A cash grant and training programme had a range of benefits for women in Tunisia, but only improved participation in income-generating activities for women who attended training without their partner

Strong gender and social norms limit women’s opportunities and labour market outcomes in the Middle East and North Africa (MENA) (ILO 2018). Empowering women in these settings is a key priority, and one common policy response involves using some type of cash grants and/or training programmes to improve women’s situation. However, while many empirical studies have found that these interventions can have large positive effects on male participants, estimated returns for women have been negligible (De Mel et al. 2008, Klinger and Schündeln 2011, Fafchamps et al. 2014, Berge et al. 2015, Giné and Mansuri 2021).

This is partly due to the gender-specific constraints that women face in the labour market and inside the household (Duflo 2012, Bernhardt et al. 2019, Jayachandran 2021). For example, women’s resources are at a higher risk of being expropriated by other household members and peers, and they are also restricted by norms and beliefs surrounding the roles that they can and cannot play inside and outside of their homes. To address gender-specific barriers and maximise returns on entrepreneurship for women, some programmes have relied on delivery mechanisms that increase women’s control over the cash they receive, including using in-kind capital (e.g. Crépon et al. 2023), mobile money deposits (Riley 2022) or women-owned bank accounts (Field et al. 2021). Alternatively, other interventions have focused on engaging husbands in programmes designed to empower women (Gupta et al. 2013), with the hope that this could improve their effectiveness.

We set up a randomised experiment in Tunisia to explore whether inviting wives to bring their partners to financial training, which was combined with an unrestricted cash grant, changed the impacts of the programme (Gazeaud et al. 2023). The experiment took place in Jendouba, one of Tunisia's poorest governorates, where women predominantly engage in agricultural tasks or home-based activities like kitchen gardening and livestock farming, while men are more likely to be involved in sectors like construction or specific agricultural occupations.

The experiment had two treatment arms

First, 1,000 women received an unrestricted cash grant worth USD 768 in PPP terms. This amount is large, about four times the median monthly income of respondents at baseline. Women in the treatment groups also received a one-day financial training, which we label as gender sensitive because it included specific videos and exercises aiming to stimulate women’s agency. The cash grant was unrestricted, in the sense that it could be spent on anything (Siu et al. 2023). Yet, women were advised to invest their money in an income-generating activity or in developing their skills and knowledge to improve their chances of success in the job market.

Second, a subset of cash grant recipients was encouraged to bring their male partners to the gender-sensitive financial training. The objective was to encourage gender dialogue, address some of the gender-specific barriers in the labour markets, and minimise resentment or backlash. Take-up was high, as 444 out of 502 (88%) women in this treatment arm attended the training with their partner.

We studied the impacts of the treatments after two years.

The programme positively affected women’s labour market outcomes, but involving men backfired

