A quarter of Ugandan firms appear to consistently make costly mistakes, with potentially far-reaching consequences for theory and policy design

Editor's Note: For more on firm behaviour and taxation read the VoxDevLit on Taxation and Development.

Economists usually assume that firms behave rationally – they maximise after-tax profits given some constraints. But do they really? There is growing evidence that firms don’t always behave as standard models predict. For example, many retail chains charge roughly the same prices across large regions of the US, despite wide variation in consumer characteristics and competition (DellaVigna and Gentzkow 2019). American firms also pay round-number wages to an extent that is difficult to rationalise (Dube et al. 2020). In Rwanda, many firms report exactly the same amount of income tax year after year, even after a tax reform allowed them to pay lower tax amounts (Tourek 2021).

If a significant proportion of firms consistently makes mistakes as conventionally defined – or simply engage in profit-maximising behaviour that is too complex to empirically rationalise – the consequences for theory and policy design could be far-reaching. In a forthcoming study (Almunia, Hjort, Knebelmann, and Tian 2021), we use administrative data on all non-micro firms in Uganda and their trade with each other between 2013 and 2016 to investigate this question.

Analysing VAT in Ugandan firms

All Ugandan firms registered for the value-added tax (VAT) have to file a monthly tax return, providing details such as the transaction amount and trading partner on all the sales and purchases made to/from other VAT-registered firms. The revenue authority requests all this detailed information in order to be able to cross-check the amounts reported by sellers and buyers. Why would firms misreport? One reason is to reduce their VAT payments: as sellers, they have an incentive to underreport the transaction amount to lower their liability, while as buyers they have an incentive to overreport to increase their tax credits.

Large discrepancies in VAT reporting

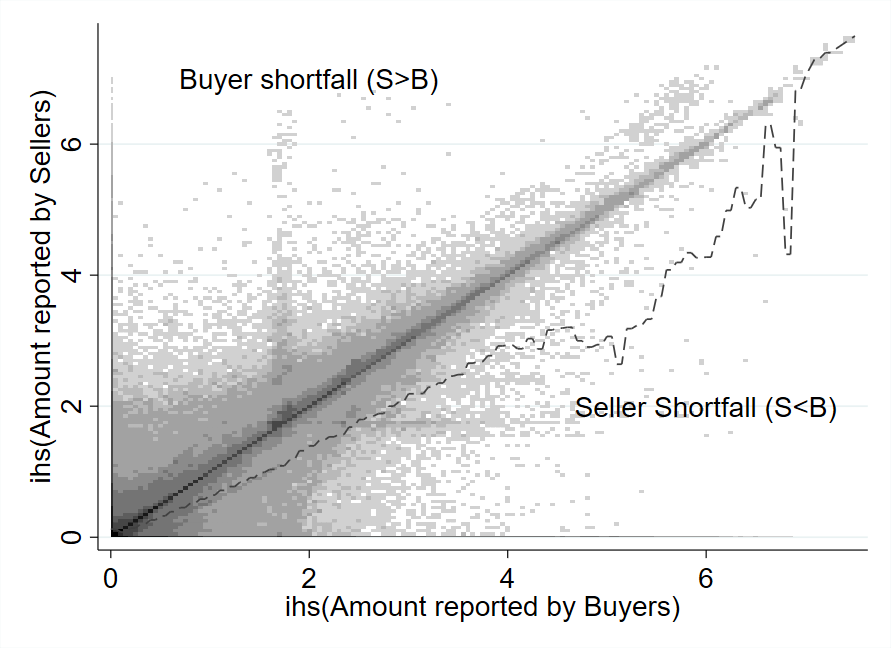

In the first part of our analysis, we document that the transaction amounts reported by seller-buyer pairs do not match in 79% of monthly observations, even after allowing for rounding errors and potential timing mismatches. Sixty percent of such discrepancies are due to the seller reporting a smaller amount than the buyer, which we label as ‘seller shortfall’. This is the type of discrepancy you would expect to observe when either the seller or the buyer, or both, are trying to evade taxes. In the remaining 40% of cases, the buyer reports a smaller amount than the seller (‘buyer shortfall’). The latter is more puzzling, as it leads to a higher net tax liability for at least one of the firms involved. The broad patterns can be seen in Figure 1, where the shade of each square in the grid is darker the more firm-pair observations it includes.

