Text-based behavioural messaging can reduce delinquency, with the most effective messages either referencing social norms, or sent to individuals with higher socioeconomic status or higher credit scores

Editor’s note: This column was corrected on 21/03/2023. A previous version of this blog post erroneously reported that treatment effects were more pronounced among poorer borrowers and those holding secured loans and with longer maturities. These statements have now been amended.

Text-based behavioural messaging is an attractive intervention for a variety of stakeholders because it is relatively cheap, can reach a large number of people quickly, and can be effective in positively influencing behaviours across a diversity of domains such as health (e.g. Orr and King 2015, Thakkar et al. 2016), tax (e.g. Hallsworth et al. 2017, De Neve et al. 2021), and agriculture (e.g. Carrión-Yaguana et al. 2020, Fabregas et al. 2019). In the realm of consumer finance, there is promising evidence that text-based behavioural messaging can improve outcomes for customers as well (e.g. Cadena and Schoar 2011, Karlan et al. 2016). However, impact may vary depending on a message’s content (Bursztyn et al. 2017), raising questions on which behavioural motives matter the most, and how this differs across customer and product type. In other words, there is significant room to tailor messages or campaigns to maximize impact.

In our study (Barboni, Cárdenas, de Roux and Theys 2022), we aim to fill this gap by collaborating with one of Colombia’s largest banks to explore how the effectiveness of text message-based reminders varies across behavioural motives, key borrower characteristics, and broad types of loan products. To do so, we use a set of randomized experiments in Colombia, where in 2020, 7% of households were delinquent on mortgage payments and 6.4% defaulted on credit card debt (Transunion 2021).

Our study

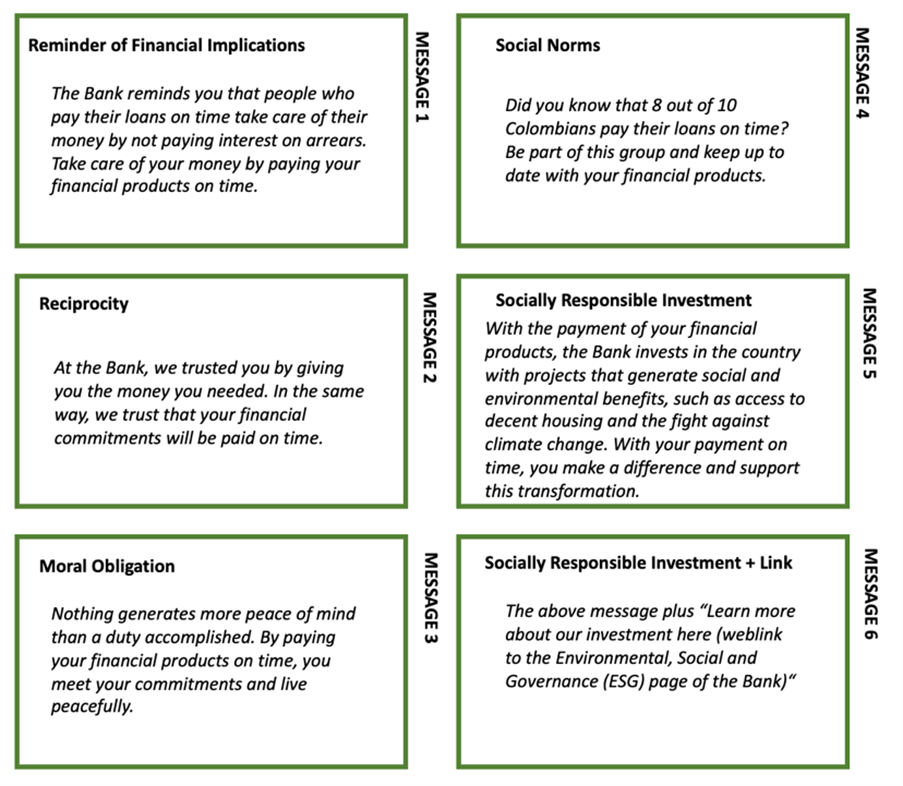

In May 2021, our partner bank enrolled 7,029 borrowers in a randomized controlled trial (RCT); recipients, who had at least one product in arrears, received text messages for three months. Borrowers were randomly assigned to receive messages that used six types of motivations – including reciprocity, social norms, and moral norms – but reminded clients to pay (see Figure 1 for all six messages). The bank conducted a second RCT with 8,040 borrowers and the same set of messages but they were sent only to non-delinquent borrowers.

Figure 1: Content of all six messages sent as part of the two RCTs. The control group did not receive any message.

To evaluate these interventions, we focus on one main outcome – repayment delinquency, as measured by the probability in a given week of being delinquent. The following are our main findings.