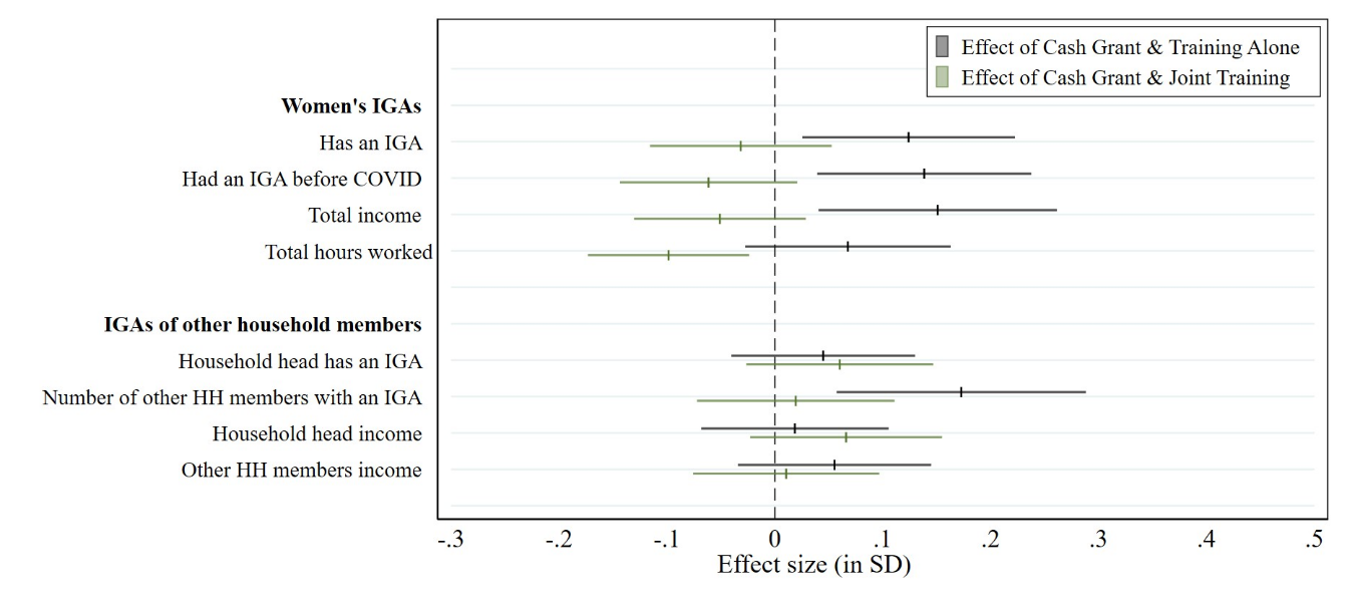

Results show that the cash grant and training programme positively affected female income-generating activities, but only for women whose male partners did not attend the training. Compared to the control group, women who received the cash grant and the training without their partner were 3.3 percentage points (45%) more likely to have an income-generating activity at endline and their income was 61% higher. Involving partners in the training seems to have backfired: women who received the cash grant and the joint training with their partner were 4.1 percentage points less likely to have an income-generating activity than women invited to participate in the training alone (Figure A).

Figure A

At least two mechanisms could explain these results. First, men’s involvement in the training may reduce women’s privacy over the cash grant, giving them less agency to invest the grant in their own activities or that of other household members. Second, even if privacy over the grant did not change, men involved in the training may have felt legitimised to influence how grant money was spent following their participation in the training.

Households as a whole benefit from the cash grants

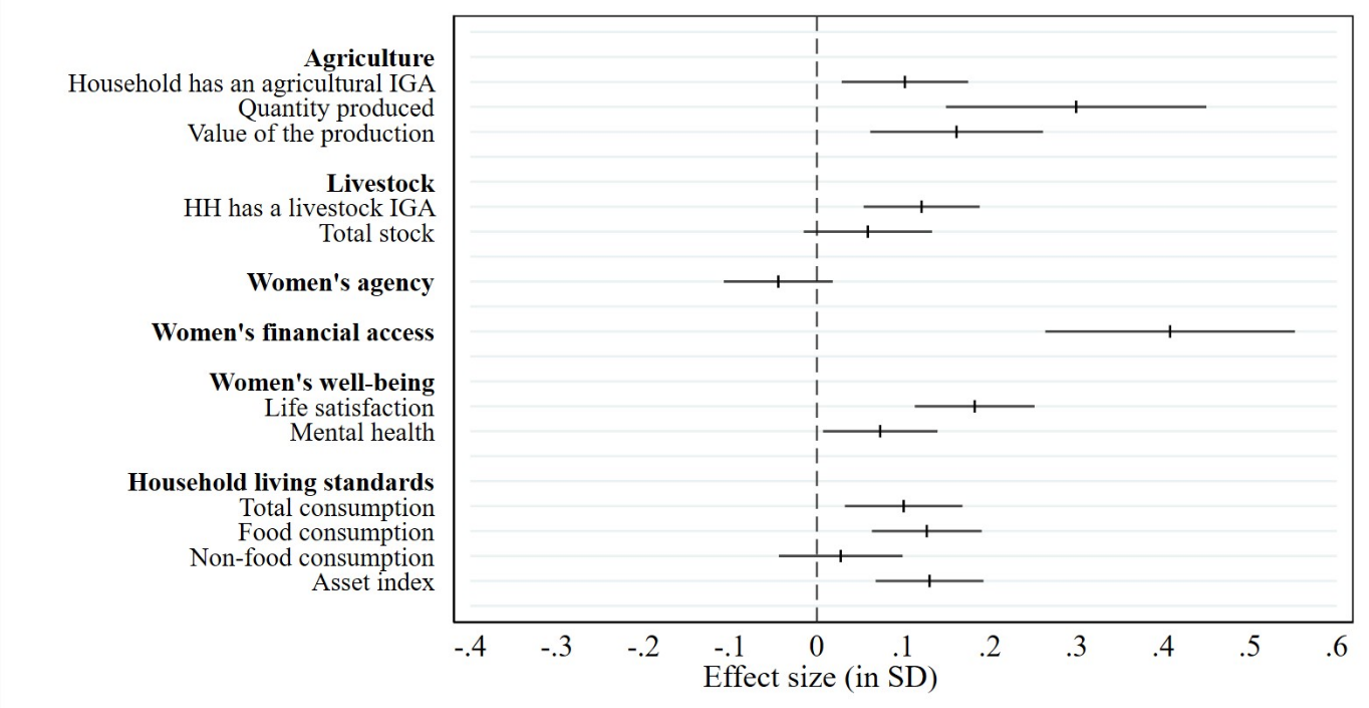

While the impact of the cash grants and gender-sensitive training on women’s employment outcomes seems limited, we find that the programme encouraged employment of other household members (+28%), especially when the partner was not involved in the programme (+49%) (Figure A). The effect on the income-generating activities of other household members suggests that women can optimally invest in other household members’ activities, and this investment is more efficient when their partners are not involved in the training. The programme also increased investments in small-scale agriculture and livestock farming, two activities traditionally undertaken by women at home (Figure B).

