City chiefs collecting taxes in Kananga, DRC, outperformed state agents thanks to their superior local information about potential taxpayers

It is now uncontroversial that state capacity — including tax capacity — is essential for economic development (Besley and Persson 2009). But how very low-capacity states build their capacity remains a puzzle. Almost by definition, low-capacity states operate alongside a range of local and traditional leaders. Although these leaders at times capture local politics (Anderson et al. 2015) and civil society (Acemoglu et al. 2014), there is growing interest in whether low-capacity states can collaborate with local leaders to improve governance outcomes, from law and order to public service delivery (Baldwin 2015, Acemoglu et al. 2019, Alatas et al. 2019, Basurto et al. 2019, Boogaard et al. 2019).

Examining a randomised policy experiment in the Democratic Republic of Congo (DRC), in a new paper we explore whether low-capacity states can increase their fiscal capacity by delegating tax collection responsibilities to local city chiefs (Balán et al. 2020).

Tradeoffs of delegating tax collection to local leaders

Governments have had the choice of either deploying state agents to collect taxes or delegating collection to customary and local leaders since time immemorial. In settings of low state capacity, it is not obvious which option would maximise government revenue. On the one hand, local leaders may have greater enforcement capacity in weak states because they have access to rich local information about taxpayers that state agents lack. Collection by local leaders may also lower administrative costs because it eliminates the need to staff a tax office in every province (Levi 1989). On the other hand, local leaders may be harder to monitor, and rulers may fear leakage eating into revenues, as well as the risk of overzealous taxation causing real economic damage or even outright tax revolts (Stella 1993).

Facing these tradeoffs, governments are thought to delegate tax collection to local leaders when the state is weak, and to rely on their own agents when the state is strong, according to economic historians and fiscal sociologists (e.g. Weber 1922). State collectors surpass local leaders in enforcement capacity, the story goes, as the state’s legal and informational power expands and eventually outweighs the local informational advantage once enjoyed by local leaders. Consistent with this idea, the countries in which customary and local leaders continue to play an important role in tax collection today predominantly have weak or fragile states, many of them in sub-Saharan Africa.

The study: City chiefs versus state agents as tax collectors in the DRC

A recent property tax campaign in the DRC provides experimental evidence on the tradeoffs between local leaders and state agents as tax collectors in a low-capacity state. The Provincial Government of Kasaï-Central began systematic property tax collection in the capital city of Kananga in 2016 (Weigel 2020). In 2018, the government predicted that engaging local city chiefs in collection would increase revenues further.

City chiefs are locally embedded leaders at the neighbourhood level who help resolve disputes over property, act as intermediaries between neighbourhoods and the government, and organise local public goods provision by citizens to maintain roads and other infrastructure. Respected local elites with responsibilities similar to customary chiefs in rural areas, city chiefs should not however be confused with their rural counterparts, who possess more authority. City chiefs play a role in property tax collection in many African countries today (Knebelmann et al. 2020).

To learn if working with city chiefs could raise revenues, the government implemented a policy experiment in which the 356 neighbourhoods of Kananga, spanning roughly 45,162 properties, were randomly assigned to “Central” or “Local” property tax collection. State agents hired by the provincial tax ministry were responsible for door-to-door collection in Central neighbourhoods, whereas city chiefs were responsible in Local neighbourhoods. Aside from the type of collector, all other aspects of tax collection — property registration and assessment, tax liabilities, the technologies used to issue receipts, collector compensation, among many others — were identical across treatments. By holding constant collector incentives and tax procedures, the experiment make it possible to estimate the causal effects of tax collection by local leaders compared to state agents.

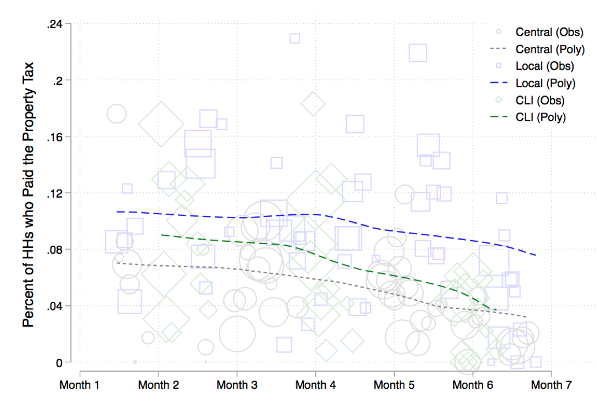

Figure 1 Tax compliance by treatment arm over campaign

This figure shows compliance (for Central, Local, and Central + Local Information [CLI]) over the tax campaign. Blue squares represent Local observations, grey circles represent Central observations, green diamonds represent CLI observations, with size indicating number of observations. Lines — dashed blue for Local, dotted grey for Central, dashed green for CLI — are local linear polynomials estimated using the displayed data, separately by treatment. Compliance decreased – similarly across treatments – over the course of the campaign as a contentious national election drew near.

