The majority of Bangladeshi migrants take on significant financial burdens to cover migration costs, but can enjoy high returns. Many returning migrants become small-scale entrepreneurs, using money saved while working abroad.

Editor's note: This article originally appeared on VoxEU.

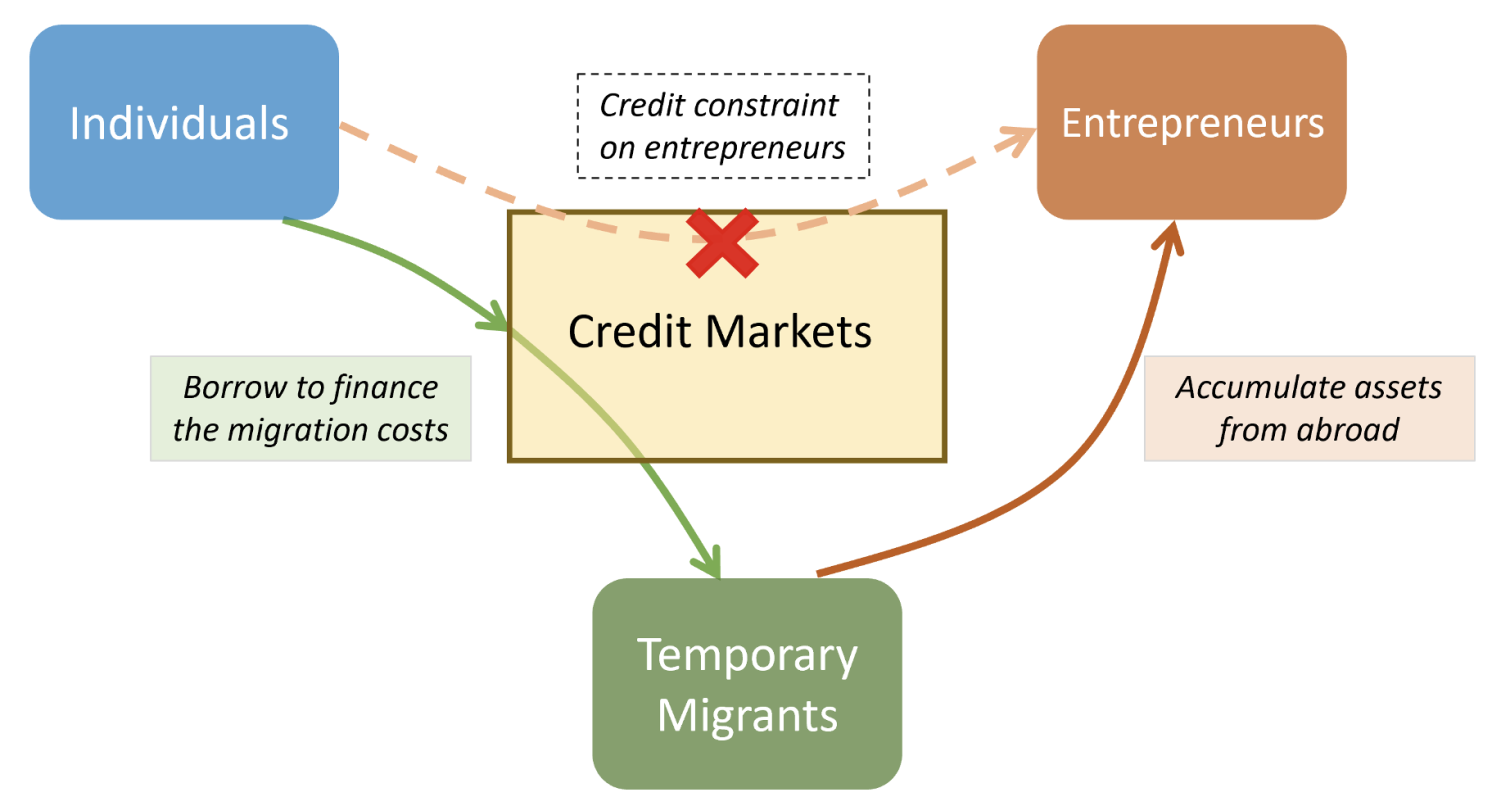

Entrepreneurs’ access to capital is a major policy concern in poorer countries seeking to expand employment and generate growth. In the context of South and Southeast Asian countries, such capital constraints are a key reason why large numbers of lower-skilled workers embark on costly and risky journeys to higher income countries (McCormick and Wahba 2001, Dustmann and Kirchkamp 2002). These migration episodes serve as stepping stones for those facing credit constraints – they go abroad so they can raise the money to start small businesses when they return home (Figure 1).

Figure 1: Missing capital markets, temporary migration and entrepreneurship

New data documents this phenomenon for workers migrating from Bangladesh to richer countries. These migrants, often employed in construction and services in countries of the Arabian Peninsula, take on significant financial burdens to cover migration costs. As we show in a recent paper (Bossavie et al. 2024), this form of migration is costly and risky, but promises high returns, which often is used as capital for self-employment. Therefore, temporary migration is an essential factor for policymakers in origin countries to consider when designing their policy interventions to boost entrepreneurship.

For our study we collected a large dataset, representative of migrants that recently returned to rural and semi-urban areas in Bangladesh after working abroad. Bangladesh is one of the main countries of origin of international migrants, with an estimated 7.8 million Bangladeshis working abroad. International migration from Bangladesh is largely low-skilled, with men representing about 95% of migrants. The picture is similar for many other major migrant-sending countries, such as India, the Philippines, Egypt, Pakistan or Nepal.