Figure 1 VAT amounts declared by sellers and buyers

These discrepancies are interesting for several reasons:

- They suggest that Ugandan firms are not very concerned about being caught evading taxes, despite the detailed information collected by the revenue authority. In fact, the ease with which seller and buyer reports can be cross-checked is one of the main reasons why international organisations – and economists more broadly – have long advocated for taxing firms through a VAT, especially in low-income countries.

- The fact that 40% of discrepancies are buyer-shortfall ones raises intriguing questions that potentially challenge a more fundamental assumption underlying the argument that the VAT is likely to be a relatively ‘self-enforcing’ tax. This is the assumption that firms are sophisticated organisations that keep track of sales and purchases, under-report their taxes if the gain is worth the risk of detection, and otherwise report their true liability.

- The discrepancies of the massive magnitude we document may have a large impact on the tax revenue collected by the government.

A methodology for inferring firm ‘type’

What ultimately matters for a firm’s VAT liability and after-tax profits is its total reported value-added across all its trade partners. We call those whose discrepancies lead to an underpayment of VAT ‘sophisticated’ since they are (self-)‘advantageous’ misreporters, and label those whose discrepancies lead to overpayment of VAT ‘confused’ or ‘disadvantageous’ misreporters. To infer a misreporting firm’s type, we need to take a stand on whether a given reporting discrepancy is due to the seller misreporting its sales, the buyer misreporting its purchases, or both.

To do so, we estimate a regression model with fixed effects that apportions blame for each discrepancy while accounting for the characteristics of each firm’s trading partners. Specifically, the outcome variable is the discrepancy between each seller and buyer (in US dollar terms), and the explanatory variables are fixed effects for all sellers and all buyers in our sample. For each individual firm, we estimate two parameters: one for their reporting behaviour as sellers, and another for their behaviour as buyers. Adding up the estimates of the two parameters for each firm allows us to categorise firms as sophisticated or confused.

We find that about 75% of Ugandan firms are advantageous (sophisticated) misreporters and the remaining 25% are disadvantageous (confused) misreporters. The latter finding is notable, as it suggests that a considerable share of firms do not act in a way that benefits themselves. Our results do not appear to be due to firm matching or unobserved sales to final consumers, and firm categorisation is fairly persistent from year to year.

Does stricter enforcement alter behaviour?

Finally, we compare how the two groups of firms behave in a tax reporting context with stricter enforcement – namely, at customs. In this way, we directly investigate if it is in fact the case that confused firms do not respond to enforcement and policy design as theory predicts, and also provide some validation of our interpretation of the estimates from the fixed effects exercise. Specifically, we check whether firms consistently declare imported inputs on their VAT returns. Again, we find a remarkable proportion of discrepancies, despite the fact that the two reports are made by the same firm: one at customs for tariff payment, and the other on the credit side of the VAT return. Most interestingly, disadvantageous firms are more likely to leave import VAT credits on the table by failing to report them on their VAT return.

The missing millions of under-reported VAT revenue

Using our results to estimate the aggregate revenue consequences of VAT misreporting, we show that disadvantageous misreporting significantly increases Uganda’s tax revenues. However, we estimate that, if all discrepancies for the period 2013–16 were corrected, the net effect would be an increase in VAT revenue of US$384 million, equivalent to 25% of actual VAT revenue and 4% of total tax collection over that period.

Policy implications

Overall, our findings suggest that the majority of Ugandan firms are sophisticated enough to respond to weak tax enforcement by considerably under-reporting on their VAT declarations. This highlights that the tax enforcement benefits of a physical paper trail in the VAT are strongly dependent on the level of administrative capacity. However, we also find that a non-negligible group of firms consistently make mistakes and do not respond to enforcement as the design of the VAT and many other policies in effect assumes.

References

Almunia, M, J Hjort, J and L Tian (2021), “Strategic or Confused Firms? Evidence from ‘missing’ transactions in Uganda”, Review of Economics and Statistics (forthcoming).

DellaVigna, S and M Gentzkow (2019), “Uniform pricing in us retail chains”, Quarterly Journal of Economics 134(4): 2011-2084.

Dube, A, A Manning and S Naidu (2020), “Monopsony and Employer Mis-Optimization Explain Why Wages Bunch at Round Numbers”, NBER Working Paper 24991.

Tourek, G (2021), “Targeting in tax behavior: Evidence from Rwandan firms”, Working Paper.