Evidence from Kenya shows that small firms have a lot of ‘slack’, i.e. they could produce substantially more output without having to hire additional workers, buy additional machines, or raise prices, simply by reducing their idle time. Why is slack so pervasive, and what are the consequences for development?

Editor’s note: This is the first of two articles covering the paper “Slack and Economic Development”. Read the second article – “Do cash transfers cause inflation?” here.

Enormous differences in income per capita across the globe suggest dramatically lower productivity in poor economies. So, what is holding back productivity in developing countries? Research proposes a range of constraints, from institutional factors (Acemoglu et al. 2001) affecting investment incentives to more proximate causes such as inefficient credit markets, lack of transportation infrastructure and low human capital (Caselli 2005, Hendricks and Schoellmann 2018).

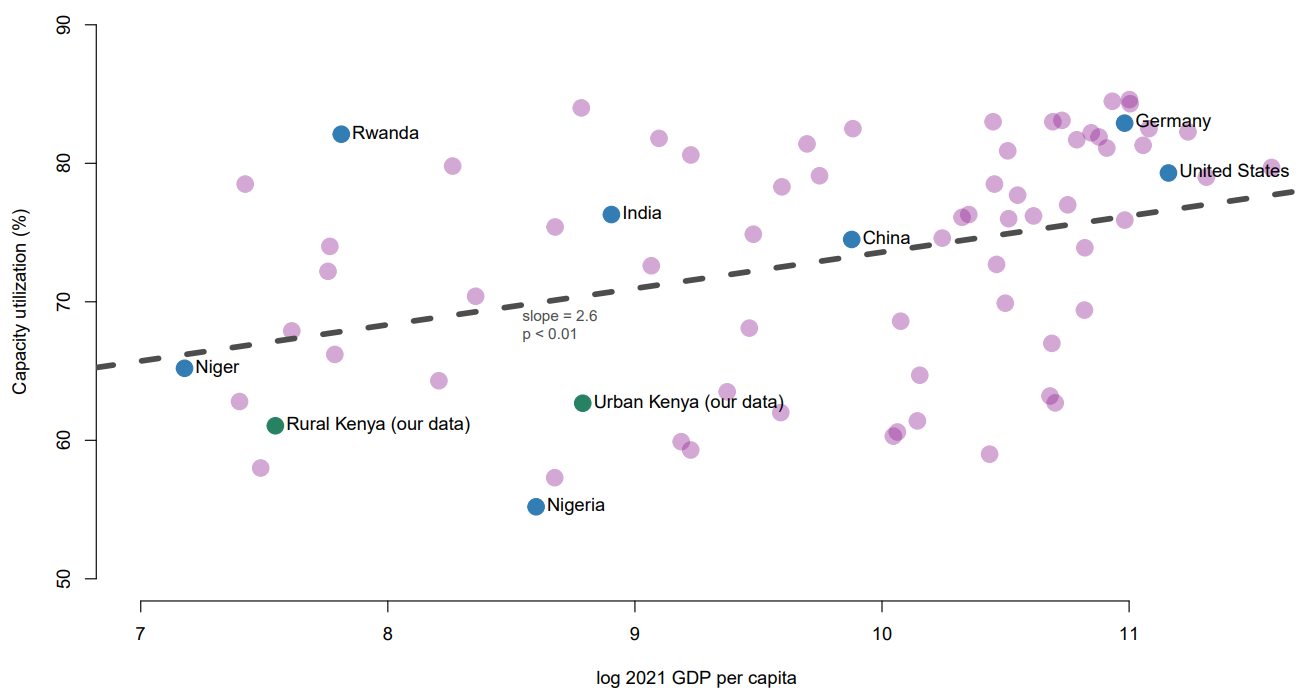

Our research (Walker et al. 2024) argues that low demand plays an important role. By combining newly collected survey data with a structural model, we show that low productivity can arise from the interaction of low demand and persistent excess capacity, i.e. idle time for workers and machines. Figure 1 illustrates a consequence of this idea: Excess capacity, or slack, is significantly higher in poorer, low demand countries, in line with influential early work on labour slack by Lewis (1954).

Figure 1: Capacity utilisation across the world

Notes: This figure presents overall capacity utilisation across countries in the most recent month/quarter/year where data is available (as of November 2023). Data for rural and urban Kenya (in green) is from our novel survey data described in section 2.1, all other observations are from Trading Economics and Moody’s Analytics (2023), which aggregate data on capacity utilisation from national statistics agencies across countries.