Regulations in the Arabian Peninsula foresee no path to permanent residence, let alone citizenship. It thus makes immigration temporary by construction, a very different context to examine than for instance migration to Europe or North America (e.g. Jones 2019). These regulations also prohibit low-skilled workers from countries in South and Southeast Asia to migrate without a valid employment contract. As a result, migrants must be matched to an employer overseas prior to departure. This matching is facilitated by agencies and informal intermediaries that charge high upfront costs: the data shows that the median total cost of migration equals approximately three years of earnings of a wage worker in Bangladesh, or more than two years of household income. Hence, migrants often take up large loans to cover these costs, in the hope to earn higher incomes abroad.

Despite formal work arrangements, migrants also face many risks, such as harsh working conditions or that wages paid are lower than expected. In addition, migrants face the very real risk of being forced to return home if they lose their job, as stay at destination is strictly tied to an employment contract. Any of these factors can result in net losses from the migration experience given the very high upfront costs. This form of migration is costly and risky, but promises high returns if successful, thus having all the characteristics of an investment.

Modelling migration as an investment

As part of our empirical analysis, we provide a detailed account of the actual financial costs and benefits of migration, and show how international temporary migration can be analysed as a risky entrepreneurial investment. We calculate monetary rates of return to this investment, accounting for the opportunity cost of migration in terms of forgone expected domestic earnings, as well as additional economic gains when foreign savings are invested in business creation after having returned to the home country.

