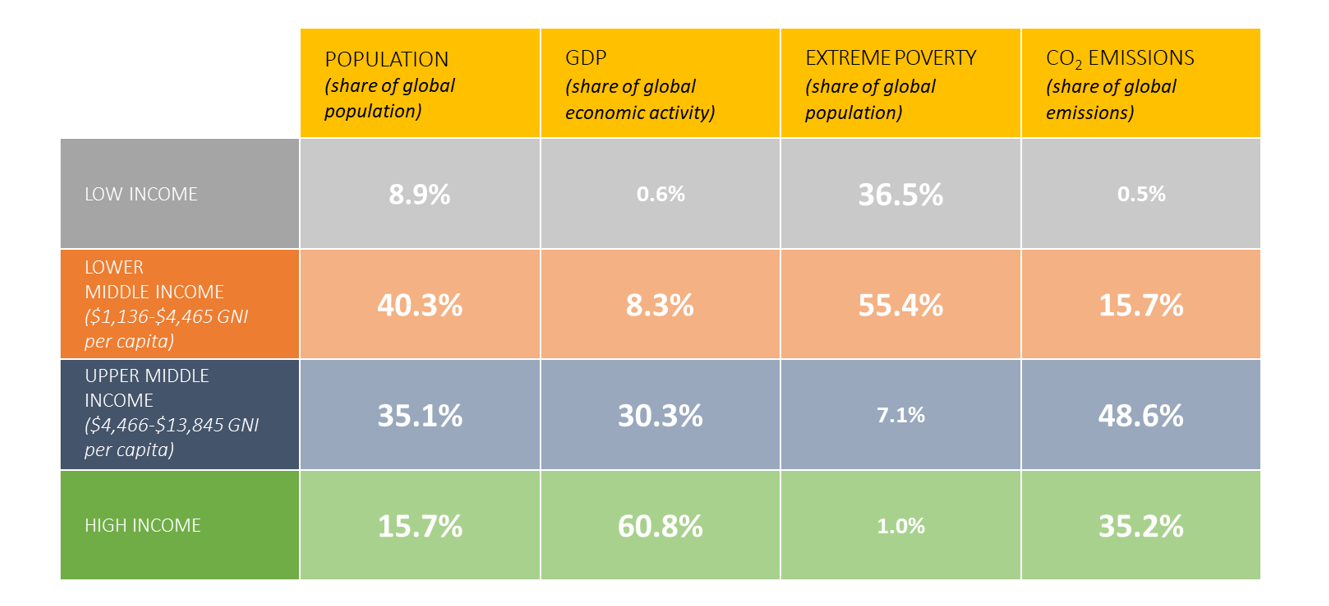

- Our recommendation: Policy responses need to be tailored to regional economic prospects and conditions (see Table 1). In low-income countries – where needs for concessional finance are greatest - this means boosting productivity and competitiveness, job creation that pivots toward labour-intensive services and involves entering global value chains and investing in state capabilities on economic fundamentals, and climate compatible economic transformation.

Trade protectionism by G20 countries will undermine growth prospects in Low Income Countries (LICs) and non-G20 MICs. Rising tariffs will worsen growth prospects everywhere and lead to higher interest rates. At the same time, while industrial policies with green objectives are becoming more common, most industrial policies are protectionist in practice. Their track record has been mixed, especially when domestic companies cannot compete abroad.

- Our recommendation: Open trade remains the best path forward for the global economy and global governance reform should turn to enabling more predictable trade through a stronger World Trade Organisation.

Extreme weather events will continue to deplete resilience in LICs. Differing approaches to climate adaptation and the lack of clarity on the nexus with building resilience will impact LICs’ acutely. In addition, capacity to build resilience is constrained by lower per capita income growth over the past five years. The economic and social risks of declining natural capital are rising.

- Our recommendation: Climate and development strategies should be integrated; fiscal and monetary policies must start factoring in the value of natural assets; and resilience must be built primarily through income generation.