Key finding: City chiefs raised more revenue

According to the government’s tax database, chiefs achieved 52% (3.3 percentage points) higher tax compliance than state collectors. Figure 1 shows how this difference persists throughout the campaign. This increase in compliance due to chief tax collection amounted to a 43% increase in property tax revenues. As a benchmark, enforcement messages on tax letters — an intervention used by tax authorities around the globe — increased revenues by one-fifth as much as tax collection by chiefs.

Importantly, the risk of mismanagement by city chiefs causing a backlash against the government largely did not materialise. While city chiefs were slightly more likely to collect bribes than state collectors, we find no evidence that they caused adverse outcomes on other margins, including tax assessment accuracy, views of the government, or crowding-out of other taxes or chief duties.

The mechanism: Chiefs used local information to target households more likely to pay

Why did chief collectors achieve higher tax compliance than state collectors? Chiefs did not visit more properties or visit them more often. Nor did they appear to be better at convincing property owners to pay after choosing to visit them. Instead, the evidence suggests that chiefs were able to target potential taxpayers more efficiently because they had better information about citizens’ propensity to pay.

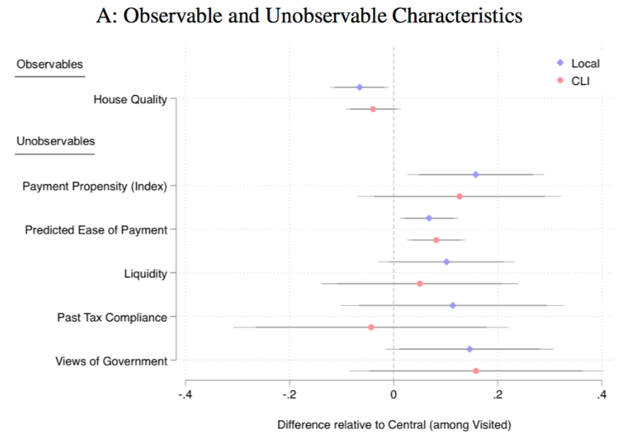

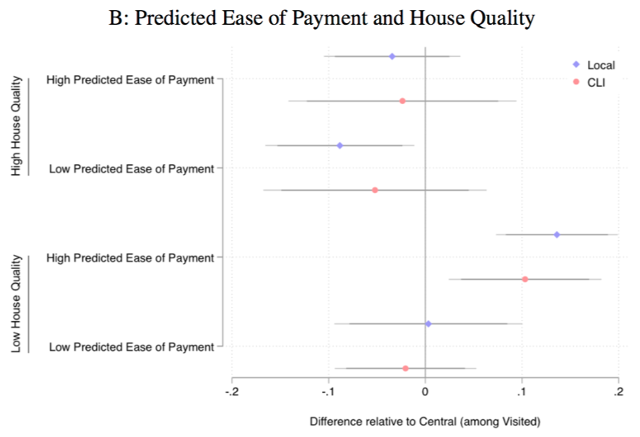

According to detailed survey measures (Figure 2), chiefs were less likely than state collectors to visit high-quality properties — an observable characteristic — yet more likely to visit properties with attributes that predict compliance but which are difficult to observe, such as having owners with cash-on-hand and those with positive views of the government. Thus, while state collectors had to rely on observable signals of tax compliance when choosing which households to visit, chiefs had access to more accurate but less observable signals thanks to their local knowledge.

Figure 2 Characteristics of households visited by collectors (after initial registration)

Notes: This figure reports differences by treatment arm in the characteristics of properties visited by collectors after registration, showing differences in the Local and CLI arms relative to the Central arm. Panel A shows differences in observable and unobservable characteristics for indices of household characteristics. Panel B shows differences in the probability of receiving a visit among households with high/low house quality and high/low predicted ease of payment. See the paper for detailed information about how these differences are estimated.