1. Text message reminders reduce repayment delinquency among delinquent borrowers

Overall, we find that among delinquent borrowers, receiving a text message lowered the probability of continuing to be delinquent by 4%, relative to a probability of 59% in the control group. Among the on-time borrowers, we find no impact.

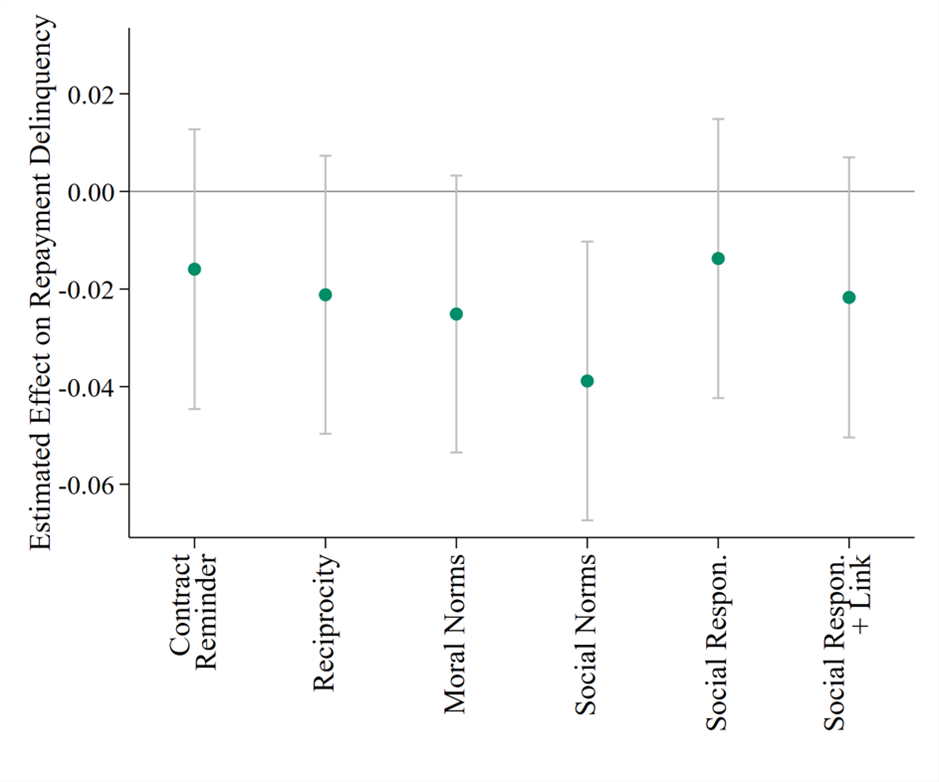

2. Message content matters – social norms are the most impactful

We find that impact differs across the six message types. Among delinquent borrowers, messages that reference social norms have the strongest impact (see Figure 2), suggesting there may be a social dimension to repayment decisions. Receiving this message reduces delinquency by almost 7%, more than a message stating the additional costs of not paying. This result indicates that other behavioural motivations, different from pure recall, can move delinquent clients to catch-up. We saw no such result among the on-time borrowers.

Figure 2: Impact of various messages on delinquency rates among already delinquent borrowers.

Beyond message content and delinquency, we identify additional characteristics that influence borrowers’ response to behavioural messages utilizing a causal forest machine learning algorithm. This method captures high-dimensional combinations of individual and loan characteristics associated with high treatment effects - combinations that could be missed in traditional heterogeneity analyses in which treatment effects are estimated in sub-samples that researchers select in an ad-hoc manner. We then compare the mean observable characteristics of the sample, splitting it into two equal halves: (1) the top 50% of individuals predicted by the algorithm to experience the highest reduction in delinquency, versus (2) the bottom 50%, predicted to experience the lowest reduction.

3. Better off borrowers with higher credit scores are better suited to receive behavioural messages, with some important differences depending on message content

Using the method described above, our analysis reveals that the following types of borrowers are more likely to benefit from the intervention: men, those who are wealthier (as measured by monthly income), more educated, have higher credit scores, are less indebted, and are employed. In short, reductions in delinquency are concentrated among individuals with higher socioeconomic status. However, there are differences across message type, with poorer, less indebted borrowers responding to contract reminders and social norms while wealthier individuals respond more to moral norms messages.

4. Loan type matters – those with unsecured, shorter maturing loans benefit most from reminder messages

We find that borrowers with unsecured loans (credit cards and consumption loans), as compared to secured loans (mortgages), benefit more from the intervention and relatedly, so do those with shorter-maturity loans. These differences are particularly strong for messages that focus on social or moral norms, while they are not large for those with themes of reciprocity or contract reminders.

What are the implications for messaging intervention design?

The following are three lessons that can inform the design and targeting of at-scale behavioural messaging interventions.