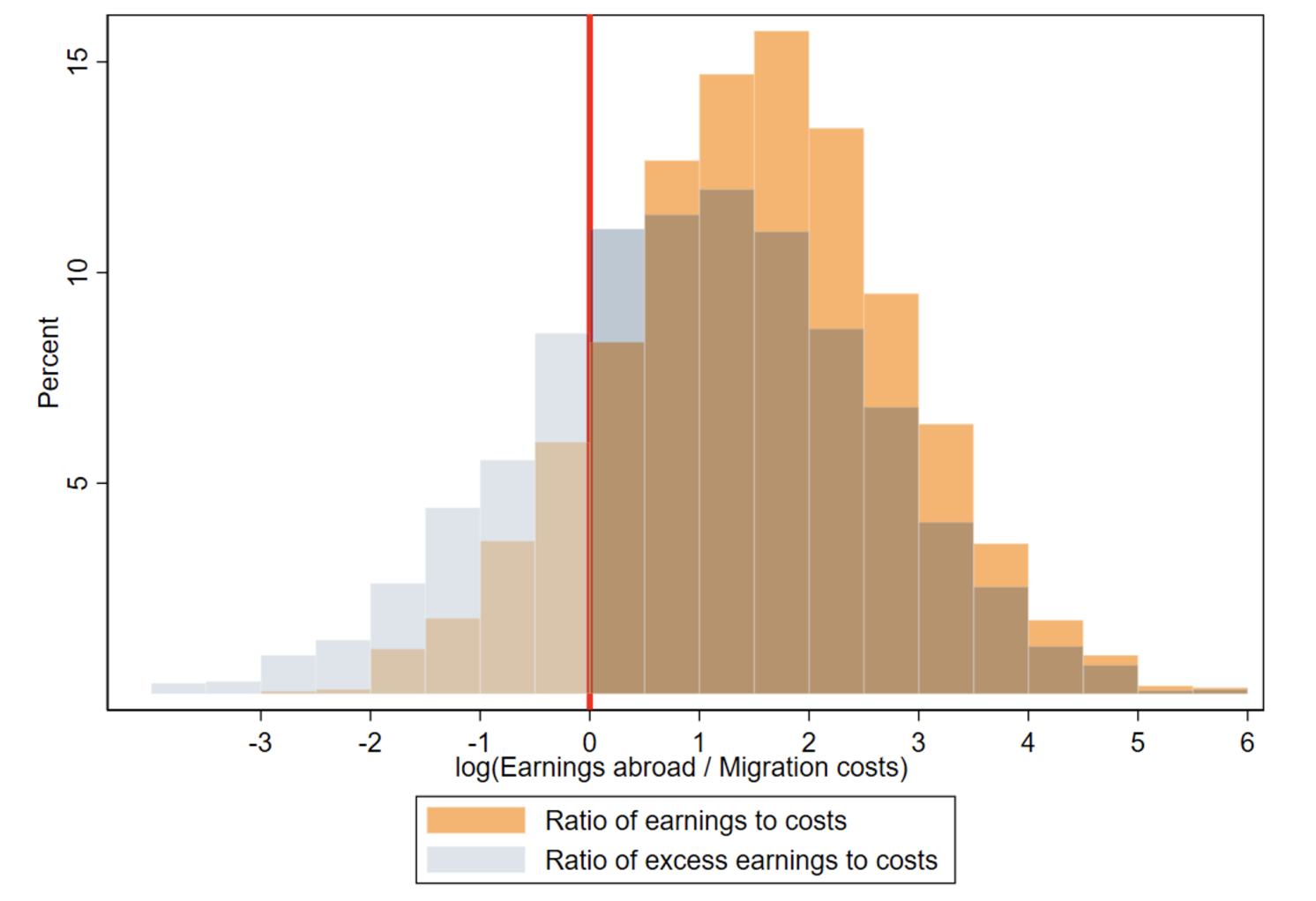

Despite the very high upfront costs paid by low-skilled migrants, we find that the investment pays off for many migrants. In fact, they break even after little more than one year, while the median length of stay is 4.7 years. Figure 2 shows the distribution of the returns to migration as the ratio between total earnings abroad over costs. Once we account for foregone earnings in Bangladesh as an opportunity cost of migration, we find that 75% of migrants realise positive net gains. Related to these calculations, our data suggests that migrants are particularly optimistic about their earnings potential abroad, very similar to the excessive optimism documented for entrepreneurs in various contexts (Dushnitsky 2010, Garud et al. 2014).