Figure B

Overall, the impact on total household income is positive, with no significant difference between the two treatment groups. While women’s income is significantly higher when they are invited to participate in the training alone, the income of household heads is higher with the joint training (this latter effect is not statistically significant at conventional levels). The two effects partly balance each other out. This suggests that participating in the training alone versus with the partner generates some substitution effect between women’s and men’s IGAs.

The cash grants positively impact living standards and wellbeing

Beyond labour market outcomes, the impacts of the cash grant and training programme were overwhelmingly positive (Figure B). Households benefited from improved living standards, measured across indicators including food consumption (+10.7%) and asset ownership (+0.13 SD). We also find positive socio-psychological benefits arising from the programme. Women in the treatment groups were more satisfied with their lives (+0.18 SD), had better mental health (+0.07 SD), and better access to finance (+0.41 SD). However, we find no significant effects on an index of women’s agency. For these outcomes, there are no significant differences between the two treatment arms.

In conclusion, our study shows the promises and pitfalls of programmes targeting women in settings where strong gender and social norms shape women’s opportunities and outcomes in the labour market. On one hand, our study provides evidence that cash grants and gender-sensitive financial trainings can be an effective way to stimulate their income-generating activities and improve household living standards in Tunisia. The programme was highly cost-effective, even in the short run: only 1.2 years of benefits are needed to obtain a positive benefit-cost ratio. On the other hand, the study highlights the importance of considering the role of husbands in programmes designed to stimulate women’s economic opportunities, as husbands’ involvement can backfire and reduce women’s economic opportunities. Our study also shows the importance of redistribution and expropriation mechanisms within households, which should be accounted for to understand the full impact of cash transfers to women.

References

Berge, L I O, K Bjorvatn, and B Tungodden (2015), “Human and financial capital for microenterprise development: Evidence from a field and lab experiment.” Management Science, 61(4): 707-722.

Bernhardt, A, E Field, R Pande, and N Rigol (2019), “Household matters: Revisiting the returns to capital among female microentrepreneurs.” American Economic Review: Insights, 1(2): 141-160.

Crépon, B, M El Komi, and A Osman (2023), “Is It Who You Are or What You Get? Comparing the Impacts of Loans and Grants for Microenterprise Development.” Working Paper.

De Mel, S, D McKenzie, and C Woodruff (2008), “Returns to capital in microenterprises: evidence from a field experiment.” The quarterly journal of Economics, 123(4): 1329-1372.

Duflo, E (2012). Women empowerment and economic development. Journal of Economic literature, 50(4), 1051-1079.

Fafchamps, M, D McKenzie, S Quinn, and C Woodruff (2014), “Microenterprise growth and the flypaper effect: Evidence from a randomized experiment in Ghana.” Journal of Development Economics, 106: 211-226.

Field, E, R Pande, N Rigol, S Schaner, and C Troyer Moore (2021), “On her own account: How strengthening women’s financial control impacts labor supply and gender norms.” American Economic Review, 111(7): 2342-2375.

Gazeaud, J, N Khan, E Mvukiyehe, and O Sterck (2023), “With or without him? Experimental evidence on cash grants and gender-sensitive trainings in Tunisia.” Journal of Development Economics, 165: 103169.

Giné, X and G Mansuri (2021), “Money or management? A field experiment on constraints to entrepreneurship in rural Pakistan.” Economic Development and Cultural Change, 70(1): 41-86.

Gupta, J, K L Falb, H Lehmann, D Kpebo, Z Xuan, M Hossain, ... & J Annan (2013), “Gender norms and economic empowerment intervention to reduce intimate partner violence against women in rural Côte d’Ivoire: a randomized controlled pilot study.” BMC international health and human rights, 13: 1-12.

ILO (2018), Global Wage Report 2018/19: What lies behind gender pay gaps. International Labour Office, Geneva.

Jayachandran, S (2021), “Social norms as a barrier to women’s employment in developing countries.” IMF Economic Review, 69(3): 576-595.

Klinger, B, and M Schündeln (2011), “Can entrepreneurial activity be taught? Quasi-experimental evidence from Central America.” World Development, 39(9): 1592-1610.

Riley, E (2022), “Resisting social pressure in the household using mobile money: Experimental evidence on microenterprise investment in Uganda.” Working Paper.

Siu, J, O Sterck, and C Rodgers (2023), “The freedom to choose: Theory and quasi-experimental evidence on cash transfer restrictions.” Journal of Development Economics, 161: 103027.