Table 1: Global economic prospects at different incomes levels as of 2024

Source: World Bank 2024

2. Set realistic and achievable finance ambitions at FFD4 (The 4th International Conference on Financing for Development) in June 2025

The challenges and ways forward:

Finance gaps continue to widen. Increasingly, global fiscal constraints, shifting political interests and reduced public support for development aid, are polarising resource allocation debates. At the same time, LICs need to increase investment in human and social capital - current spending levels remain far below what is required for meaningful gains. Climate and development finance will dominate international policy agendas in 2025. Smart ways forward on finance will address issues with private finance, climate adaptation and debt management.

The “promise” of private finance mobilisation did not materialise. This has been the most underwhelming aspect of finance for development. For the most part, equity, foreign direct investment and blended finance is not going to LICs or sub-Saharan Africa (OECD 2024 Finance for Development FFD factsheets). Yet more official donors are pivoting to private mobilisation further fragmenting the finance system.

Our recommendation: Strategies guiding public and private financial instruments should be more realistic and transparent about their relative potential for delivering the greatest economic and social returns. They must be supported by the right data and measures, theories of change, and capacity to adapt to different contexts. Public actors should best use their resources by building better enabling environments for investment, passing efficient regulations, clarifying the role of public finance in the equation (beyond public debt), and leveraging private finance.

The case for climate adaptation has not been unequivocally made. A stronger case for investing in climate adaptation is needed. ADB research shows a projected 17% GDP loss in Asia by 2070 if current climate policies remain unchanged.1 The data shows that carbon credit markets are advancing through government, multilateral and market-led initiatives, though quality control remains an issue.

Our recommendation: A "triple dividends" approach—linking avoided losses with social and economic benefits—can help bolster the case, emphasising the importance of innovation and prioritising finance for climate adaptation based on its long-term benefits. Tiered carbon pricing could be a useful strategy to internalise the environmental costs of depletion of natural capital.

The debt crisis is becoming a systemic issue. LICs will need USD 440 billion in additional financing for the period 2022-26 to rebuild buffers and accelerate income convergence2. 24, out of 68, LICs are at high risk of external debt distress and 11 are in debt distress3.

Our recommendation: Reform to the Common Framework on debt is crucial. Dialogue with countries in debt distress should be candid about getting macroeconomic fundamentals right. Greater creditor transparency is also essential. Initiatives like the GEMS database holds great promise for providing information on private and sub-sovereign performance. Development partners can respond better by building national capacity for debt management and tax administration and maximising access to concessional and affordable financing.

3. Get higher development impact and returns from investments

Ways forward for more cost-effectiveness and innovation.

Development programmes need to be more cost-effective. There remains an ongoing question as to whether we are doing the right things, at the right time, and in the right way. This is the challenging question development co-operation policy makers and practitioners must answer daily and show to taxpayers and partners. If we are serious about unlocking progress, then designing the most cost-effective programmes must be central to every decision.

Our recommendation: Measuring impact per dollar is critical, whether at the direct service provision level or the systems level. Impact and its measurement need to be incentivised and guided by consistent and driving forces within our institutions. Immediate and long-term effects must also be considered — as outlined in USAID’s Position Paper on Cost Effectiveness. We learnt that Development Finance Institutes often address tensions between impact metrics and business objectives by categorising impacts into frameworks.

Constraints to innovation remain. Innovation remains hindered by low-risk appetites, complex and slow approval processes, and the tendency in development agencies to stay within our comfort zones, even when evidence, funding, and partner government support are secured for new initiatives.

Our recommendation: Closer collaboration on rigorous evidence, cost-effectiveness analysis and more strategic communication on the cost of inaction and returns on investment is essential. There should be more investment in public goods, like the still-being-built IDEAL (Impact Data and Evidence Aggregation Library), which standardises evidence from over 15,000 randomized control trials (RCTs). These are resources that can help bridge evidence gaps and streamline decision-making.

When smart policies and finance are informed by rigorous research, evidence, and data that challenge assumptions and enable innovation, they will unlock progress on the big issues for global development.

Note about the authors

We are Chief Economists, research and economic policy directors – and members of the Network of Chief Economists of Development Agencies and Finance Institutes, which had its annual meeting under Chatham House rules at UK FCDO in November 2024. Here are links to the meeting agenda, summary and presentations by participants. This note represents the personal views of the authors.

Footnotes

[1] ADB (2024) https://www.adb.org/news/adb-says-climate-change-could-reduce-gdp-developing-asia-and-pacific-17-2070