Positive spillovers of a microcredit expansion programme on the commercial banking system can foster local development

In recent years, developing countries have made great strides towards financial inclusion thanks to more stable macroeconomic conditions and flourishing microfinance sectors. Access to financial services at commercial banks has traditionally been limited in these countries due to weak institutions and a shortage of collateral wealth (Morduch 1999, Kaboski and Townsend 2012).

Despite a vast literature on the economic benefits of microfinance, a key unanswered question is: to what extent can a healthy microfinance sector fulfil a screening role and intermediate the transition of previously unbanked borrowers to commercial banks? In a recent paper (Agarwal et al. 2018), we address this question by examining the impact of a nationwide government-subsidised microcredit expansion programme in Rwanda, which created an extensive network of community-focused savings and credit cooperatives (Umurenge SACCOs, henceforth “U-SACCOs”).

The data: A Rwandan credit register

Our analysis exploits a rich administrative dataset extracted from a credit register that reports all the individual loans granted in Rwanda. The credit register is maintained by a private credit reference bureau and provides detailed borrower information regarding payment history and defaults (that is, both positive and negative information). This information is supplied to contributing lenders upon query and against a fee.

The dataset comprises the universe of loans extended by commercial banks, U-SACCOs, and other microfinance institutions (MFIs) to individual borrowers for nine years around the implementation of the programme (2008-2016). Our final dataset includes more than four million observations on bank-borrower loan exposures, on a monthly basis, for almost 180,000 individuals.

A two-part analysis

1. Credit cooperatives and financial access

A unique feature of the U-SACCOs programme is it's staggered roll-out across Rwandan municipalities. This enables us to empirically identify the programme’s impact on financial access. Specifically, we compare the likelihood that an individual in a given municipality obtains credit either before or after the set-up of a U-SACCO in that municipality, relative to individuals in municipalities that do not yet have a loan-granting U-SACCO.

The results

- The programme significantly and permanently raised the likelihood of loan-granting for the previously unbanked population by about 10 percentage points.

- The loan-granting effect is economically sizable given the low level of financial access before the programme and is stronger in rural and less financially developed municipalities.

- This effect is driven by the U-SACCOs that were set up during the programme.

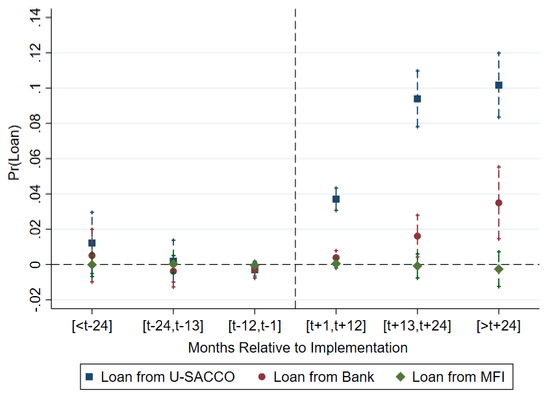

- We document that starting in the second year of the programme, there are spillover effects to commercial banks, which begin to expand their branch network in underbanked areas. Our estimates indicate that the likelihood of loan-granting by commercial banks increases up to 3.5 percentage points after the programme compared to the pre-programme period (Figure 1).

Figure 1 Likelihood of loan-granting, by lender type, before and after the programme

Notes: The figure shows the effect of the U-SACCO programme on the likelihood of individuals in a given municipality having a loan, in a U-SACCO, another MFI, or a commercial bank, respectively, before and after the U-SACCO becomes operative in that municipality. The chart is based on a specification estimated in a panel dataset at the borrower-municipality-month level, representing a linear probability model in which the dependent variable is the individual probability of having a loan. The chart plots the estimated coefficients and the associated 90% confident intervals of the interaction terms between the U-SACCO variable and a set of time dummies. The vertical line corresponds to the month in which each U-SACCO granted the first loan in the municipality. See Agarwal et al. (2018) for details. Source: Authors’ estimates using data from the Rwandan Credit Reference Bureau.

Despite this success, U-SACCOs face capacity constraints due to small balance sheets, insufficient funding, and lending limits (Cull et al. 2014). As a result, they are unable to fully meet the credit demand from the population.