First, the strong effect of the social norms message suggests that payment decisions are influenced by more than financially focused considerations. Relatedly, our results suggest that positive framing (which all six message types use), as opposed to leveraging potential negative outcomes of non-payment, is effective at influencing behaviour. This suggests that although banks may be most concerned with the financial implications of non-payment, this is not necessarily what best motivates their customers to pay once they are already delinquent.

Secondly, there are returns to targeting individuals based on who they are. When strategies to maintain a healthy debt portfolio for high credit score or high socioeconomic status individuals fail, campaigns with specifically targeted behavioural messages can be a promising and affordable tool to reduce loan delinquency. Furthermore, the increased effectiveness for those with mortgages longer maturity loans suggests that behavioural messages speak to borrowers who have stronger and/or longer lending relationships with their bank. This contradicts previous findings that mortgage owners are not responsive to information campaigns (Keys et al. 2016), and indicates that targeting only credit cards customers (Bursztyn et al. 2019, Adams et al. 2021, Medina 2021) may miss a high-impact group.

Finally, our results suggest that behavioural messages are not the best tool in all contexts. In addition to avoiding messages that are ineffectual for certain groups, this includes borrowers who are currently on-time but who may become delinquent. This will be especially important in times of economic downturn, as marginally vulnerable borrowers may seek additional or emergency credit.

All in all, our results suggest that behavioural messaging can be a promising way to reduce the burden of payment delinquency and can thus help financial entities maintain healthy portfolios. Indeed, our back-of-the-envelope calculations suggest that sending the social norm message, without additional targeting, could save the bank nearly $21,000 monthly. For reference, a person earning the minimum wage in Colombia makes $227 monthly. Tailoring message content by recipient, by leveraging person-level information readily available to banks, can yield even larger returns. How to reduce the delinquency of groups who do not respond to behavioural messaging interventions is a topic that needs further research.

References

Athey, S and G Imbens (2016), “Recursive partitioning for heterogeneous causal effects. Proceedings of the National Academy of Sciences”, 113(27):7353–7360.

Athey, S, J Tibshirani and S Wager (2019), “Generalized random forests”. The Annals of Statistics, 47(2):1148–1178.

Barboni, G, J C Cárdenas and N de Roux (2022), “Behavioral Messages and Debt Repayment”, Documento CEDE 2022-22.

Bursztyn, L, S Fiorin, D Gottlieb and M Kanz (2019), “Moral incentives in credit card debt repayment: Evidence from a field experiment.” Journal of Political Economy, 127(4):1641-1683

Cadena, X, and A Schoar (2011), “Remembering to pay? Reminders vs. financial incentives for loan payments” NBER Working Paper 17020.

Carrión-Yaguana, V D, J Alwang and V H Barrera (2020), “Promoting behavioral change using text messages: A case study of blackberry farmers in Ecuador.” Journal of Agricultural and Applied Economics, 52(3): 398–419 Available at: https://doi.org/10.1017/aae.2020.7.

De Neve, J E, C Imbert, J Spinnewijn, T Tsankova and M Luts (2021), “How to improve tax compliance? Evidence from population-wide experiments in Belgium.” Journal of Political Economy, 129(5): 1425-1463.

Fabregas, R, M Kremer, M Lowes, R On, and G Zane (2019), "SMS-extension and farmer behavior: lessons from six RCTs in East Africa." Online at: https://www.atai-research.org/wp-content/uploads/2020/05/textfarmers1.pdf .

Hallsworth, M, J A List, R D Metcalfe and I Vlaev (2017), “The behavioralist as tax collector: Using natural field experiments to enhance tax compliance.” Journal of public economics, 148: 14-31.

Karlan, D, J Kendall, R Mann, R Pande, T Suri, and J Zinman (2016), “Research and impacts of digital financial services” NBER Working Paper 22633.

Keys, B J, D G Pope and J C Pope (2016), "Failure to refinance." Journal of Financial Economics, 122(3): 482-499.

Orr, J A and R J King (2015), “Mobile phone SMS messages can enhance healthy behaviour: a meta-analysis of randomised controlled trials.” Health psychology review, 9(4): 397-416.

Thakkar, J,R Kurup, T L Laba, K Santo, A Thiagalingam, A Rodgers and C K Chow (2016), “Mobile telephone text messaging for medication adherence in chronic disease: a meta-analysis.” JAMA internal medicine, 176(3): 340-349.

Transunion (2021), "TransUnion Industry Insights Report, Cuarto trimestre de 2020." Available here. Accessed: 2022-05-24.

Wager, S and S Athey (2018), “Estimation and inference of heterogeneous treatment effects using random forests”, Journal of the American Statistical Association, 113(523):1228–1242.