What is slack in economics? New descriptive statistics on slack from Kenya

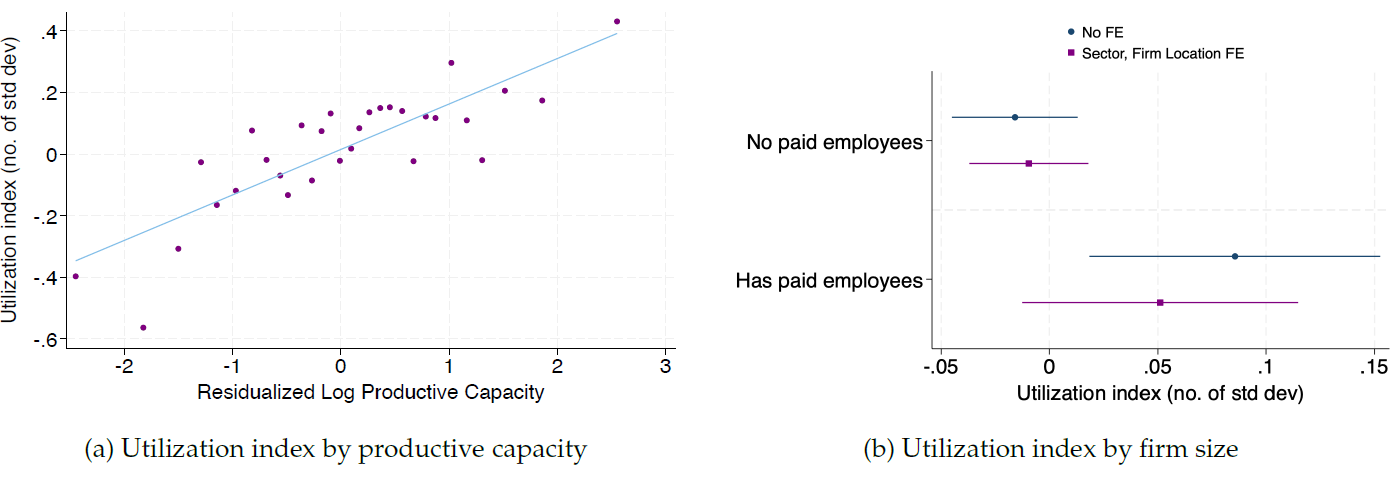

To make sense of this cross-country relationship, we draw on large-scale survey data from rural Western Kenya and urban markets in the capital Nairobi. We carefully measure utilisation rates of capital and labour, as well as customer flows across firms, and document three striking patterns:

- Slack is concentrated among small firms, an important observation given that 90% of firms in our rural sample, and 76% of urban firms, are single-person owner-operated micro enterprises.

- Slack is higher for firms operating in remote locations such as homesteads or small rural markets, especially when compared to firms active in the busy markets of the capital, Nairobi. These findings highlight how low demand, and access to markets, lower utilisation rates at the micro-level, similar to the cross-country evidence.

- There is more slack in firms active in sectors characterised by ‘lumpy’ inputs such as personal services, e.g. a barber that needs to ‘man the shop’ and wait for customers to arrive, or the village grain mill where villagers come to grind their weekly consumption of maize at quantities too small to warrant a trip to the next village.

What are the causes of excess capacity?

‘Lumpiness’ of inputs naturally creates scope for underutilisation. Whenever a store owner with capacity for 40 hours of work or a machine capable of a certain number of operating hours faces low demand, measured utilisation may drop significantly as firms cannot go below one machine, or one worker.

Importantly, these factors – the prevalence of many small owner-operated micro-enterprises, high transportation costs, and low access to markets and customers (most customers simply walk to their closest market) and low market integration – are typical of most developing country settings around the world and may rationalise (part of) the cross-country relationship we document above.

Figure 2: Stylised facts about slack

Notes: This figure depicts stylised facts about slack using a “utilization index”, a summary measure of capital and labour utilisation based on several different survey measures. A higher value of the utilisation index implies less slack. Panel (a) shows that firms with higher revenue potential have higher utilisation or lower slack. Panel (b) presents means of the utilisation index by whether firms hire any paid employees, both unconditional (in blue) and comparing firms within the same location and sector (in purple). Panel (c) shows averages of the utilisation index by firm location; firms in more central locations have less slack. Panel (d) reports firms’ stated reasons for under-utilisation following an open-ended questionnaire. Firms’ responses are grouped by broad category, with demand and cost-related reasons featuring prominently.

Modelling the causes and consequences of slack

Motivated by these facts, we develop a new model of capacity underutilisation in developing economies that can speak to both the causes and consequences of slack. We argue that slack arises in small firms because these firms are particularly affected by input indivisibilities. In a typical example from our setting, transportation costs and trust frictions force owners of micro enterprises such as tailors or food vendors to sit idle until customers arrive1. Small, low productivity firms may thus operate with significant excess capacity and could easily serve a few more customers during their idle time at little extra cost. Larger firms are less affected by input indivisibilities because the move from e.g. the 10th to the 11th employee is much less significant than 0 versus 1.