2. New borrowing activities

The second part of our analysis focuses on the borrowing activities of previously unbanked individuals who, by virtue of the microcredit expansion programme, obtain their first loan from a U-SACCO. Once they start borrowing from U-SACCOs, these individuals enter the credit register, which tracks all their borrowing activities, and builds credit history. In addition, the credit register allows borrowers to signal their creditworthiness to any potential lender. We track individuals who obtain their first loan at a U-SACCO and subsequent loans at commercial banks and examine the terms on which they obtain subsequent loans.

The results

- We document that switching borrowers obtain larger, cheaper, and longer-term loans from commercial banks compared to similar borrowers who remain at U-SACCOs (and do not switch).

- Although switching borrowers initially receive smaller loans compared to similar borrowers already at commercial banks, loan size increases over time.

- Furthermore, using loan default information as a gauge of borrower risk, we document that switching borrowers are not riskier than similar borrowers already at commercial banks.

- However, switching borrowers are less risky than similar borrowers who remain at U-SACCOs (and do not switch).

These findings suggest that commercial banks ‘cream-skim’ low-risk U-SACCO borrowers and hence emphasise the screening role of U-SACCOs for the commercial banking system.

Implications

The micro-macro paradox

Our results help reconcile a ‘micro-macro paradox’ in the literature on the economic impact of microfinance. While randomised control trials (RCTs) reveal “a consistent pattern of modestly positive, but not transformative effects” (Banerjee et al. 2015), most studies based on aggregated and household survey data show more promising results (Bruhn and Love 2014, Brown et al. 2016, Allen et al. 2017). Our analysis adds to this literature by documenting, for the first time, the positive spill-overs of a microcredit expansion programme on the commercial banking system.

Local development

Our findings suggest that U-SACCOs can foster local development not only directly by providing financial services to the underprivileged population, but also indirectly by allowing previously unbanked individuals to obtain (larger, cheaper, and longer-term) credit from commercial banks, with potential boosting effects for entrepreneurship and small business growth.

Information frictions

More broadly, our analysis supports the notion that MFIs play an important screening role of the unbanked population and can therefore help reduce credit-market information frictions in developing countries. In addition, a well-functioning credit reference bureau, which collects both positive and negative information, allows borrowers in the microfinance sector to build credit history and signal their creditworthiness to other lenders.

As information frictions are mitigated, the Rwandan experience is that commercial banks increase their branch network in previously under-served areas and tap into a new customer base. Banks “cream-skim” low-risk borrowers from the pool of newly-banked individualsin the microfinance sector and offer them attractive loan terms.

Conclusion

Our main message is that a healthy microfinance sector coupled with a comprehensive credit reference bureau can attenuate information frictions in credit markets and hence play a crucial role in financial development. That said, such programmes could also have the unintended consequence of leaving microlenders with a pool of risky borrowers, undermining the financial viability of their business model, and posing financial stability risks.

References

Agarwal,S, Kigabo, T, Minoiu, C, Presbitero, A and Silva, A F (2018), "Financial access under the microscope".

Allen, F, Carletti, E, Cull, R, Qian, J, Senbet, L and Valenzuela, P (2017), "Improving access to banking: Evidence from Kenya", CEPR Discussion Paper No. 9840.

Banerjee, A, Karlan, D and Zinman, J (2015). “Six randomized evaluations of microcredit: Introduction and further steps”, American Economic Journal: Applied Economics 7(1): 1-21.

Brown, M, Guin, B and Kirschenmann, K (2016). “Microfinance banks and financial inclusion”, Review of Finance 20(3): 907-946.

Bruhn, M and Love, I (2014). “The Real Impact of Improved Access to Finance: Evidence from Mexico”, The Journal of Finance 69(3): 1347–1376.

Cull, R, Demirgüç-Kunt, A and Morduch, J (2014). “Banks and Microbanks”, Journal of Financial Services Research 46(1): 1-53.

Kaboski, J P and Townsend, R M (2012). “The Impact of Credit on Village Economies”, American Economic Journal: Applied Economics 4(2): 98–133.

Morduch, J (1999). “The Microfinance Promise”, Journal of Economic Literature 37(4): 1569–1614.