The value of local information to tax collectors is rendered vivid in a third, hybrid treatment arm, “Central + Local Information” (CLI), in which state agents collected taxes after a half-day consultation with the neighbourhood chief. During this meeting, the chief went line by line through the property register, indicating the ability and willingness to pay of each property owner in the neighbourhood, thereby transmitting the chief’s knowledge to the state collectors.

State collectors in the CLI treatment arm achieved higher compliance than in the Central one, when they did not consult with the chief before collection (Figure 1). State collectors in CLI did not conduct more tax visits, but instead changed which household types they targeted in response to the chief’s information, visiting and taxing those recommended by the chief with a higher probability. Comparing the households that collectors chose to revisit for tax collection, state collectors in the CLI arm, in fact, more closely resemble chief collectors than state collectors in the Central arm. These results demonstrate the importance of local information in tax collection.

Implications: Local leaders as tax collectors in urban and peri-urban areas?

Should low-capacity governments delegate tax collection responsibilities to local leaders? In Kananga, doing so raised more revenue — and proved 53% more cost-effective — than state collection. Although it increased bribes slightly, chief collection did not undermine views of the government or backfire along other margins. Engaging local leaders in tax collection therefore represents an important tool that low-capacity governments should consider in urban and peri-urban areas (where states can more easily monitor collectors compared to rural areas).

As countries develop and build stronger states, the value of engaging customary and local leaders in tax collection will likely decline. In particular, with more third-party information available to tax ministries — because of the expansion of the formal sector (Jensen 2018) and increasing financial development (Gordon and Li 2009) — chiefs’ informational advantages will likely dissipate and eventually be surpassed by the state. In the meantime, however, local leaders can be useful allies in weak states seeking to establish rudimentary fiscal capacity.

References

Acemoglu, D, A Cheema, A I Khwaja and J A Robinson (2019), “Trust in State and Non-State Actors: Evidence from Dispute Resolution in Pakistan”, Journal of Political Economy 128(8): 3090-3147.

Acemoglu, D, T Reed and J A Robinson (2014), “Chiefs: Economic Development and Elite Control of Civil Society in Sierra Leone”, Journal of Political Economy 122(2): 319–368.

Alatas, V, A Banerjee, R Hanna, B Olken, R Purnamasari and M Wai-Poi (2019), “Does elite capture matter? Local elites and targeted welfare programs in Indonesia”, AEA Papers and Proceedings 109: 334–39.

Anderson, S, P Francois and A Kotwal (2015), “Clientelism in Indian villages”, American Economic Review 105(6): 1780–1816.

Balan, P, A Bergeron, G Tourek and J Weigel (2020), “Local elites as state capacity: How city chiefs use local information to increase tax compliance in the D.R. Congo”, CEPR Discussion Paper 15138.

Baldwin, K (2015), The Paradox of Traditional Chiefs in Democratic Africa, Cambridge University Press.

Basurto, M P, P Dupas and J Robinson (2019), “Decentralization and efficiency of subsidy targeting: Evidence from chiefs in rural Malawi”, Journal of Public Economics 185: 4047.

Besley, T and T Persson (2009), “The origins of state capacity: Property rights, taxation and politics”, American Economic Review 99(4): 1218–1244.

Gordon, R and W Li (2009), “Tax structures in developing countries: Many puzzles and a possible explanation” Journal of Public Economics 93(7): 855–866.

Jensen, A (2018), “Employment structure and the rise of the modern tax system”, Working Paper.

Boogaard, V, V D, S Jibao, and W Prichard (2019), “Informal taxation in Sierra Leone: Magnitudes, perceptions and implications” African Affairs 118(471): 259–284.

Knebelmann, J, V Pouliquen and B Sarr (2020), “Bringing property owners into the tax net”, Working Paper 102.

Levi, M (1989), Of Rule and Revenue, University of California Press.

Stella, P (1993), “Tax farming: A radical solution for developing country tax problems?”, Staff Papers 40(1): 217–225.

Weber, M (1922), Economy and society: An outline of interpretive sociology, Vol. 1, University of California Press.

Weigel, J (2020), “The participation dividend of taxation: How citizens in Congo engage more with the state when it tries to tax them”, Quarterly Journal of Economics 135(4): 1849-1903.