There may of course be other factors generating slack, such as customers demanding flexible hours, arriving at unpredictable times or there being limited outside options for microentrepreneurs and workers. The consequences of this for the macroeconomy would be similar. Aggregate slack is then manifested through many small firms in the presence of significant frictions to the division of labour (Bassi et al. 2024, Hsieh & Olken 2014, Foster and Rosenzweig 2022).

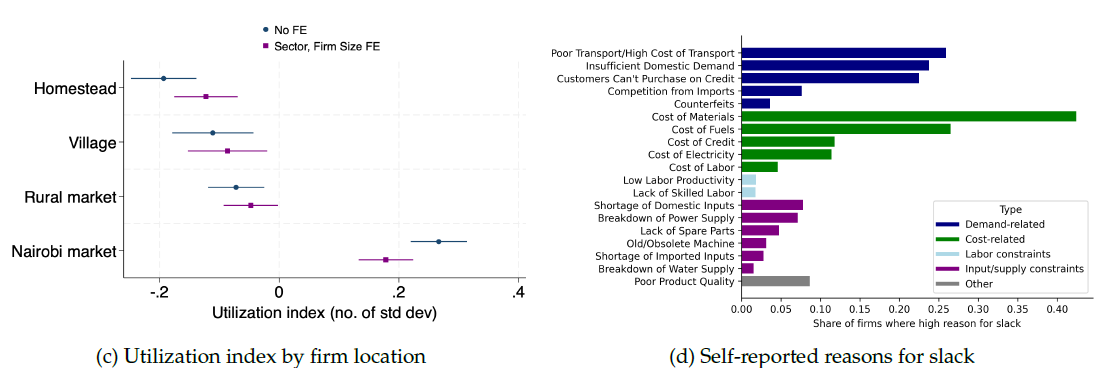

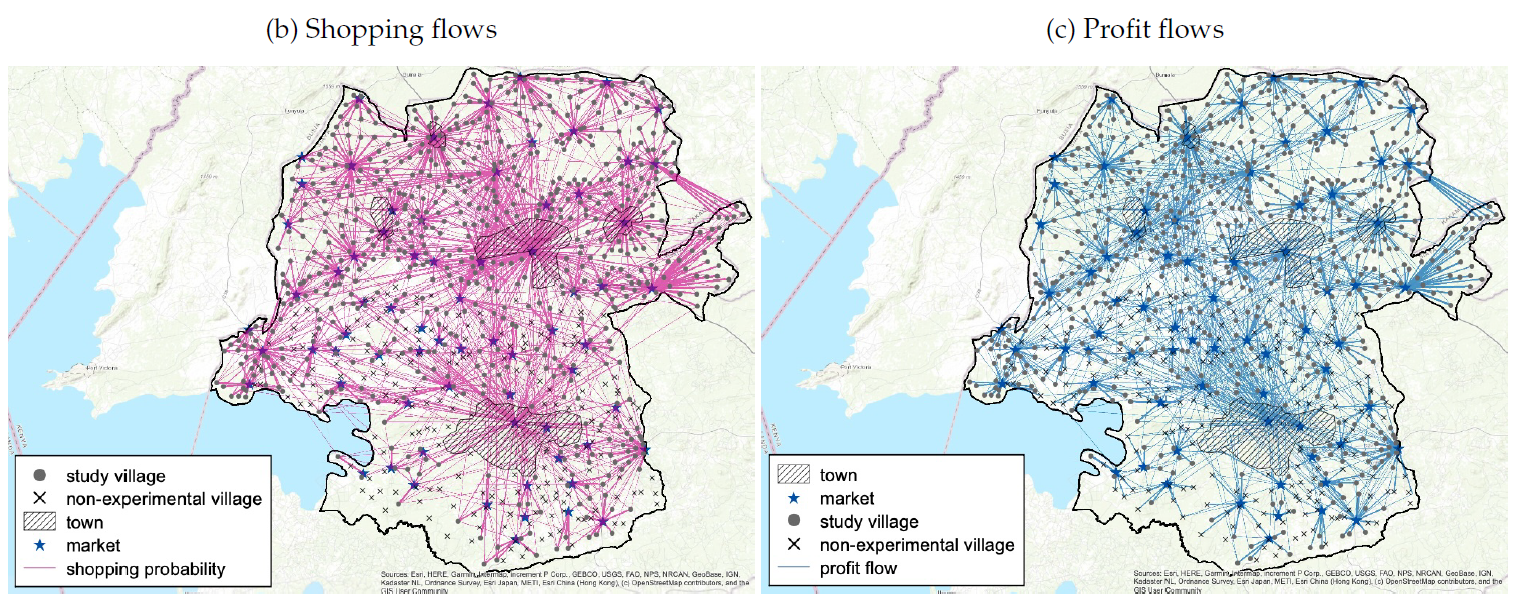

To tease out the macroeconomic implications, we embed this supply decision in a modern spatial model, which accounts salient characteristics of developing country labour markets, such as a large share of agriculture and frequent transitions between wage labour and self-employment (Donovan et al. 2023). We carefully map the model to the economic geography of Siaya County in Western Kenya, with its population of 400,000 individuals distributed across 842 villages and four towns and production taking place across 70 weekly markets. To do so, we rely on exceptionally rich data, covering trade and profit flows from between villages and markets – illustrated in Figure 3.

Figure 3: Geography of the Egger et al. (2022) experiment

Notes: Maps depict Siaya County in western Kenya. Panel A shows all households: treatment (cash transfer recipients) and control households in the Egger et al. (2022) experiment. Panel B depicts shopping patterns (expenditure shares) from each village to each weekly market. Panel C depicts profit flows between markets and villages.

What are the aggregate implications of slack?

Our model features significant underutilisation, lowering measured labour productivity in our setting. This underutilisation suggests that firms could produce substantially more output without having to hire additional workers, buy additional machines, or raise prices, simply by reducing their idle time. In this setting, demand-side policies or stimulus may be very effective at raising output without creating inflationary pressure. To test this we apply our model to a recent large-scale cash transfer experiment that took place in Western Kenya, which also sheds light on the inflationary effects of cash transfers. Read our linked VoxDev article to learn more.

Broader policy implications: Slack, economic development and macroeconomic policy