Figure 2: Ratio of excess earnings over migration costs among return migrants from Bangladesh

Notes: The figure presents two overlaid distributions on a common axis. The earnings-to-cost ratio is calculated by dividing total earnings (wage rate multiplied by the duration abroad) by the total migration costs. The excess-earnings-to-cost ratio is computed by deducting the potential income that could be earned in Bangladesh from foreign earnings, then dividing the remainder by the migration costs. 88% (75%) of individuals achieved total (excess) earnings abroad that surpassed the costs of migration, as indicated by their log ratios exceeding 0 on the horizontal axis. Source: Bossavie et al. (2024), using data from the Bangladesh Return Migrant Survey (BRMS) 2018/19.

A striking feature we see in our data is a strong movement into self-employment after return. Prior to migration, the individuals in our sample have a self-employment rate of around 30%, similar to non-migrants, but it increases to over 60% after return. This is significantly higher than for people within the same age group and human capital characteristics but who have never migrated. Many of these returning migrants become small-scale entrepreneurs, such as shopkeepers or taxi drivers. Still, their earnings exceed those of dependently employed workers, many of whom are informal labourers in agriculture or construction.

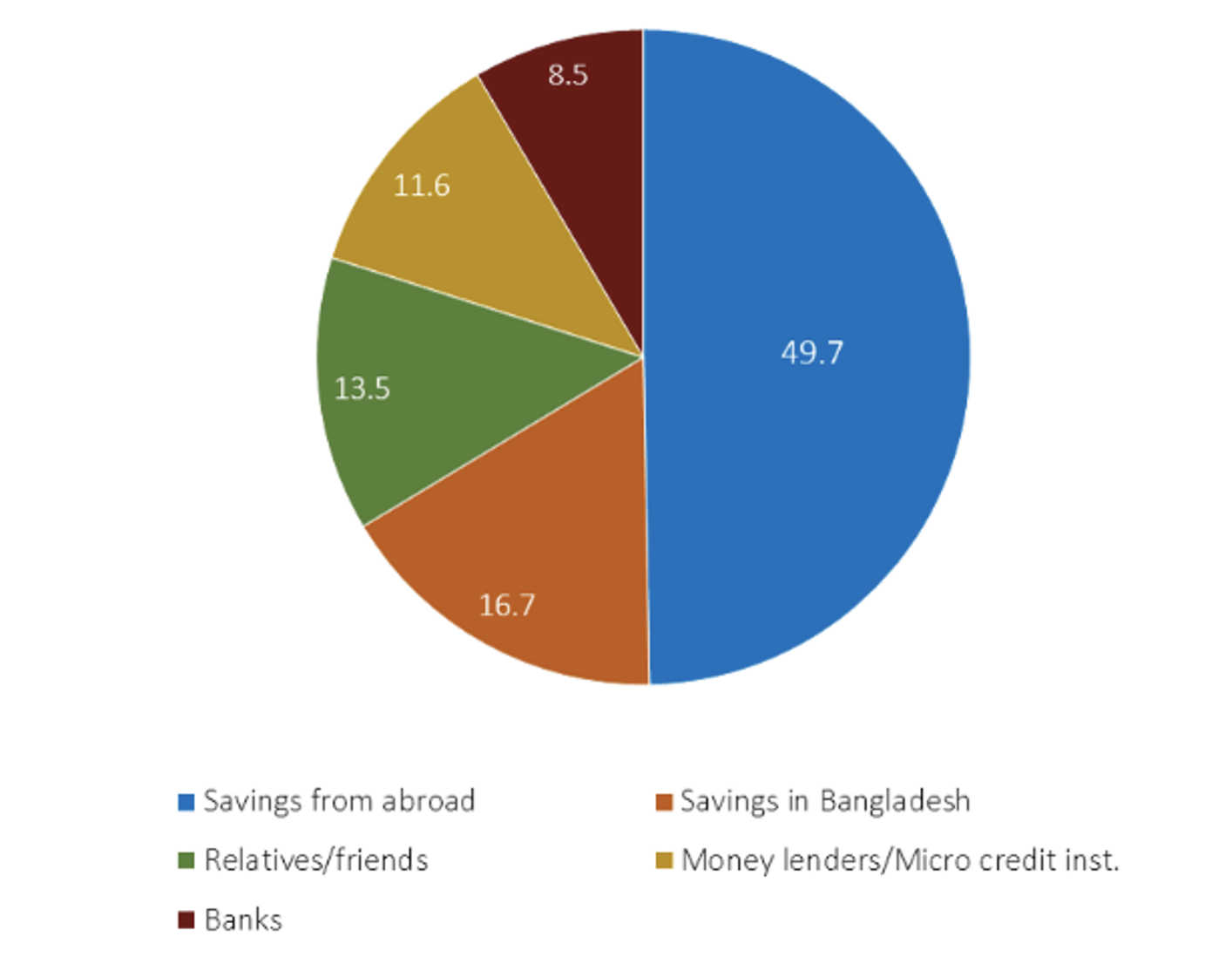

But why are workers able to borrow money to pay for emigration costs but not for self-employment activities? Credit access for entrepreneurship by low-skilled Bangladeshis is very limited and comes with high interest rates, as is the case in many poor countries (Banerjee and Duflo 2014, De Mel et al. 2008, Gulesci et al. 2019). Instead, migrant loans are much more widely available. Temporary international migration can thus be an important stepping-stone on the route to self-employment. In line with this, the main source of self-employment capital (around 50%) for returnees is money saved while working abroad (Figure 3).

Figure 3: Primary source of finance of non-agricultural enterprises started by return migrants

Note: This figure shows the distribution of the primary source for startup funding by return migrants who own non-agricultural enterprises. Numbers are the percentage of each group in the sample. The sample is restricted to males aged 18-59. Source: Bangladesh Return Migrant Survey (BRMS) 2018/19

Conclusion