Our analysis shows that slack matters quantitatively for economic development and macroeconomic policies in developing countries (Goldberg and Reed 2023). More speculatively, technological innovations such as the gig-economy, more flexible work arrangements, better online phone coverage and online marketplaces may increasingly allow firms and customers to better coordinate their transactions, thus lowering the need for idle capacity. Similarly, the promotion of thicker markets through product standardisation, the coordination of economic activities through weekly market days, access to exports, and industrial policy may all be levers to lessen the aggregate impacts of slack over time.

References

Acemoglu D, S Johnson, and J A Robinson (2001), "The colonial origins of comparative development: An empirical investigation," American Economic Review 91(5): 1369–1401. https://doi.org/10.1257/aer.91.5.1369

Bassi V, J H Lee, A Peter, T Porzio, R Sen, and E Tugume (2023), "Self-employment within the firm," NBER Working Paper No. 31740. https://doi.org/10.3386/w31740

Breza E, S Kaur, and Y Shamdasani (2021), "Labor rationing," American Economic Review 111(10): 3184–3224. https://doi.org/10.1257/aer.20201385

Caselli F (2005), "Accounting for cross-country income differences," in Handbook of Economic Growth (ed. P Aghion and S N Durlauf), Elsevier, 1(A): 679–741. https://doi.org/10.1016/S1574-0684(05)01009-9

Donovan K, W J Lu, and T Schoellman (2023), "Labor market dynamics and development," Quarterly Journal of Economics 138(4): 2287–2325. https://doi.org/10.1093/qje/qjad019

Egger D, J Haushofer, E Miguel, P Niehaus, and M Walker (2022), "General equilibrium effects of cash transfers: Experimental evidence from Kenya," Econometrica 90(6): 2625–2672. https://doi.org/10.3982/ECTA17945

Foster A, and M Rosenzweig (2022), "Are there too many farms in the world? Labor market transaction costs, machine capacities, and optimal farm size," Journal of Political Economy 130(3): 611–667. https://doi.org/10.1086/717890

Goldberg P K, and T Reed (2023), "Presidential address: Demand-side constraints in development. The role of market size, trade, and (in)equality," Econometrica 91: 1915–1950. https://doi.org/10.3982/ECTA20787

Hsieh C T, and B A Olken (2014), "The missing 'missing middle'," Journal of Economic Perspectives 28(3): 89–108. https://doi.org/10.1257/jep.28.3.89

Hendricks L, and T Schoellman (2018), "Human capital and development accounting: New evidence from wage gains at migration," Quarterly Journal of Economics 133(2): 665–700. https://doi.org/10.1093/qje/qjx047

Lewis W A (1954), "Economic development with unlimited supplies of labour," The Manchester School 22: 139–191. https://doi.org/10.1111/j.1467-9957.1954.tb00021

M Walker, N Shah, E Miguel, D Egger, F S Soliman, T Graff (2024) “Slack and Economic Development”