Our findings suggest that migrant remittances are an important resource for capital accumulation in a labour abundant country like Bangladesh. These remittances increase the capital available to aspiring entrepreneurs. Enterprises by former migrants make up an important share of overall business creation in Bangladesh: non-agricultural self-employment rates are significantly higher among returning migrants, at over half versus around 20% for non-migrants. This translates into about one third of businesses being created by returned migrants.

As such, temporary migration can contribute to structural transformation of lower-income countries by enabling credit-constrained workers to enter non-agricultural entrepreneurship that generates higher incomes. Once these income gains due to entrepreneurial and self-employment activities are taken into account, the benefit-to-cost ratio of temporary migration turns decidedly more positive. Policies aiming to support temporary international migration and a repatriation of assets accumulated overseas may prove to have a strong impact on entrepreneurial investments that are difficult to match by policies focusing on efficient loan provision alone.

References

Banerjee, A V, and E Duflo (2014), "Do firms want to borrow more? Testing credit constraints using a directed lending program," Review of Economic Studies 81(2): 572-607.

Bossavie, L, J-S Görlach, Ç Özden and H Wang (2024), "Capital Markets, Temporary Migration and Entrepreneurship: Evidence from Bangladesh," World Development 176 (2024): 106505.

De Mel, S, D McKenzie and C Woodruff, "Returns to Capital in Microenterprises: Evidence from a Field Experiment," Quarterly Journal of Economics 123(4): 1329-1372.

Dushnitsky, G (2010), "Entrepreneurial optimism in the market for technological inventions", Organization Science 21(1): 150-167.

Dustmann, C and O Kirchkamp (2002), "The optimal migration duration and activity choice after re-migration", Journal of Development Economics 67(2): 351-372.

Garud, R, H A Schildt and T K Lant (2014), "Entrepreneurial storytelling, future expectations, and the paradox of legitimacy," Organization Science 25(5): 1479-1492.

Gulesci, S, A Madestam and M Battaglia (2019), “Repayment flexibility and risk taking: Evidence from credit contract,” VoxEU.org 6 January.

Jones, M R (2019), “Immigrants’ earnings growth and return migration from the US,” VoxEU.org 25 April.

McCormick, B and J Wahba (2001), "Overseas work experience, savings and entrepreneurship amongst return migrants to LDCs," Scottish Journal of Political Economy 48(2): 164-178.